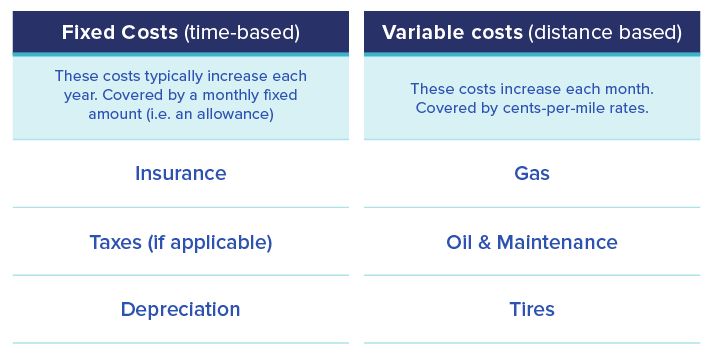

The FAVR method accounts for. An IRS non-taxable FAVR Plan accounts for both the fixed costs such as depreciation and zip code sensitive insurance as well as the per mile variable costs such as fuel oil and tires.

Mileage Reimbursement Solutions For Business Motus

Mileage Reimbursement Solutions For Business Motus

FAVR programs reimburse drivers for the fixed costs of owning and operating a vehicle such as insurance taxes and depreciation in addition to variable costs like fuel and maintenance which differ based on location.

Favr mileage reimbursement. The reimbursements are a combination of monthly allowance and mileage rate. Fixed and Variable Rate FAVR Reimbursements Say goodbye to unproductive employee behavior and tax waste. FAVR is designed for workers who drive their personal vehicles for job-related purposes at least 5000 miles each year.

This ratebased on the nationwide average cost of operating a vehicle in the prior. FAVR is a tax-efficient IRS-compliant program that means less money leaves your companys. The fixed and variable rate reimbursement often referred to.

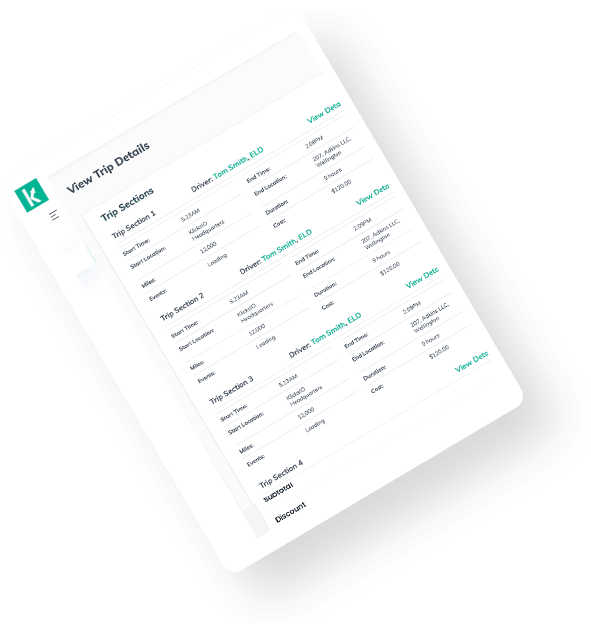

Because FAVR reimbursements are based on actual rather than estimated. A FAVR plan reimburses employees through a combination of mileage reimbursement and a monthly allowance. Mileage reimbursement and also exposes organizations to increased risk.

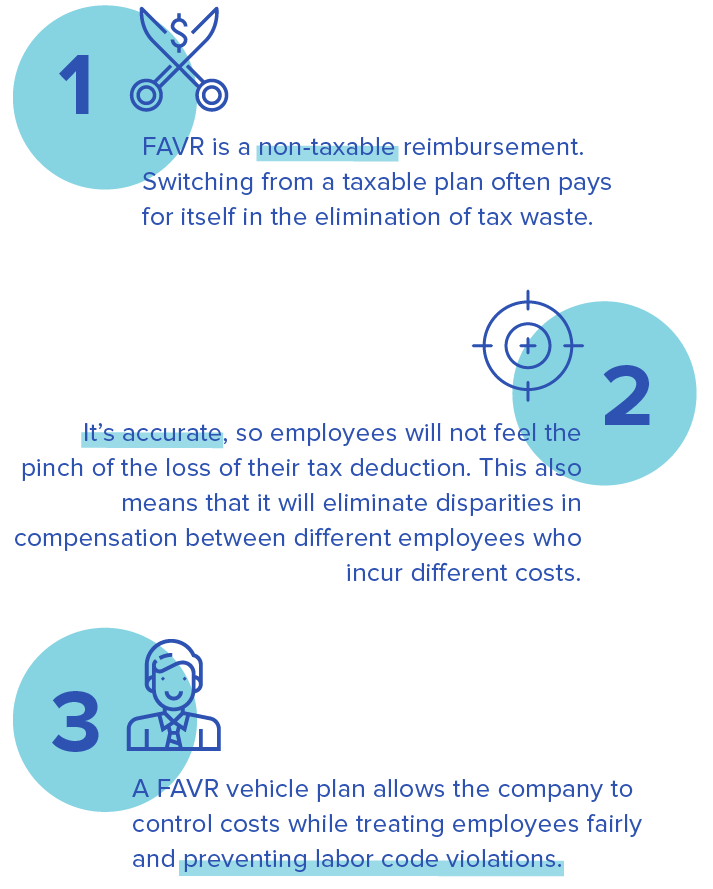

Their new FAVR program accounts for different vehicle profiles and adjusts for fuel prices. Because these programs are so dynamic they are considered a first-rate option. Also known as FAVR reimbursement this IRS revenue procedure holds a number of distinct advantages over standard car allowances mileage reimbursements and other common reimbursement methods.

Why is FAVR More Accurate FAVR is the most accurate reimbursement solution because it provides a customized reimbursement to each mobile employee based on their local costs and business mileage which can vary month to month What are Some Other Advantages. Concur FAVR by Motus is the only tax-free IRS-approved method to ensure employees are accurately reimbursed. Fixed and variable costs.

Fixed costs include things like insurance taxes and registration fees. But another strategy has gained traction with employers across the country. The mileage reimbursement rate for 2018 is 545 cents for business miles driven up from 535 cents in 2017.

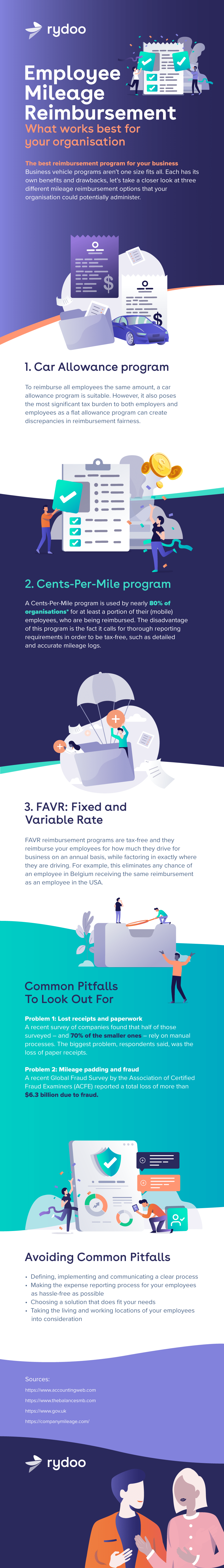

The companys Senior Finance Director says By receiving a fixed reimbursement relevant to the vehicle profile plus variable reimbursement based on each months mileage and adjusted for the price of gas in their territory drivers are confident that they are getting treated fairly. An advantage of a FAVR over a flat carbusiness travel allowance is that it may be. Most organizations pay either a set monthly car allowance or a mileage reimbursement rate typically the standard mileage rate set by the IRS.

While the majority of companies use the IRS standard mileage rate FAVR could be a more precise alternative and better option for your company. An IRS revenue plan A FAVR or Fixed and Variable Rate reimbursement is an allowance reimbursing employees who drive their own car to work. FAVR Mileage Program for Personal or Company Vehicles Many companies utilize a Fixed and Variable Rate FAVR reimbursement program to account for the higher or lower vehicle costs reflected in different regions of the country.

Unlike one-size-fits-all car allowance or cents-per-mile reimbursement programs fixed and variable rate FAVR programs reimburse employees for their individualized fixed and variable costs. A FAVR Allowance and reimbursement program will reduce your direct costs of vehicle operation and simplify the budgeting for usual fleet expenses and introduce controls over what vehicles employees choose or how employees spend their reimbursement allocation and insure the vehicle. A Fixed Variable Rate reimbursement plan is a tax-efficient method for reimbursing employee business mileage.

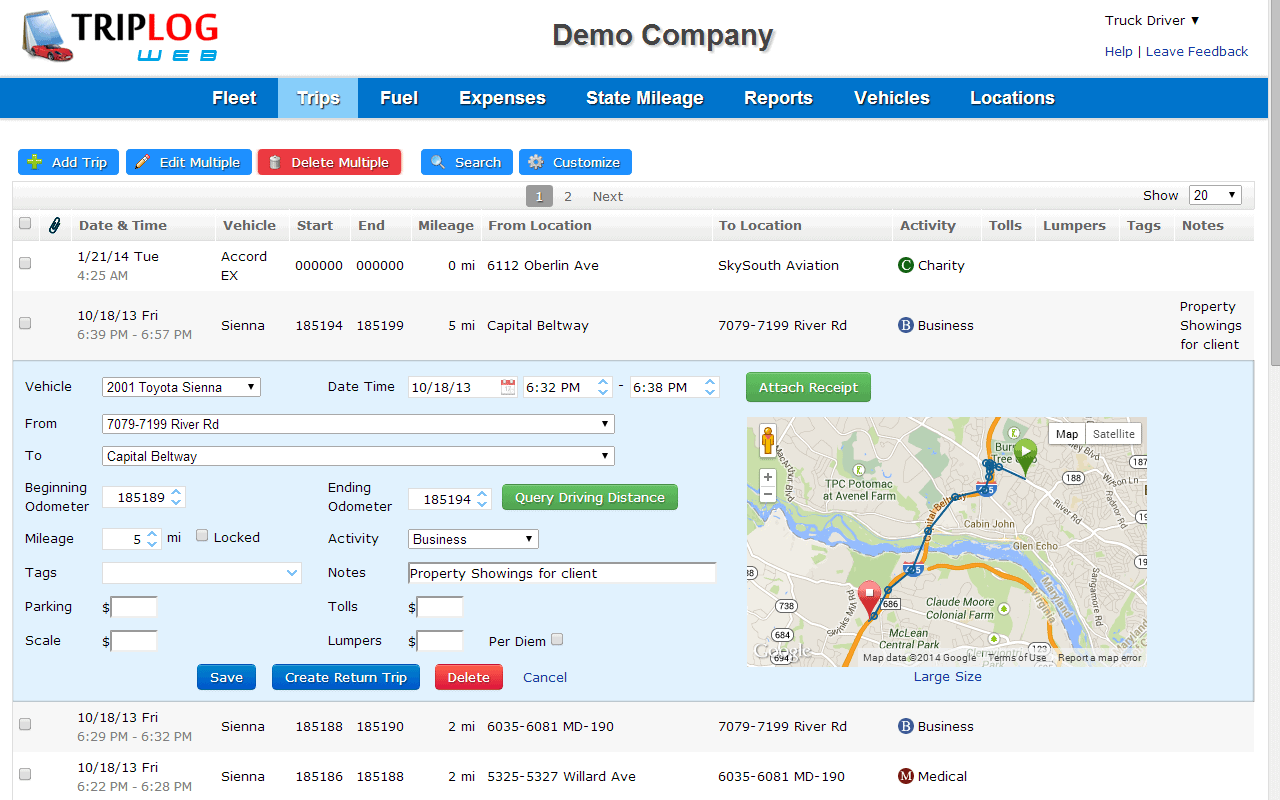

A streamlined solution for expense management and reimbursement helps eliminate up to an average 21 hours of manual work per year. It encompasses both fixed and variable costs. It covers fixed and variable expenses by employees that are using vehicles for business purposes.

Compared to the three traditional models FAVR is. Not only are FAVR allowances non-taxable unlike standard allowances but they also accurately and equitably reimburse employee vehicle expenses unlike mileage reimbursement. It reimburses employees by way of a combination of a monthly allowance and mileage reimbursement payments.

More equitable than cents-per-mile reimbursements because it avoids over- and under-payments which can diminish employee satisfaction. The IRS separates these by fixed costs and variable costs. Lackey recommended using a fixed and variable rate FAVR program to determine a suitable mileage reimbursement rate for your business.

Administration of a non-taxable FAVR Plan program can be. What is a FAVR reimbursement plan. This enables you to reimburse employees for the actual costs of owning maintaining and driving a.

Mileage Reimbursement Or Favr What S The Best Approach

Mileage Reimbursement Or Favr What S The Best Approach

2021 Everything Your Business Needs To Know About Favr

2021 Everything Your Business Needs To Know About Favr

Employee Mileage Reimbursement What Works Best For Your Organization Rydoo

Employee Mileage Reimbursement What Works Best For Your Organization Rydoo

Mileage Reimbursement Or Favr What S The Best Approach

Mileage Reimbursement Or Favr What S The Best Approach

Motus Favr Methodology Transforms Mixed Use Asset Reimbursement

Motus Favr Methodology Transforms Mixed Use Asset Reimbursement

All About Fixed Variable Rates Favr And Business Mileage Plans

All About Fixed Variable Rates Favr And Business Mileage Plans

Do Your Company S Mileage Reimbursement Program A Favr Sap Concur

Do Your Company S Mileage Reimbursement Program A Favr Sap Concur

Mileage Reimbursement Solutions For Business Motus

Mileage Reimbursement Solutions For Business Motus

2021 Everything Your Business Needs To Know About Favr

2021 Everything Your Business Needs To Know About Favr

Concur Favr By Motus End To End Mileage Spend Solution Sap Concur

2021 Everything Your Business Needs To Know About Favr

2021 Everything Your Business Needs To Know About Favr

Http Mercury Assoc Com Wp Content Uploads Tax Consequences Under Different Reimbursement Methods Article Automotive Fleet Pdf

Comments

Post a Comment