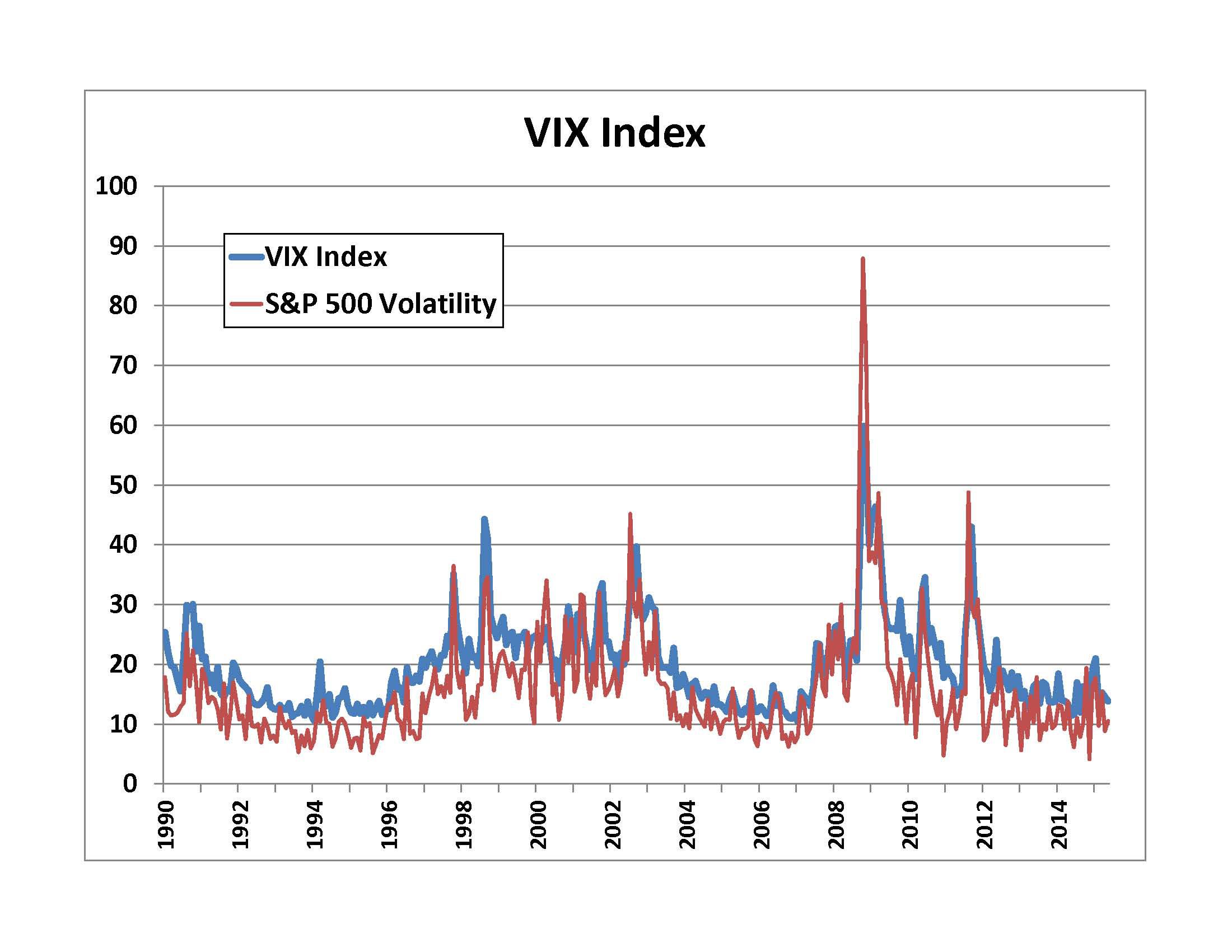

The VIX has fallen 378 from. UVXY ProShares Ultra VIX Short-Term Futures ETF.

Lessons From The Crash Of Short Volatility Etps Artur Sepp Blog On Quantitative Investment Strategies

Lessons From The Crash Of Short Volatility Etps Artur Sepp Blog On Quantitative Investment Strategies

On day 2 the ETF.

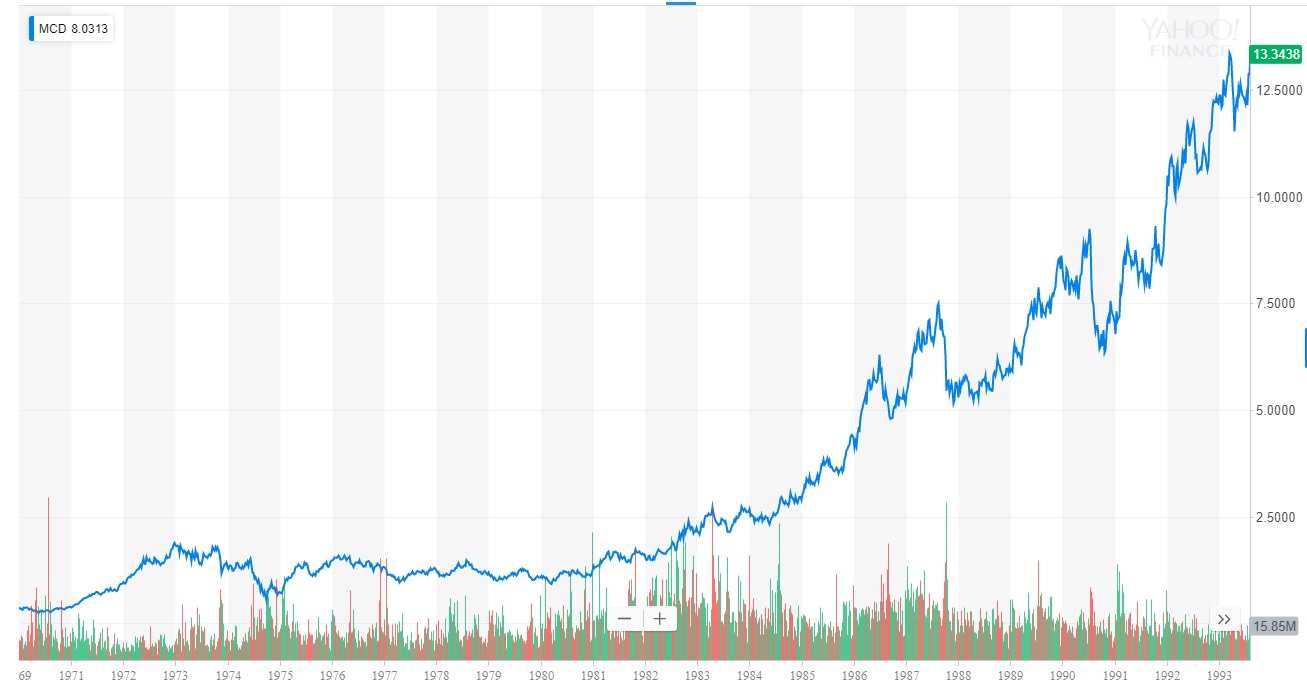

Leveraged vix etf. This operation adjusts the leverage back to 3x. VolatilityShares recently filed for the VolatilityShares 2x Long VIX Futures ETF in hopes of filling the gap left open by the 1 billion TVIX. The other types of VIX ETFs are the leveraged ETFs which aim to amplify the returns generated by the VIX index.

One company however intends to change that. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk consequences of seeking daily leveraged or daily inverse leveraged investment results and intend to actively monitor and manage their investment. Additionally there are the Leveraged Small Cap Exchange-traded Funds ETF which have gained momentum in recent times.

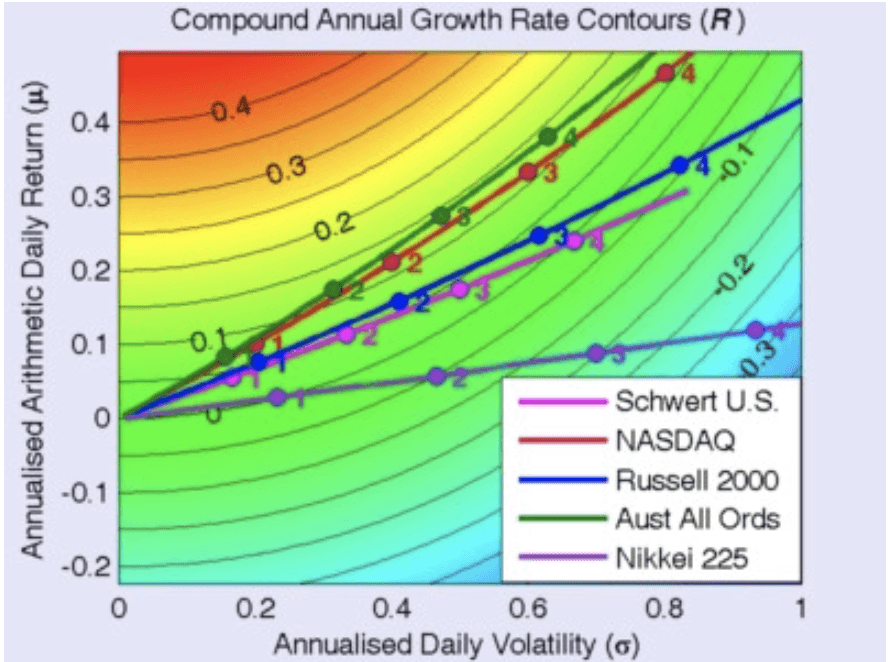

Inverse Volatility ETFs While leveraged volatility ETFs offer a higher performance than the VIX or other underlying indexes inverse ETFs are negatively correlated to the market indexes. VIIX VelocityShares VIX Short-Term ETN. It is important to note that none of the options futures or ETNs linked to the VIX offer exposure.

These leverage ETFs offer amplified returns on their corresponding small cap market index and using these investors can gain more exposure like two times or three times from a select market or sector of their choice in the small cap space. The use of leverage by a Fund increases the risk to the Fund. This implies taking a loan for 200 so that we control assets worth 300.

The metric calculations are based on US-listed Volatilities ETFs and every Volatilities ETF has one issuer. Its also important to point out that ETFs that effectively short the VIX inverse ETFs or are designed to double the VIXs performance. If an issuer changes its ETFs it will also be reflected in the.

These ETFs are designed to generate amplified returns based of the VIX through the use of financial instruments including swaps futures and other derivatives. This ETF offers leveraged exposure to an index comprised of short-term VIX futures contracts making it a very powerful tool for those looking to implement sophisticated strategies requiring exposure to the VIX. 27 lignes Leveraged 3X ETFs are funds that track a wide variety of asset classes such.

Inverse volatility ETFs short future contracts on the VIX or the benchmark index and are usually. VIX ETF Options. Inverse VIX ETFs make use.

Daily Inverse VIX Short-term ETN XIV Short VIX Short-Term Futures ETF. VXX VXXB iPath SP 500 VIX Short-Term Futures ETN. There are 3 VIX ETFs that trade in the US excluding inverse and leveraged funds as well as those with under 50 million in assets under management AUM.

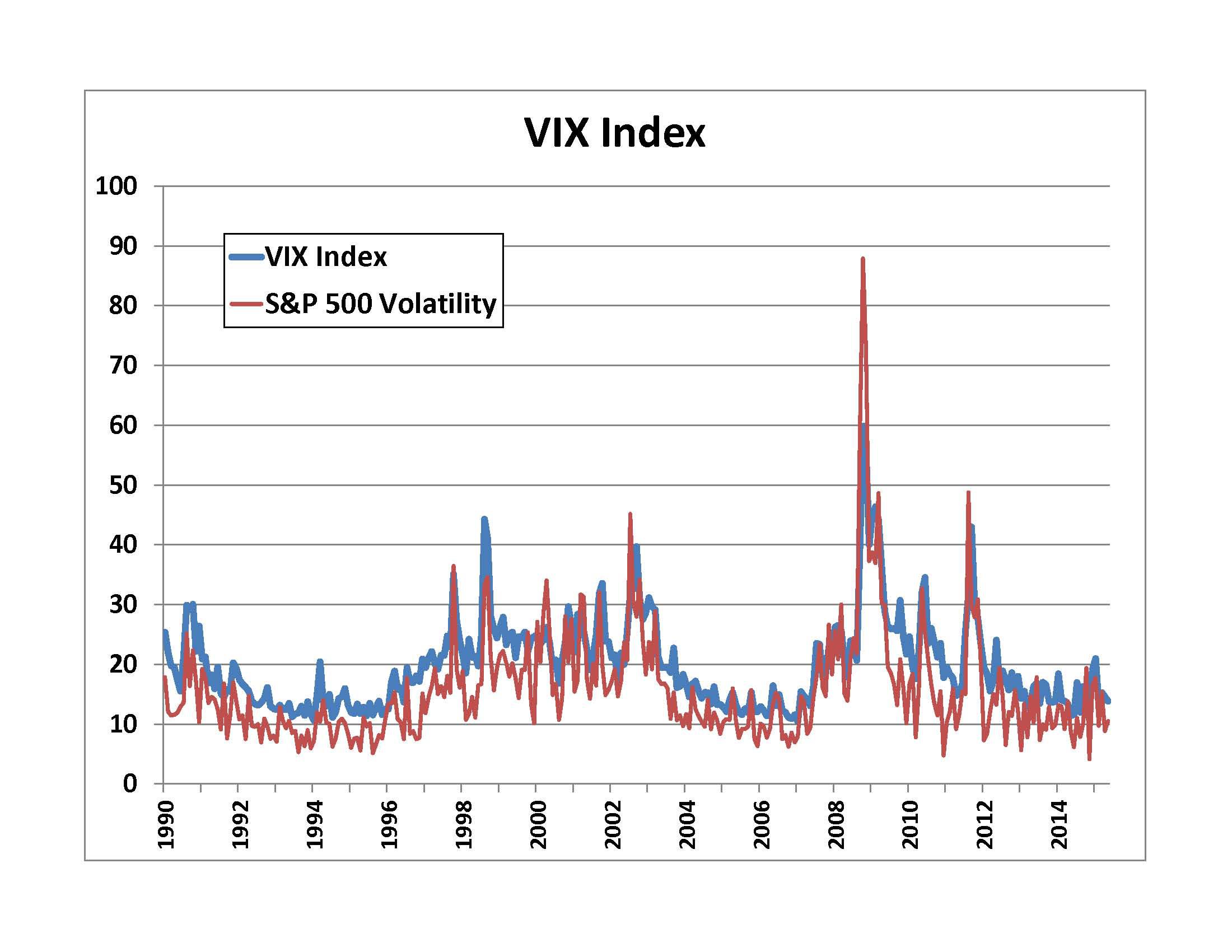

For instance if the VIX index value rises by 15 percent the 2x leveraged VIX ETF will rise by 3 percent during the same time period. But because our equity grew faster than the assets our leverage is now less than 3x. The Chicago Board Options Exchange Market Volatility Index VIX also known as the markets fear gauge is the most widely used benchmark of volatility.

In short a VIX ETF is not a good long-term investment. Leveraged Inverse and More Short-Term VIX ETNs. These ETNs offer investors the opportunity to invest in contracts that are several months out as.

InverseLeveraged Volatility Funds. 1x Long Unleveraged Short-Term VIX Futures. 2x Long Leveraged Short-Term VIX Futures.

VIX the CBOE Volatility Index is a standard index that tracks the volatility at the market level. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk consequences of seeking daily leveraged or daily inverse leveraged investment results and intend to actively monitor and manage their investment. ETF issuers who have ETFs with exposure to Volatilities are ranked on certain investment-related metrics including estimated revenue 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields.

Ultra VIX Short-Term Futures ETF. The VIX also known as the fear index is a. These ETFs provide leveraged exposure to the SP 500 VIX Short-Term Futures Index inverse leveraged exposure to the Nasdaq 100 and leveraged exposure to the Nasdaq 100 respectively.

Daily 2x VIX Short-Term ETN. Our loan is not affected by this so our equity increases by 30. Leveraged Volatility ETFs provide magnified exposure to the CBOE Volatility Index VIX.

UVXY offers daily leveraged exposure to short-term VIX futures usually of one or two months maturity. The use of leverage by a Fund increases the risk to the Fund. On day 2 the value of our assets rises by 10.

On day 1 we buy a 3x leveraged ETF for 100. Similarly the Inverse VIX 3x leveraged ETF will go down by -45 percent during the same period as it is set to generate the inverse returns. VIXY ProShares VIX Short-Term Futures ETF.

Inverse VIX ETFs are the exchange-traded funds that attempt to provide returns which are inverse of those realized from the VIX index. TVIX VelocityShares Daily 2x VIX Short-Term ETN. The ETF now performs its daily reset.

Nature Of Short Vix Strategies Quantitative Finance Stack Exchange

Nature Of Short Vix Strategies Quantitative Finance Stack Exchange

How To Short The Vix Without Blowing Up Your Entire Portfolio Backtesting A Hedged Short Vxx Portfolio Nasdaq

How To Short The Vix Without Blowing Up Your Entire Portfolio Backtesting A Hedged Short Vxx Portfolio Nasdaq

Lessons From The Crash Of Short Volatility Etps Artur Sepp Blog On Quantitative Investment Strategies

Lessons From The Crash Of Short Volatility Etps Artur Sepp Blog On Quantitative Investment Strategies

Volatility Blow Up Leads To Inverse Vix Etn Casualty Etf Strategy Etf Strategy

Volatility Blow Up Leads To Inverse Vix Etn Casualty Etf Strategy Etf Strategy

Understanding Vix Etfs Careful What You Wish For Etf Com

Understanding Vix Etfs Careful What You Wish For Etf Com

Vix Index What It Is How It Works And How To Trade It

Vix Index What It Is How It Works And How To Trade It

Don T Use Vix Etfs To Bet On Volatility The Motley Fool

Don T Use Vix Etfs To Bet On Volatility The Motley Fool

Lessons From The Crash Of Short Volatility Etps Artur Sepp Blog On Quantitative Investment Strategies

Lessons From The Crash Of Short Volatility Etps Artur Sepp Blog On Quantitative Investment Strategies

The New Tvix Another 2x Leveraged Vix Etf Could Be Coming Etf Focus On Thestreet Etf Research And Trade Ideas

The New Tvix Another 2x Leveraged Vix Etf Could Be Coming Etf Focus On Thestreet Etf Research And Trade Ideas

What Does Etf Stand For In Investing Vix Intraday Historical Data

What Does Etf Stand For In Investing Vix Intraday Historical Data

Understanding Vix Etfs Careful What You Wish For Etf Com

Understanding Vix Etfs Careful What You Wish For Etf Com

The New Tvix Another 2x Leveraged Vix Etf Could Be Coming Etf Focus On Thestreet Etf Research And Trade Ideas

The New Tvix Another 2x Leveraged Vix Etf Could Be Coming Etf Focus On Thestreet Etf Research And Trade Ideas

Leveraged Etf Investors Are Ignoring Volatility At Their Peril Seeking Alpha

Leveraged Etf Investors Are Ignoring Volatility At Their Peril Seeking Alpha

Options On Leveraged Vix Etfs Legal Issues Seeking Alpha

Options On Leveraged Vix Etfs Legal Issues Seeking Alpha

Comments

Post a Comment