But for small to medium-sized businesses SMBs there is more than meets the eye when it comes to the impact from COVID-19 on MA interest. Some advisors say its the best MA.

Bullish Baby Boomers Help Fuel Red Hot Small Business M A Market

Bullish Baby Boomers Help Fuel Red Hot Small Business M A Market

While many small businesses owned by baby boomers were badly affected by the epidemic there is also a large group of boomer businesses that have used the epidemic and record low interest rates as an opportunity to expand.

Small business m&a. During such situation MA takes place which helps the drowning company to come back with new strategies and policies. The fact is that the average MA firm did zero to one deal last year. MA advisors bridge the transaction market gap between the smaller businesses that are sold by business brokers typically less than 2 million transaction value or less than 1 million in EBITDA and medium to larger size businesses that are clearly led by investment bankers where the deal size is greater than 100 million or EBITDA is greater than 30 million.

How do I know if another small business or consumer can pay me with Zelle. Not five not 10 zero to one. This article is available to paid digital subscribers.

Yet many business brokers are not knowledgeable and do not have experience. Small business requirements for MA may be small sized meaning low deal value and hence less commission and fees for MA advisors. Every business be it large or small goes through a phase of establishment growth maturity decline and rebirth.

Small Business Mergers and Acquisitions Since business MA transactions are inherently more complex than real estate sales business brokers bring a lot more to the table than real estate agents. Pandemic injects some reluctance into small business MA market BY Mark Sanchez Sunday July 05 2020 1154am A couple of small business deals Andrew Longcore has been approached about lately illustrate the effects on the MA market this year from the COVID-19 pandemic. Mergers and acquisitions MA is a general term used to describe the consolidation of companies or assets through various types of financial transactions.

MA groups survive by charging retainers not by selling companies. For a small company. How small businesses can be MA players too Apr 14 2021 In a crowded mergers and acquisitions environment Bluestone Investment Partners has carved out its.

In the small business arena MA volume has begun to grow only in the last year and there has been a small increase in valuations at this level. The easiest way to find out is to simply ask if theyre enrolled with Zelle. If its a consumer let them know they can look for Zelle in their banking app.

Selecting the right MA Advisory for Small Business. Valuations are not projected to escalate measurably for the remainder of the year. Startups and small businesses face different considerations and constraints than do large corporations.

According to a study by the New York Fed and AARP older business owners 45 and older entered the epidemic with more financial cushions than their younger. When a manager on those teams decides they want the technology or talent they bring it up to the MA team which acts as a service organization helping Apples engineering groups close the. Small business size standards are established by the US Small Business Administration SBA on an industry-by-industry basis but the general SBA definition is a for-profit independently owned and operated business concern with fewer than 500 employees for manufacturing businesses and less than USD 7 million in annual receipts for most nonmanufacturing businesses.

Small businesses may be. Posted on August 13 2018 As small businesses embrace a strengthening economy there is another reason for entrepreneurs to be optimistic. At this time only those enrolled with Zelle through their banking app are able to send and receive money with eligible business accounts.

What Are Mergers and Acquisitions MA. Businesses take up the challenges of innovation and decisions that may go to a wrong route leading to the loss. Startup and Small-Business Financial Plan The templates in this section are not specific to MA transactions but they help in the planning and due diligence phases of the process.

Valuations in Middle-Market May Increase Further but Small Business Valuations. Bullish baby boomers help fuel red hot small business MA market Published Sun May 16 2021 900 AM EDT Updated Sun May 16 2021 916 AM EDT Ellen Sheng ellensheng.

Byond M A Talks Accelerate Small Business Growth Through M A

Byond M A Talks Accelerate Small Business Growth Through M A

Mergers Acquisitions M A Valuation Street Of Walls

Europe S Top 25 Mid Market Financial M A Advisors And Firms

Europe S Top 25 Mid Market Financial M A Advisors And Firms

Federal Agency Issues Guidance On Ppp Loans And M A Deals

Federal Agency Issues Guidance On Ppp Loans And M A Deals

Small Business Buyers Find M A Targets Plentiful

Small Business Buyers Find M A Targets Plentiful

Baker Tilly Talks Small Business Mergers Pymnts Com

Baker Tilly Talks Small Business Mergers Pymnts Com

Mergers Acquisitions M A Valuation Street Of Walls

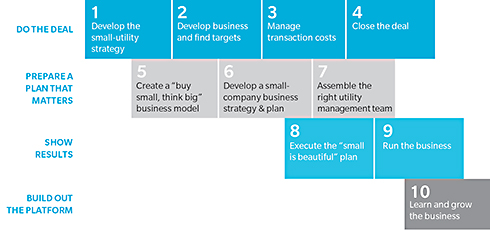

Small Is Beautiful M A Opportunities With Smaller Utilities

Small Is Beautiful M A Opportunities With Smaller Utilities

/dotdash_Final_Selecting_Mergers__Acquisitions_Advisories_For_Small_Businesses_Feb_2020-49eddd7ae4364798b2135983509638c8.jpg) Selecting Mergers Acquisitions Advisories For Small Businesses

Selecting Mergers Acquisitions Advisories For Small Businesses

Comments

Post a Comment