Whether the company has any liability exposure will depend on the degree of company involvement and the relevance of any undisclosed information. A publicly traded company issues a tender offer with the intent to buy back its own outstanding securities.

An Introduction To Secondary Auctions For Private Markets

An Introduction To Secondary Auctions For Private Markets

Tender offers can benefit everyone involved.

Private company tender offer. An introduction to tender offers conducted by or facilitated by privately held companies for shares of their stock undertaken primarily to provide liquidity to existing stockholders. The offer is to tender or sell their shares for a specific price at a predetermined time. RFQ Request for Quotation.

The conversation has been edited for length and clarity. Login to View Tender Details. Where a tender offer is being made by a company or its management it is often in association with a going private transaction.

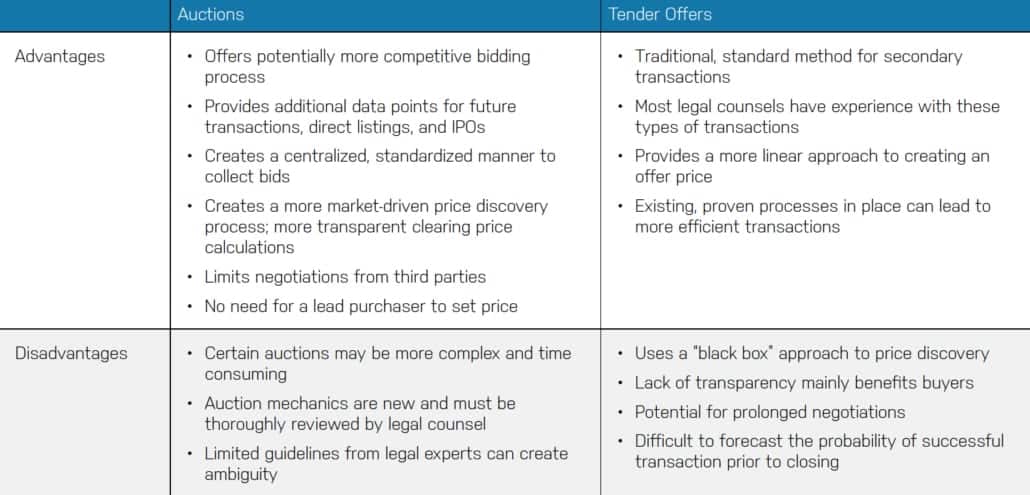

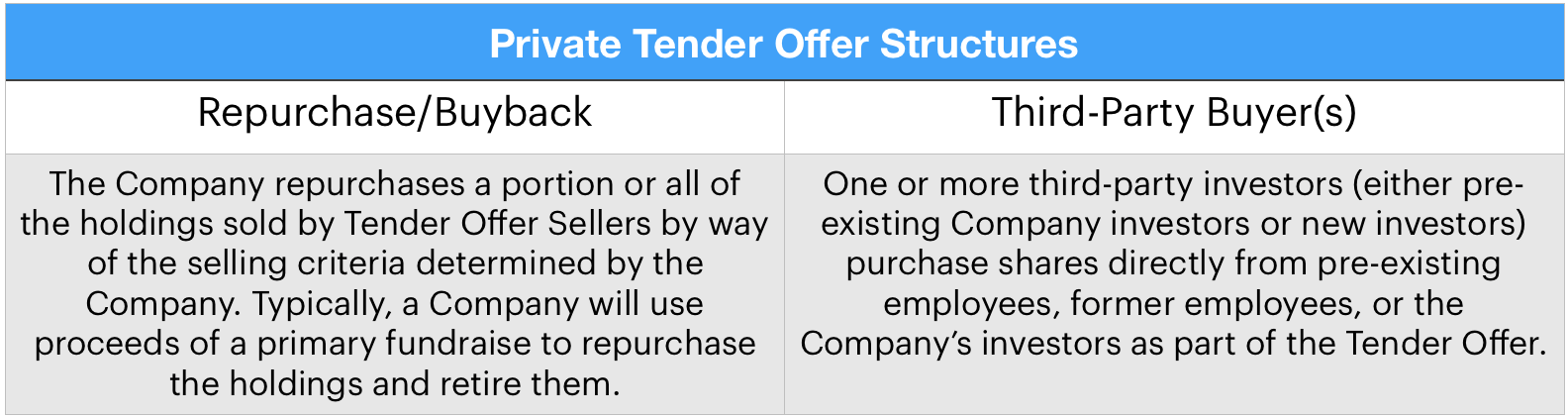

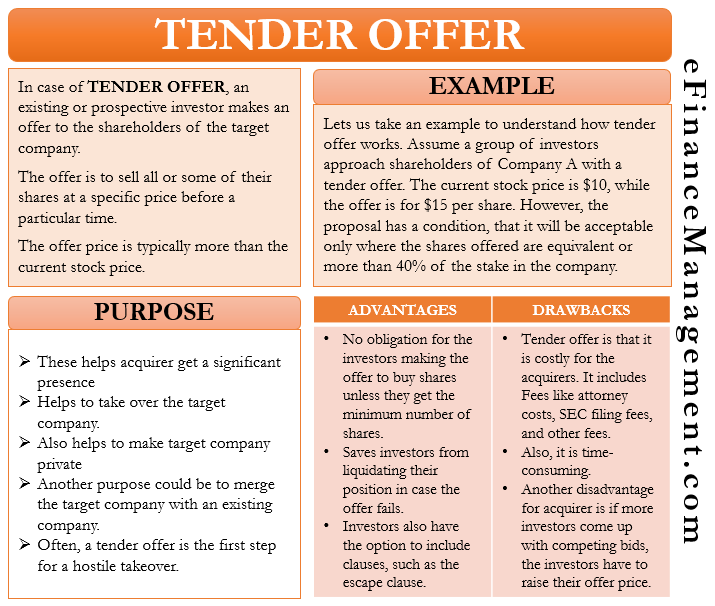

A tender offer sometimes called a buyback is a type of secondary transaction where existing holders of private company shares sell them back to the company or to outside investors. In other words its a potential way for you to sell some of your shares while your company is still private. RFI Request for Information.

Private sector tenders on the other hand also roughly have these stages but have preferred to use acronyms beginning with R and any number of other alphabet-soup combinations besides. They also offer scope to supply a far greater range of products and services that dont fit into the public sector market. Get Private Tenders Details Of Company And Sector At Tender Tiger.

The Construction of a 25ml Reinforced Concrete Reservoir at Ombimini Village. Leasing Of The Tolhuis Together With The Adjacent Building On A Portion Of Erf 1001 Ceres Re-Advertisement 2021-05-26 1200. Simdlangentsha Central Rwss Phase 3.

Supply installation and commissioning of gprs modemiot as per ugvcls tender specification covering modem supplies web application for solution engineering and integration data hosting services for five years either on public cloud or private dat. Contizano has extensive experience organizing secondary transactions including a tender offer for Twilio. Sometimes a privately or publicly traded company executes a tender offer directly to.

In its simplest form a debt tender offer is an offer typically by the issuer to purchase all or a portion of its outstanding debt securities for cash at a price specified by the offeror. A tender offer is a proposal that an investor makes to the shareholders of a publicly traded company Private vs Public Company The main difference between a private vs public company is that the shares of a public company are traded on a stock exchange while a private companys shares are not. Another reason a private company might conduct a tender offer is to bring on additional investors or raise capital without having to dilute their existing stock or issue new preferred shares.

Where it is being made by a third party it is generally for the purpose of acquiring control over the target company and can be either a friendly or hostile takeover attempt. We Have More Than 10 Lakh Tender Results Over 5 Lakh Live Tenders And Over 45K Fresh Tenders. Our Company first used Complete Tenders in May 2018 where I was struggling to finish a tender due to the complexities of the finances.

Usually a tender offer only applies to a limited number of available shares. We Provide Tender Alert Tender Evaluation Management And Publication Tender Information. Hutchinson orchestrated the first pre-IPO employee private liquidity transaction at Facebook structuring discussions that were held in Mark Zuckerbergs living room.

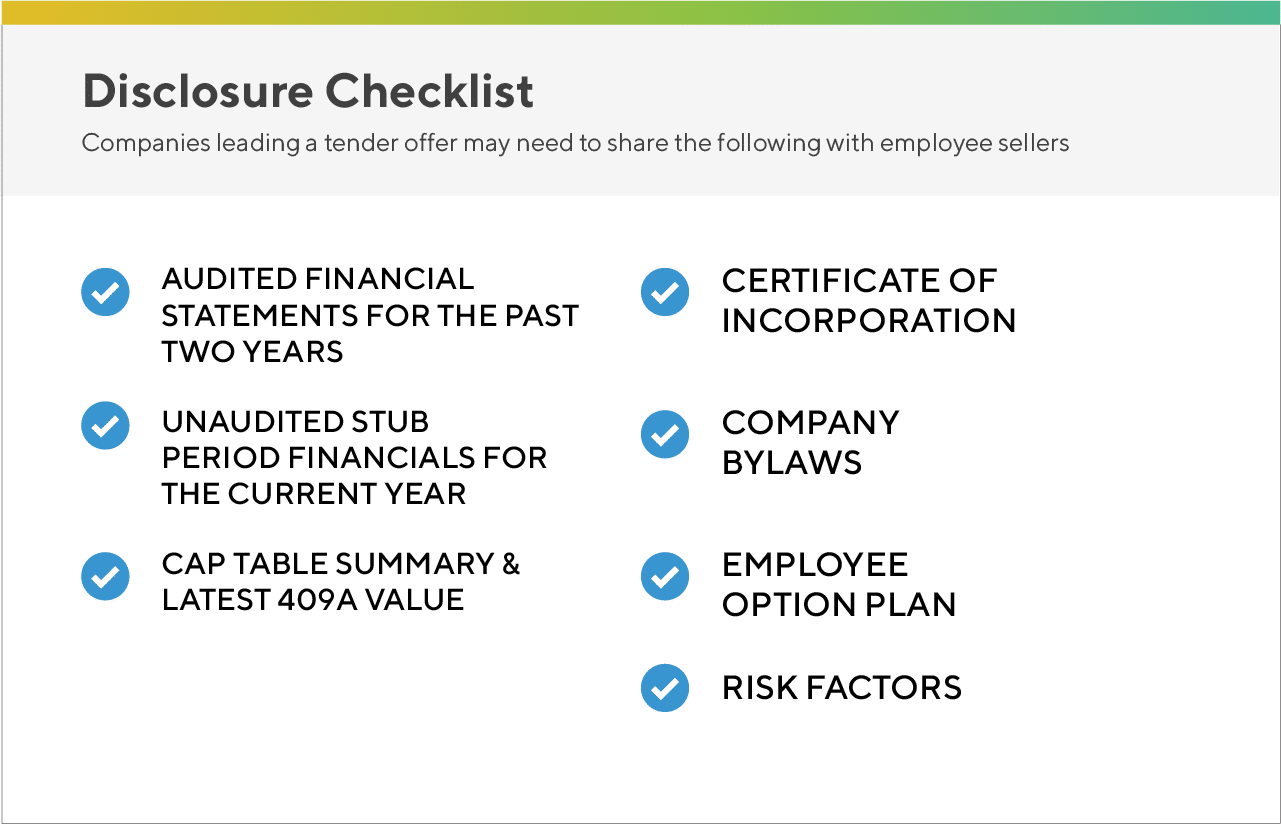

Depending on the number of sellers and other factors the transaction may need to be structured according to the SECs Regulation 14E eg offer kept open for 20 business days. NPMs tender offer technology eases the operational burden on a private company and the purchasers and streamlines the process of collecting participant interest and document signing. A tender offer is a structured company-sponsored liquidity event that typically allows multiple sellers to tender their shares either to an investor or back to the company.

This can be really beneficial for example to a later stage company looking to bring on strategic investors leading up to an IPO. This Note highlights selected legal and practical considerations for counsel advising on this kind of a private tender offer including a tender offer conducted as part of a structured liquidity program. 11 - Jun - 2021 20 Days to go.

RFT Request for Tender. Private sector tenders wont follow the same formula as public sector tenders.

/What-Is-a-Tender-Offer-58b457153df78cdcd8f17e62.jpg) Understanding Tender Offer S Effect On Investors

Understanding Tender Offer S Effect On Investors

Private Tender Offer Best Practices Pdf Free Download

Private Tender Offer Best Practices Pdf Free Download

Understanding Tax Implications Of Tender Offers Carta

Understanding Tax Implications Of Tender Offers Carta

Tender Offer Vs Merger One Step Two Step Mergers Wall Street Prep

Tender Offer Vs Merger One Step Two Step Mergers Wall Street Prep

Disclosures Needed For An Employee Tender Offer Founders Circle

Disclosures Needed For An Employee Tender Offer Founders Circle

Tender Offer What To Do When Your Company Announces One

Tender Offer What To Do When Your Company Announces One

Private Tender Offer Best Practices Pdf Free Download

Private Tender Offer Best Practices Pdf Free Download

Tender Offer Definition How It Works And Regulations

Tender Offer Definition How It Works And Regulations

Why Do Private Companies Run Liquidity Events Carta

Why Do Private Companies Run Liquidity Events Carta

What Is A Tender Offer Private Company

Https Silo Tips Download Private Tender Offer Best Practices

My Private Company Is Doing A Tender Offer Should I Participate Flow Financial Planning

My Private Company Is Doing A Tender Offer Should I Participate Flow Financial Planning

Tender Offer Meaning Purpose Process And More

Tender Offer Meaning Purpose Process And More

Increase Morale And Productivity With A Tender Offer

Comments

Post a Comment