You will need to maintain this minimum amount to continue to invest. It appears that the full array of regular Fidelity investment options are available within HSAs.

Fidelity Surpasses 10 Billion In Health Savings Account Assets Business Wire

Fidelity Surpasses 10 Billion In Health Savings Account Assets Business Wire

Its a great way to prepare for health care costs in retirement.

How to invest hsa fidelity. Standard Fidelity investment commissions apply. Fidelity gives you broad investing options including our Fidelity HSA Funds to Consider. Money from the sale will appear in your cash balance when the trade settles usually within a few business days.

There are no investment minimums on Fidelity retail and advisor mutual funds. Fidelity allows you to invest your HSA money into Fidelity mutual funds and index funds. Fidelity even offers a handful of fund options that are only available to clients with a Fidelity HSA.

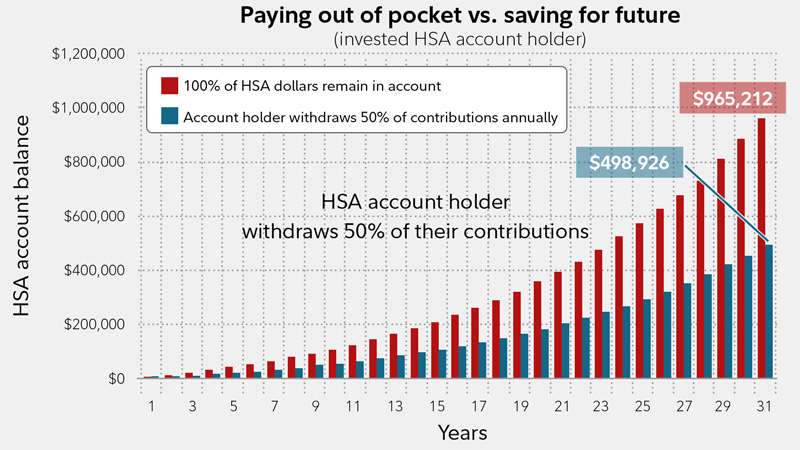

When you want to access itwhether its 2 days 2 years or 20 years from nowyou can sell some of your investments at any time. And theres no required minimum to begin investing7. With HSA Bank for example you cannot invest your HSA money until you have at least 1000 in your HSA account.

With Optum Bank mutual fund investments. Before we go over and discuss the top rated or the 7 best Fidelity Mutual Funds worth investing in here are some important terms investors should know. Exactly how I invest my Fidelity HSA.

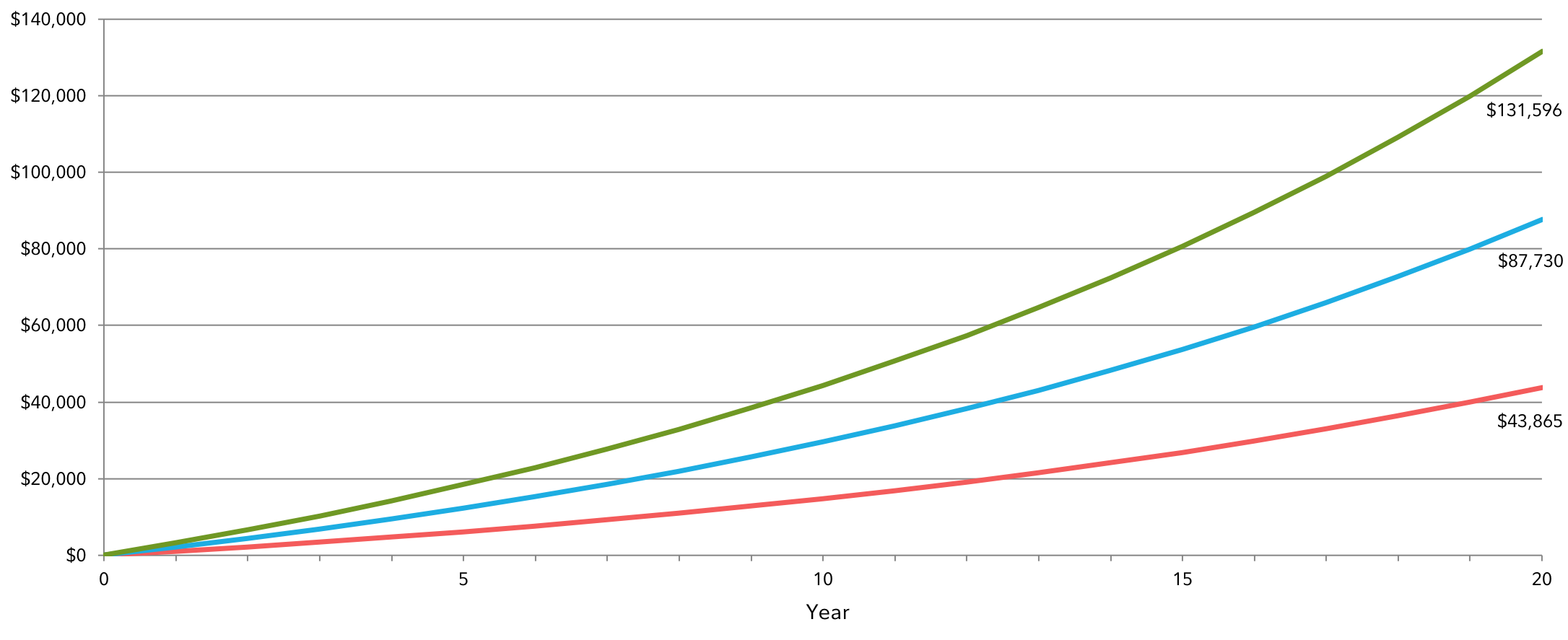

You can choose to invest some or all of your HSA money for potential growth. When considering how to invest your HSA savings you may want to consider one of Fidelitys Health Savings funds which does not require a specific investing time horizon and provides a conservative asset mix 20-40 stocks and 60-80 bonds to help protect against down market risk while also participating in the market gains. Investing firms like Fidelity offers the best low-cost mutual funds investment options and some other types of Fidelity growth company investment services to accommodate and provide a satisfactory user experience.

This example does not account for the effect of interest dividends and taxes. Other HSA investing options include single-fund options such as our target date funds and target allocation funds as well as our entire brokerage lineup which includes mutual funds. A separate transfer request may be required for each type of account.

With no minimum to start 1 and no account transaction fees 2 to invest its easy to get started. Your existing HSA may be held in 2 separate accounts both of which are eligible to be transferred. I went to Fidelitys site and chose the option to open an account and found the choice for Health Savings Account HSA I was then prompted on whether I was an existing customer or not.

You can start investing at any time by making a one-time trade or setting up automatic investing for future contributions. I talk all about how. These are professionally selected funds for HSA investing all with waived investment minimums and no transaction fees.

Before investing your HSA your administrator may require you to maintain a minimum balance in your account. The Basics of Investing Your HSA Maintain a Minimum Balance. Fidelity HSAs are brokerage accounts giving you more options for simple seamless investing of your HSA money in a range of mutual funds stocks bonds ETFs Treasuries and more.

Money you invest is still part of your HSA and is available for current or future use. If you would like more options our brokerage platform offers more than 10000 mutual funds stocks bonds ETFs and CDs to select from. Secondly youve got to put your balance to work in investments while youre.

Go to Investing your HSA. Actual net returns will be based on the investors investment choices within the Fidelity HSA. Select from a variety of investment options including our Fidelity HSA Funds to Consider 1.

There are two key steps. Fidelity HSA accounts come with a Fidelity debit card. Your Fidelity HSA is a single account that allows you to manage a portion of your savings in a high-yield core position and invest the rest for future medical expenses.

Systematic investing does not ensure a profit and does not protect against loss in a declining market. Learn more about the pros and cons of investing your HSA and why this may be a beneficial strategy to consider for your overall financial wellness. Consider your current and anticipated investment horizon when making an investment decision as the illustration may not.

A bank account holding your cash balance. First of all youve got to actually use your HSA starting with putting money into it. A brokerage account holding your investments.

The HSA or Health Savings Account is the single most powerful wealth-building vehicle out there. Find out an overview of what investment options Fidelity has for HSA accounts and the what kind of fees to expect as I walk you through setting up my employe. How to Invest Your Employer-Sponsored HSA with Fidelity May 7 2021 in HSA Health Savings Account.

Your current HSA provider will be able to help you determine the right process. I had to create a Fidelity login but obviously if you already have one youll choose that option and log in.

Fidelity Hsa How I Invest It For Maximum Youtube

Fidelity Hsa How I Invest It For Maximum Youtube

5 Ways Hsas Can Fortify Your Retirement Fidelity

5 Ways Hsas Can Fortify Your Retirement Fidelity

Which Is The Best Hsa Fidelity Vs Lively Review White Coat Investor

Which Is The Best Hsa Fidelity Vs Lively Review White Coat Investor

My Fidelity Hsa Account Review Updated 2021

My Fidelity Hsa Account Review Updated 2021

Hsa Investing Hsa Investment Options Fidelity Investments

Hsa Investing Hsa Investment Options Fidelity Investments

How The Hsa And Its Wonderful Triple Tax Advantage Builds Wealth

How The Hsa And Its Wonderful Triple Tax Advantage Builds Wealth

Which Is The Best Hsa Fidelity Vs Lively Review White Coat Investor

Which Is The Best Hsa Fidelity Vs Lively Review White Coat Investor

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

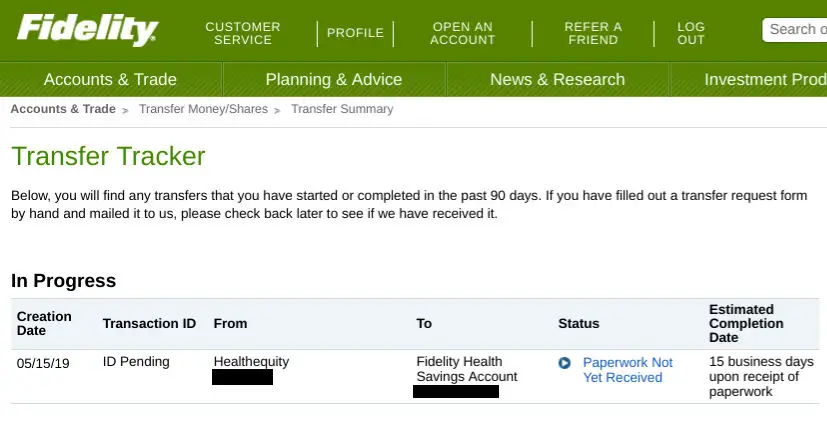

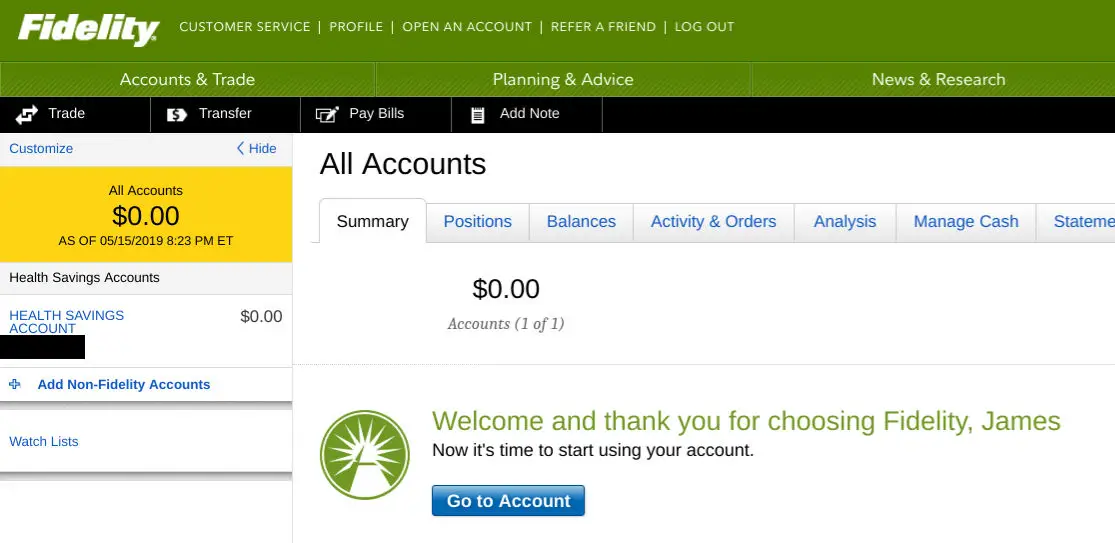

We Moved Our Health Savings Account To Fidelity Route To Retire

We Moved Our Health Savings Account To Fidelity Route To Retire

How To Invest Your Employer Sponsored Hsa With Fidelity Youtube

How To Invest Your Employer Sponsored Hsa With Fidelity Youtube

We Moved Our Health Savings Account To Fidelity Route To Retire

We Moved Our Health Savings Account To Fidelity Route To Retire

Hsa Investing Hsa Investment Options Fidelity Investments

Hsa Investing Hsa Investment Options Fidelity Investments

Fidelity Health Savings Account Investing Hsa Sundayfundday Youtube

Fidelity Health Savings Account Investing Hsa Sundayfundday Youtube

Comments

Post a Comment