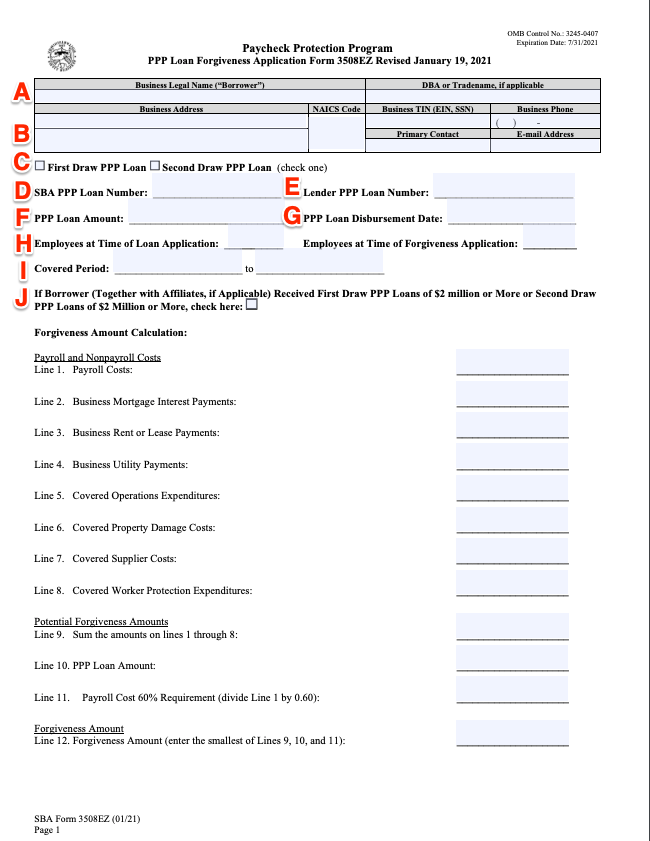

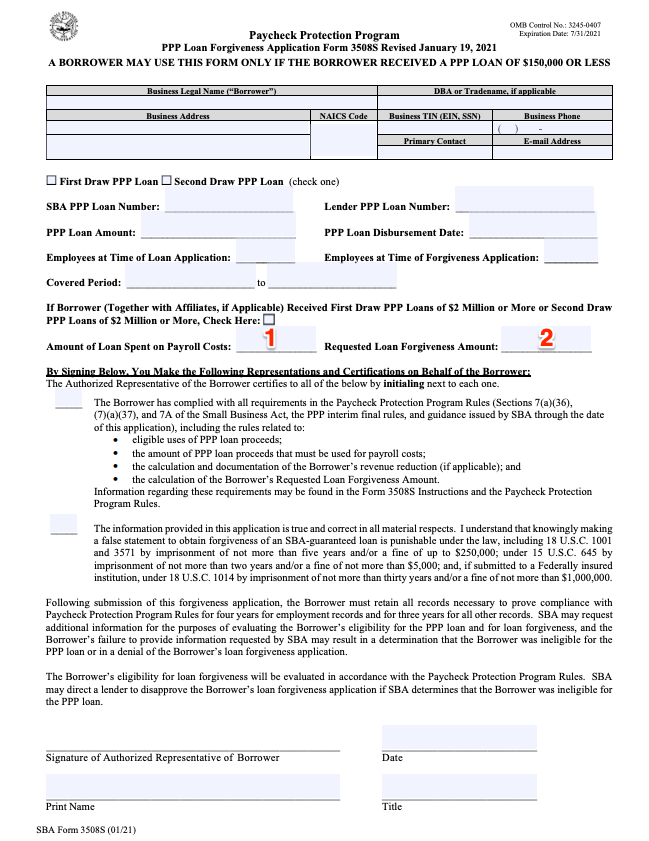

Since you dont have staff headcount payroll and benefits to calculate your application process for the loan and later for forgiveness is much simpler. How to Fill Out the PPP Forgiveness Application.

Self Employed Here S What You Need To Know About Ppp Eidl Loans

Self Employed Here S What You Need To Know About Ppp Eidl Loans

PPP Funds have run out for most banks.

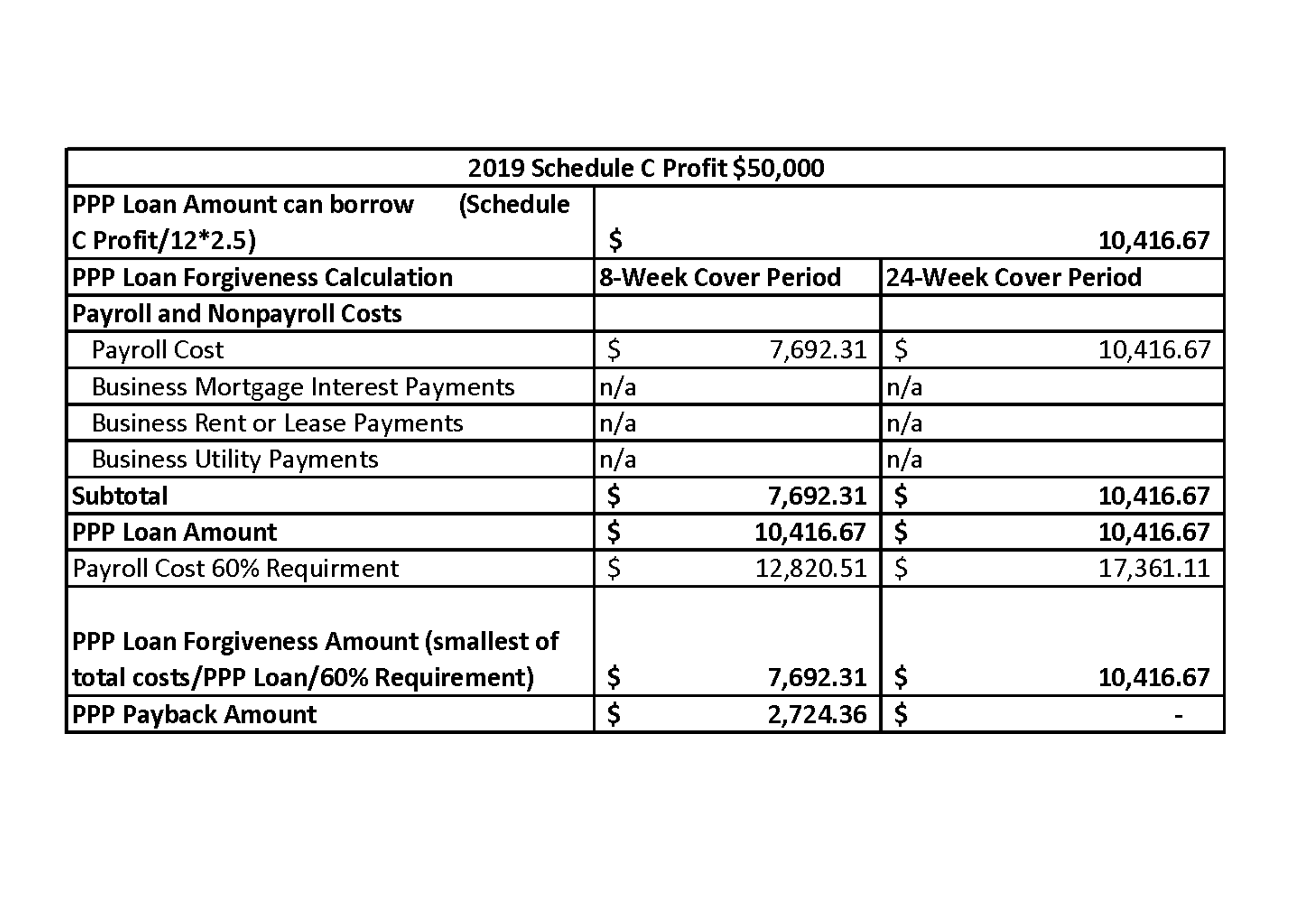

Ppp loan for self employed. Use our calculator to confirm your PPP eligibilty and amount. The calculator also tells you if you can get PPP a second time. We will use a self-employed individual Jason as an example to help you better understand how to complete this application.

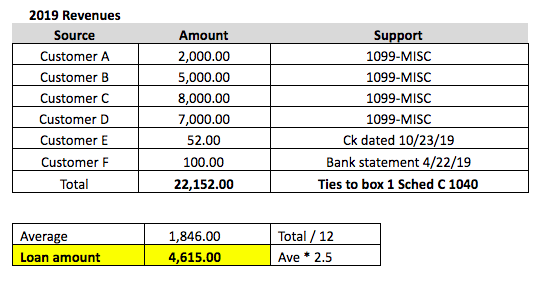

As a self-employed individual with no employees your PPP loan was based on your Schedule C Net Income Line 31. However new changes to the program impact how self-employed worker loans are calculated and forgiveness criteria. That is the amount that you will also use for forgiveness.

For self-employed individuals that have multiple businesses with PPP loans you are capped at 20833 in owner compensation replacement across all loans obtained by all businesses. For many self-employed individuals PPP loan forgiveness will be based largely or entirely on owners compensation replacement. The PPP loan programs original rules made it difficult for self-employed workers to qualify for any meaningful size loan and the payroll ratio requirements made it impossible to receive complete forgiveness on the loans.

More guidance available at our PPP Resource Center. The PPP makes it possible for lenders to provide low-interest loans that are 100 forgiven in some situations. If you qualify for PPP by all means be sure to apply.

The PPP loan forgiveness extension may help the self-employed On June 7 The Payroll Protection Program Flexibility Act was passed into law extending the covered period in which borrowers can use Payroll Protection Program PPP loan proceeds from eight weeks to 24 weeks. Instead the self-employment income of general active partners may be reported as a payroll cost up to 100000 annualized on a PPP loan application filed by or on behalf of the partnership. The latest changes apply to loans of 150000 or lessthe maximum loan amount for most sole proprietors independent contractors and self-employed individuals.

The updated PPP applications for self-employed workers and sole proprietors who file IRS Form 1040 Schedule C now asks for the total amount of gross income found on line 7 of the tax form. While you can begin your application online learning more about a PPP loan for self-employed workers is also important. As long as you dont have employees on payroll this form applies to you.

The goal is to create crystal clear documentation showing how you used these forgivable funds. But because weve always been partnered with CDFIs we still have almost 9 billion available to lend. The Bottom Line on Applying for PPP When Self-Employed.

If you are an individual entrepreneur or self-employed person with no other employees and have been negatively impacted by the COVID-19 pandemic we are going to cut through the piles of Paycheck Protection Program PPP regulations and tell you how to apply for a PPP loan in five easy steps. Simply put theres a loan program offered because of the Cares Act called the PPP. The new PPP application for self-employed workers and sole proprietors who file IRS Form 1040 Schedule C now asks for the total amount of gross income found on line 7.

Whats a PPP Loan. PPP Eligibility Calculator for Self Employed1099 Self-employed and 1099 workers. When these funds are used properly these loans are completely forgiven.

1040 Schedule C for 2019 Your birth date A color copy of your Drivers License front and back 1099-MISC if you have them A voided check for your business bank account If. Starting January 11 2021 PPP Paycheck Protection Program loans were once again open. What Documents Do the Self-Employed Need to Apply for a PPP Loan.

To apply for PPP loan forgiveness self-employed individuals can use the simplified Form 3508EZ. Maximum PPP Loan Calculation Change. Heres how to pay your PPP loan money if youre self employed.

If youre self-employed as a sole proprietor or independent contractor with no employees you can still apply for a Paycheck Protection Program PPP loan. For example if you receive 15000 in owner compensation from one business you will only be able to receive 5833 compensation from all other businesses you have an ownership stake in. We discuss this in detail in our article.

How the Self-Employed can apply for a PPP Loan in Five Easy Steps By Bill Cunningham. Blueacorn PPP Loans for Self-Employed and 1099s Weve Helped over 500000 Self-Employed People Get Over 8 Billion in PPP Loans. If youre applying for a PPP loan.

If you do have payroll expenses you can use the standard Form 3508. Jasons Schedule C Net Income for 2019 was 85000. 7 rijen In order to apply for a PPP loan as a self-employed individual or independent contractor.

This article now contains the latest PPP loan forgiveness updates from the Small Business Administration SBA and Treasury Department released on January 19 2021. If you are a partner in a partnership you may not submit a separate PPP loan application for yourself as a self-employed individual.

How To Get Ppp Loans If You Re Self Employed Austin Business Journal

How To Apply For A Ppp Loan When Self Employed Divvy

How To Apply For A Ppp Loan When Self Employed Divvy

How Ppp Loan Forgiveness Works For The Self Employed Bench Accounting

How Ppp Loan Forgiveness Works For The Self Employed Bench Accounting

How To Apply For A Ppp Loan When Self Employed Divvy

How To Apply For A Ppp Loan When Self Employed Divvy

How Ppp Loan Forgiveness Works For The Self Employed Bench Accounting

How Ppp Loan Forgiveness Works For The Self Employed Bench Accounting

Self Employed Guide To The Ppp Forgiveness Application Bench Accounting

Self Employed Guide To The Ppp Forgiveness Application Bench Accounting

Paycheck Protection Program Ppp Tips For The Self Employed

Paycheck Protection Program Ppp Tips For The Self Employed

How To Apply For A Ppp Loan If You Re Self Employed Nav

How To Apply For A Ppp Loan If You Re Self Employed Nav

Self Employed Individuals And Small Businesses Paycheck Protection Program And Loan Forgiveness Smolin

Self Employed Individuals And Small Businesses Paycheck Protection Program And Loan Forgiveness Smolin

Fast Facts About Ppp Eidl Loan Forgiveness Medows Cpa

Fast Facts About Ppp Eidl Loan Forgiveness Medows Cpa

Self Employed Guide To The Ppp Forgiveness Application Bench Accounting

Self Employed Guide To The Ppp Forgiveness Application Bench Accounting

Sba Ppp Loan Self Employed Explained Paycheck Protection Program Youtube

Sba Ppp Loan Self Employed Explained Paycheck Protection Program Youtube

How To Apply For A Ppp Loan If You Re Self Employed

How To Apply For A Ppp Loan If You Re Self Employed

How To Track Ppp Loan Expenses For Self Employed Individuals Updated Template Included Youtube

How To Track Ppp Loan Expenses For Self Employed Individuals Updated Template Included Youtube

Comments

Post a Comment