In order to do business with Fannie Mae a mortgage lender must comply with the Statement on Subprime Lending issued by the federal government. Fannie Maes HomeReady and standard loan programs require only a 3 down payment for a single-family home.

Fannie Mae Home Ready Overview Naihbr

Fannie Mae Home Ready Overview Naihbr

Other applicable underwriting and eligibility requirements for the loan to be eligible for sale to Fannie Mae.

Fannie mae loan requirements. To buy a second home or an investment property you need a down payment of 10 and 20 respectively. Fannie Mae only deals with mortgages made to individuals. The general loan limits for 2021 have increased and apply to loans delivered to Fannie Mae in 2021 even if originated prior to 112021.

This part provides the requirements for originating conventional and government loans for sale to Fannie Mae. Documentation of income continuity is not required for most employment-related income types. Confirm the Condo Project Insurance Requirements.

A four-year waiting period is required measured from the discharge or dismissal date of the bankruptcy action. The applicable Loan Documents Loan Documents All documents evidencing securing or guaranteeing the debt obligation executed for a Mortgage Loan and approved by Fannie Mae. However while having credit scores on the low end of acceptable may still get an approval it can lead to higher interest rates.

The minimum original term is 85 months subject to applicable committing and delivery requirements for whole loans and loans in MBS. Follow the Condo Project Review Type Requirements. You can use your own funds or get a gift donation from a family member.

A corporation or general partnership would not qualify for a Fannie Mae loan. The term of a first mortgage may not extend more than 30 years beyond the date that is one month prior to the date of the first payment. This includes the continuity of income requirements that apply to all borrowers.

The Lender Contract Lender Contract Program Documents per the Multifamily Selling and Servicing Agreement. Fannie Mae Loan Requirements. The income from the co-borrower will not be accepted for.

Exceptions for Extenuating Circumstances. Fannie Mae will allow a mortgage that has a co-borrower and that person is not required to take title to the property. Requirements for conventional first mortgage loans eligible for delivery to Fannie Mae.

Acceptable Loan Terms. The Eligibility Matrix also includes credit score minimum reserve requirementsin months and maximum debt-to-income ratio requirements for manually underwritten loans. Fannie Maes minimum credit score requirements are published in the Eligibility Matrix and are based on the representative credit score for the transaction and the highest of the LTV CLTV or HCLTV ratios as applicable.

The minimum credit requirements for a Fannie Mae loan is 620 for a fixed-rate single-family home mortgage and 640 for adjustable-rate mortgages. Fannie Mae is your source for mortgage financing and reliable housing information. A fully executed sales contract for the current residence and confirmation that any financing contingencies have been cleared.

A few of the items that a lender will look at when considering financing include. It includes the following subparts. Require the borrower to obtain appropriate endorsements that will bring the coverage in line with Fannie Maes requirements if the existing property insurance policy does not provide the amount of coverage Fannie Mae requires and send a copy of these endorsements to the servicer of the first-lien mortgage loan.

Condo Project Review and Insurance Requirements Ineligible Project Characteristics for Condos. Refer to Lender Letter LL-2020-14 for specific requirements. Fannie Mae will waive this requirement and not require the debt to be included in the DTI ratio if the following documentation is provided.

A two-year waiting period is permitted if extenuating circumstances can be documented and is measured from the discharge or dismissal date of the bankruptcy action. Fannie Mae requires that lenders use an appraiser who is licensed following their guidelines. Fannie Mae purchases or securitizes loans that have original terms up to 30 years.

Conforming Conventional Loan Requirements Fannie Mae and Freddie Mac require that all borrowers meet certain credit scores income requirements work history debt to income ratios and minimum down payments. See B3-51-02 Determining the Representative Credit Score for a Mortgage Loan for additional information. Your total monthly expenses.

Loan Application Package Eligibility Underwriting Borrowers Underwriting Property Unique Eligibility and Underwriting Considerations Government Programs Eligibility and Underwriting Requirements Insurance Closing.

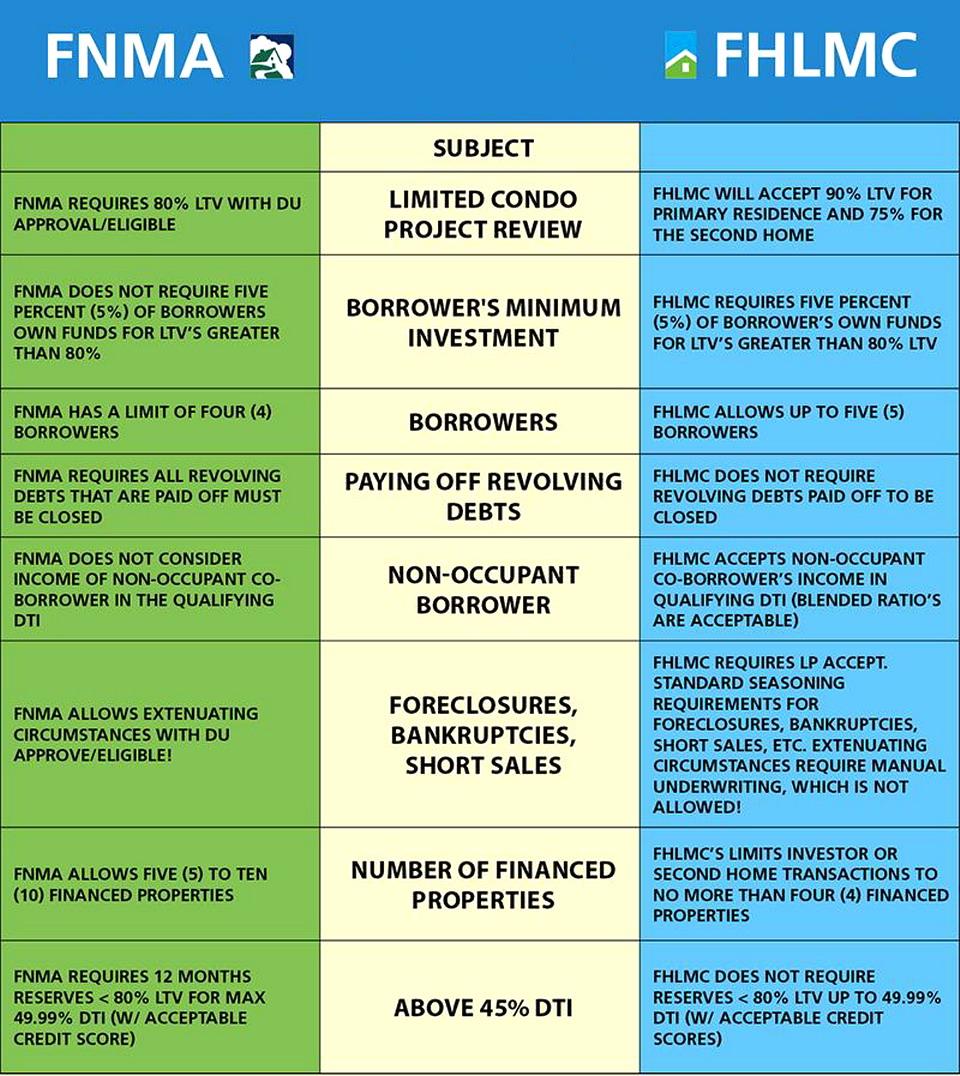

Fannie Mae Vs Freddie Mac Primacy Real Estate

Fannie Mae Vs Freddie Mac Primacy Real Estate

Fannie Mae Freddie Mac Relax Appraisal Employment Verification Standards In Wake Of Coronavirus Housingwire

Fannie Mae Freddie Mac Relax Appraisal Employment Verification Standards In Wake Of Coronavirus Housingwire

Mortgage Loan Underwriting Fannie Mae Guidelines Allow For 95 Ltv On Purchase And Rate Term Refinance For 1 Unit Properties 85 Loan To Value For Cash Out Refinances

Fannie Mae Requirements For Investor And Second Home Borrowers With Five To Ten Financed Properties Iloan Home Mortgage

Fannie Mae Requirements For Investor And Second Home Borrowers With Five To Ten Financed Properties Iloan Home Mortgage

Fannie Mae Eligibility Matrix Blog Home Mortgage Alliance Corporation

Fannie Mae Eligibility Matrix Blog Home Mortgage Alliance Corporation

Who Are Freddie Mac Fannie Mae And Ginnie Mae Realtyhop Blog

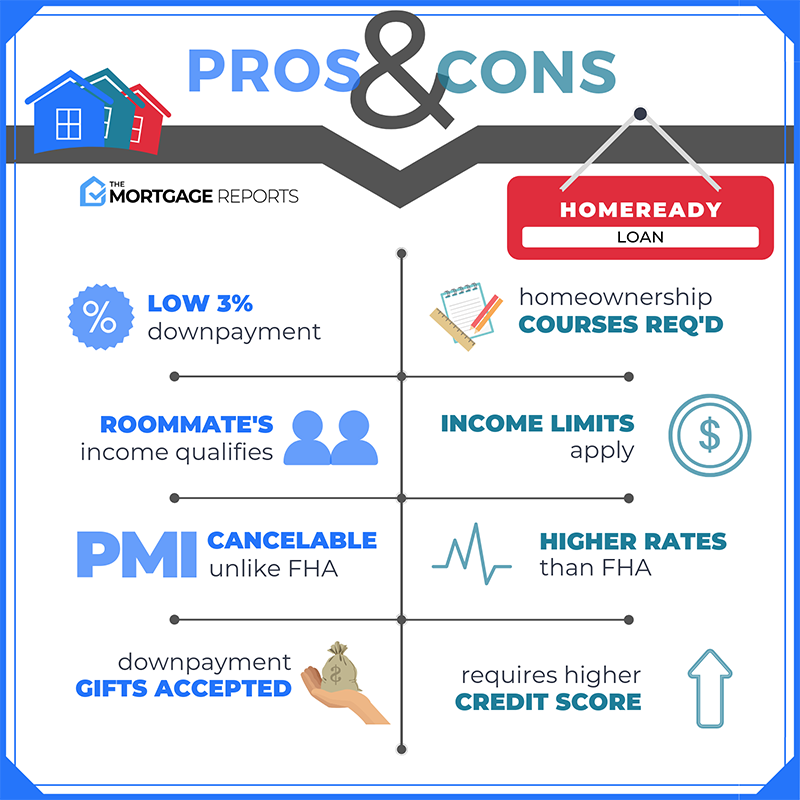

Freddie Mac S Home Possible Versus Fannie Mae S Homeready Which Is Better Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Freddie Mac S Home Possible Versus Fannie Mae S Homeready Which Is Better Mortgage Rates Mortgage News And Strategy The Mortgage Reports

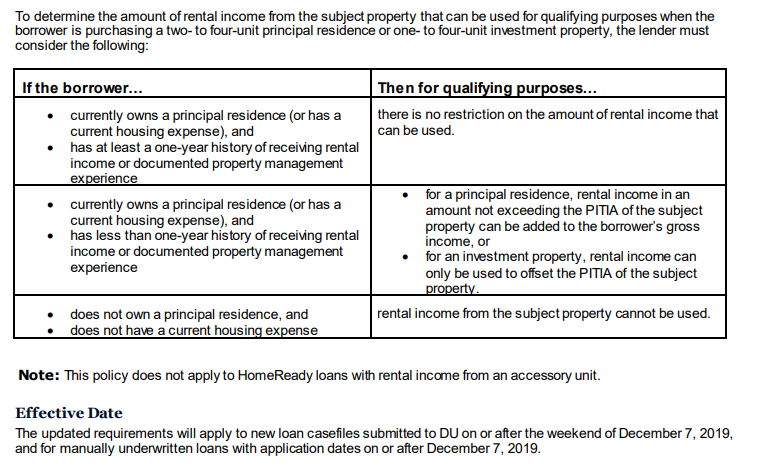

Fnma Guidelines Changes Dec 7 2019 Blueprint

Fnma Guidelines Changes Dec 7 2019 Blueprint

Fannie Mae Makes Mobile Home Loans Cheaper To Boost Affordable Housing National Mortgage News

Fannie Mae Makes Mobile Home Loans Cheaper To Boost Affordable Housing National Mortgage News

Fannie Mae Guideline Changes Gifts 97 Financing And Mortgage Insurance Iloan Home Mortgage

Fannie Mae Guideline Changes Gifts 97 Financing And Mortgage Insurance Iloan Home Mortgage

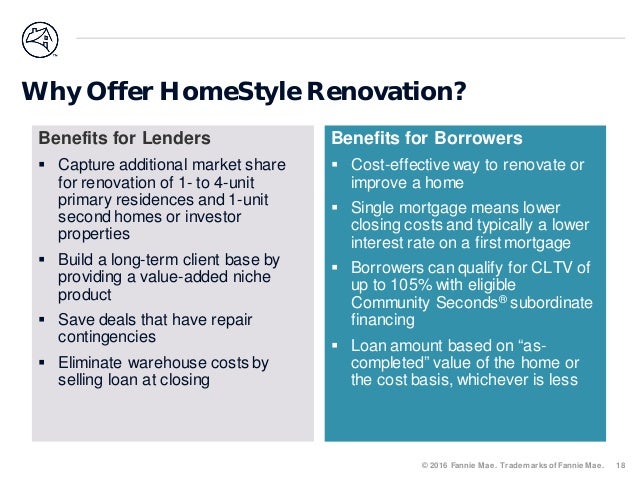

Homestyle Renovation Fannie Mae

Homestyle Renovation Fannie Mae

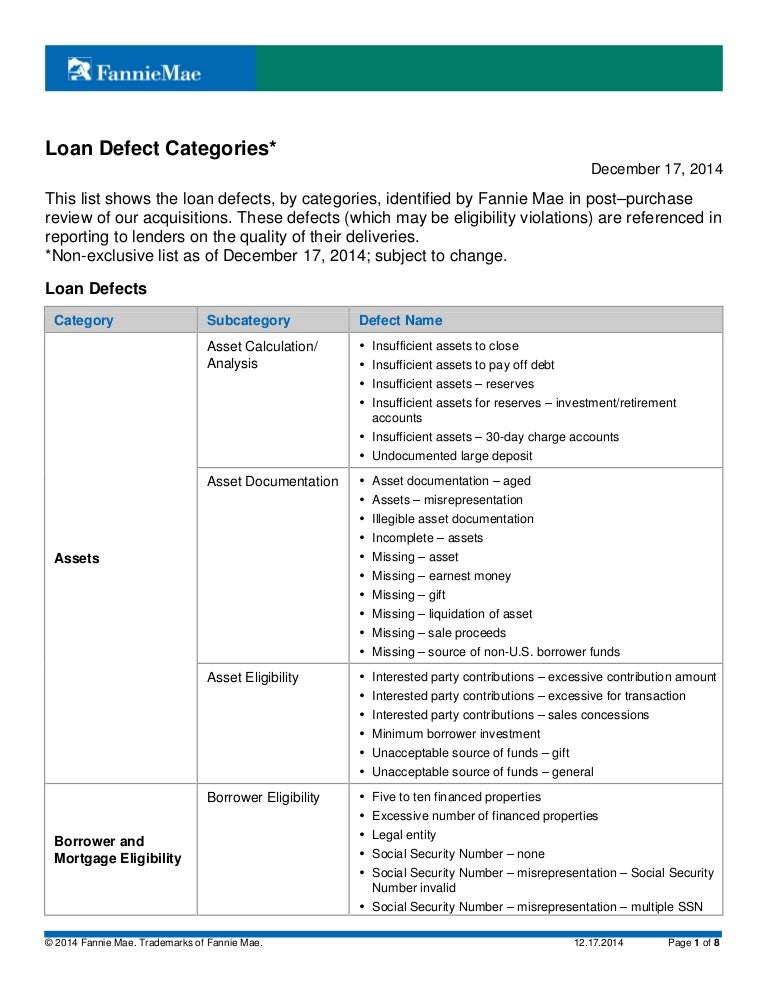

Fannie Mae Loan Defect Categories 12 17 2014

Fannie Mae Loan Defect Categories 12 17 2014

Fannie Mae Mortgage Lenders Unnecessarily Restrict Credit Housingwire

Fannie Mae Mortgage Lenders Unnecessarily Restrict Credit Housingwire

Fannie Mae Guideline Changes Gifts 97 Financing And Mortgage Insurance Iloan Home Mortgage

Fannie Mae Guideline Changes Gifts 97 Financing And Mortgage Insurance Iloan Home Mortgage

Comments

Post a Comment