Your policy values can be accessed during your lifetime through a periodic payment. The minimum premium is 10000 and the maximum premium depends on your age.

Talk to a New York Life financial.

New york life premiums. New York Life offers a wide range of universal life options. For term policies New York Lifes plans are Yearly Convertible and Level Premium Convertible. In 2018 they dropped to number three but still earned over 7 million.

Whole Life Universal Life Term Life and Target Life policies are allowed. 25000 can go below 25000 minimum as long as annual base premium. From 2015-2017 New York Individual Life Insurance ranked number two in premiums written earning over 7 million two out of the three years but maintained over 5 percent of the market share.

The New York Life Premium Plus Elite Variable Annuity differs from many other variable annuity policies in that the Mortality and Expense Risk and Administrative Costs Charge is calculated as a percentage of the Adjusted Premium Payments under the policy excluding premiums allocated to the Fixed Account rather than as a percentage of Separate Account assets. Sold in one-year increments for the Yearly Convertible policy. The majority of our clients take advantage of these features.

Planning for health events. Cash value and growth. Please enable it to continue.

Builds cash value while offering flexible premiums and death benefits. Premium costs can vary widely from person to person and online quotes are not available with New York Life. New York Life stands out for offering a convertible term policy.

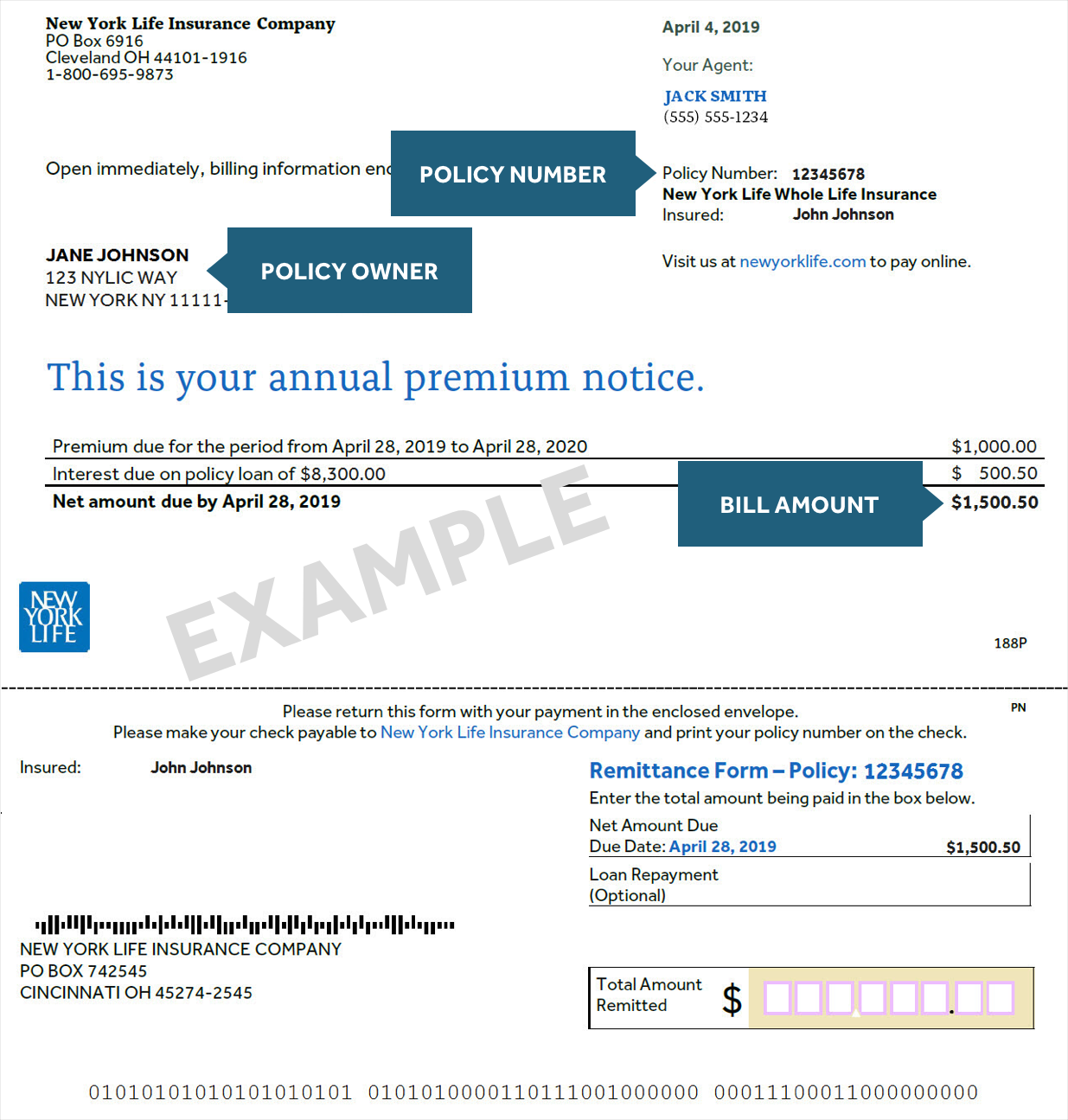

Similar to other insurers New York Life offers term life insurance with level premiums. Bill amount This amount must match the bill exactly including decimals and zeroes. Life insurance policies from New York Life offer financial protection and more.

Maintain your initial premium or adjust based on your budget or coverage needs. Policies that are Paid to Date through June 23 rd 2020 the end of the Do Not Lapse period and either miss a premium payment Whole Life and Term or enter the grace period Universal Life and Variable Universal Life between June 24 th 2020 and December 31 st 2020 are only eligible for the Financial Hardship Program. Connect 1 The premium quoted is for a 35-year-old male rated select-preferred paying monthly recurring premiums on a Whole Life AD 117 policy with a 250000 face amount and no riders.

As with any life insurance New York Lifes term life insurance premiums vary. Additionally if you are terminally ill you could use a portion of your death benefit to pay for treatment or care with the Living Benefits 4 option. Issue ages 0-90 Face amounts Minimum.

Premiums are guaranteed to never increase and there are options for how long and how often you paymonthly quarterly or yearly. Maintain your initial premium or adjust based on your budget or coverage needs. Therefore the 190 charge is not reflected.

If you become disabled New York Life will cover your premiums with the Disability Waiver of Premium option available at an additional cost. Learn from our financial professionals which type of life insurance is right for you. Invests its cash value in riskier accounts compared to other policies for a higher return.

Plus you can adjust your premiums and death benefits. If you want tax-free acceleration of your policys death benefit to protect against financial hardship should you become chronically ill you might want to purchase our Chronic Care option. Annually semi-annually or through our automatic bank drafting method monthly Check-O-Matic C-O-M.

Your gender health status lifestyle habits coverage amount and terms determine your premiums. 60000 if youre between 21 and 49 100000 if youre between 50 and 69 125000 if. You can choose the term length of the policy to suit your needs.

This policy lasts one year but you can renew it annually at a new premium rate. If you become disabled New York Life will cover your premiums if you purchase the Disability Waiver of Premium option Your coverage continues as long as youre disabled. A New York Life financial professional can help determine whats right for you.

Whole Life Insurance Issuing company New York Life Insurance Company Whole life can help you meet your long-term financial goals as well as protect you against lifes uncertainties. Were sorry but mynyl doesnt work properly without JavaScript enabled. These term life insurance options are.

New York Life offers several convenient ways to pay premiums. Heres a simple example for a healthy male and female at various ages with 250000.

Insurance Policies On Slaves New York Life S Complicated Past The New York Times

Insurance Policies On Slaves New York Life S Complicated Past The New York Times

Whole Life Insurance Endless Protection Cash Value New York Life

New York Life Insurance Review 2021 Nerdwallet

New York Life Insurance Review 2021 Nerdwallet

New York Life Insurance Review Great Variety Of Whole And Universal Life Insurance Policies Valuepenguin

/New_York_Life-83fff0afb8d44741b19c44767a3873c7.jpg) New York Life Insurance Review 2021

New York Life Insurance Review 2021

New York Life Insurance Review Life Insurance Simplified

New York Life Insurance Review Life Insurance Simplified

/New_York_Life-72399691072c4656bca10c75dc35ad59.jpg) Best Life Insurance Companies Of 2021

Best Life Insurance Companies Of 2021

National Guard State Sponsored Life Insurance Usba Generation 3 Plan

Best Life Insurance Companies In The United States In 2021

Best Life Insurance Companies In The United States In 2021

/New_York_Life_Recirc-e05045fd08f44f36952e68ef2e2b19c0.jpg) New York Life Insurance Review 2021

New York Life Insurance Review 2021

:max_bytes(150000):strip_icc()/New_York_Life-72399691072c4656bca10c75dc35ad59.jpg) Best Life Insurance Companies Of 2021

Best Life Insurance Companies Of 2021

Comments

Post a Comment