Schwab reserves the right to act as principal on any fixed income transaction public offering or securities transaction. When you go to place your order use the Limit Yield option.

Can I Buy Vanguard Funds Through Charles Schwab In 2021

Can I Buy Vanguard Funds Through Charles Schwab In 2021

Shedding Light on the Bond Buying Process.

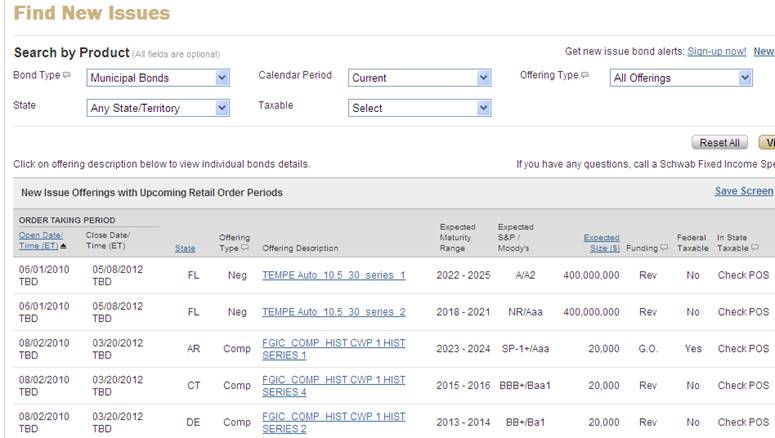

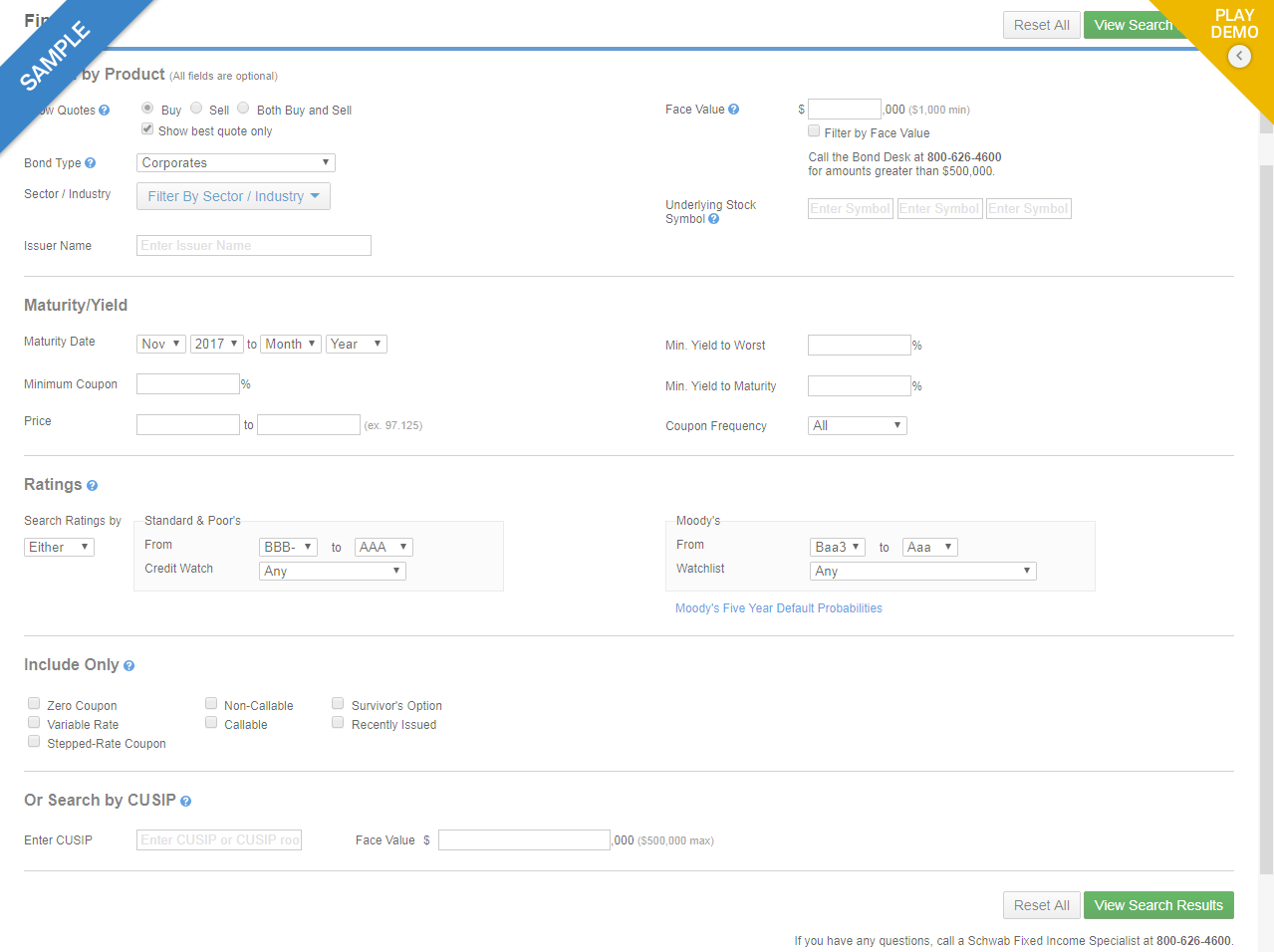

How to buy bonds on schwab. To search through the brokers debt offering just go to Research at the top menu on the Schwab website and click on Bonds Fixed Income Here you will find a screener for all fixed-income products the broker offers. Each ticker and name links to more detailed data about each fund including graphs fund. Use the Brokers Search Tool.

How To Buy at Auction US. Treasury BondsT-NotesT-Bills at Charles Schwab Step 1. As noted above treasury bonds are issued in increments of 100.

Treasury bonds through a broker or directly through Treasury Direct. Service charges apply for trade orders placed through a broker 25 or by automated phone 5. Multiple leg online option orders such as spreads straddles combinations and rollouts are charged per-contract fees for the total number of option contracts.

Selecting a position to sell. Focus on the yield and especially on the yield-to-worst to get the best deal. Select number of shares you wish to purchase On the website of Schwab just use the ETF ticker and the number of shares you wish to purchase.

Click on the Transact dropdown next to your account and scroll to. The registration is the name of the owner either a person or entity the. There is a drop-down menu for bond.

The data that can be found in each tab includes historical performance the different fees in each fund the initial investment required asset allocation manager information and much more. If you wish to invest in any of the ETFs mentioned above it is important to examine the details including the expense ratio the domestic stock market the international market. Learn about Bonds First.

You can purchase government bonds like US. Charles Schwab Bond To find out detailed information on Charles Schwab Bond in the US click the tabs in the table below. An exchange processing fee applies to sell transactions.

Certain types of Schwab ETF OneSource transactions are not eligible for the commission waiver such as short sells and buys to cover not including Schwab ETFs. How you register the bond at purchase determines who owns the bond and who can cash it. Complex online option orders involving both an equity and an option leg including BuyWrites or WriteUnwinds are charged per-contract fees for the option leg.

What determines who owns an I bond and who can cash it. Videos you watch may be added to the TVs watch history and influence TV. You can also choose the Trade History link to review previous trading activity for this bond before selecting to Buy or Sell.

Schwab offers multiple options for retirement fund holders who want to invest and eventually grow their money through mutual funds or within their vast range of stocks and bonds offering. Buy them in paper form using your federal income tax refund. Trades in ETFs available through Schwab ETF OneSource including Schwab ETFs are available without commissions when placed online in a Schwab account.

Buy them in electronic form in our online program TreasuryDirect. Before you pour large amounts of money into an investment you definitely want to. Be sure to select Auction You get no bidask spread only when you buy a new issue.

Charles Schwab has a lot of low cost investing options. If the ETF you chose is not commission-free you also have to make sure that your account has enough cash to pay both for the price of the share and the added commission fee. Dont over-concern yourself with the bidask spread on the bond.

Please call us at 800-626-4600 for information MondayFriday 830 am600 pm. BUYING BONDS from outside of israel. Select the BuySell Bonds link to see available bid and ask prices for your position.

After youve learned a sufficient amount concerning the strengths. If playback doesnt begin shortly try restarting your device. The bond includes a commitment from the Israeli government to pay the loan back plus an agreed rate of interest while using your money known as the bond coupon or yield.

You can buy bonds through the US. Large-block transactions orders of more than 250 bonds may be eligible for special handling and pricing. In this video I look at 4 good index funds that are low cost and well-diversified.

If you wish to make a stock profit in the long term you must best. Service charges apply for trades placed through a broker US25 or by automated phone. Online pricing plus 25trade.

Anywhere from a few weeks to 50 years. Treasury Department through a brokerage like Fidelity or Charles Schwab or through mutual fund or exchange-traded fund. You are telling the brokers on the Fidelity network that youll buy this bond only if it yields say 42 percent.

Your loan amount bond price is returned to you when the bond matures after a fixed period of time. How can I buy I bonds.

Treasury Bonds Bills Notes Buying Cost At Brokers 2021

Treasury Bonds Bills Notes Buying Cost At Brokers 2021

Charles Schwab Treasury Bills Bonds T Notes Buying 2021

Charles Schwab Treasury Bills Bonds T Notes Buying 2021

Do You Know How Much You Re Paying For Bonds Charles Schwab

Do You Know How Much You Re Paying For Bonds Charles Schwab

Here Are The Stocks Schwab Self Directed Investors Loved In 2020 Financial Planning

Here Are The Stocks Schwab Self Directed Investors Loved In 2020 Financial Planning

Investing In Bonds Charles Schwab

Investing In Bonds Charles Schwab

Understanding And Buying Bonds At Charles Schwab Youtube

Understanding And Buying Bonds At Charles Schwab Youtube

How To Build A Bond Portfolio Charles Schwab

How To Build A Bond Portfolio Charles Schwab

How To Shop For Bonds Charles Schwab

How To Shop For Bonds Charles Schwab

Better Shop Around Schwab Study Finds That While Many Investors Consider Themselves Bargain Hunters Few Comparison Shop For Bonds Despite The Potential Benefits Business Wire

Better Shop Around Schwab Study Finds That While Many Investors Consider Themselves Bargain Hunters Few Comparison Shop For Bonds Despite The Potential Benefits Business Wire

How To Build A Bond Portfolio Charles Schwab

How To Build A Bond Portfolio Charles Schwab

Do You Know How Much You Re Paying For Bonds Charles Schwab

Do You Know How Much You Re Paying For Bonds Charles Schwab

Comments

Post a Comment