Were here to help you make the best decisions to ensure that your company and its assets are protected against the many unique risks that businesses face on a daily basis. Commercial Insurance The experts at Standard Mortgage Insurance Agency have the in-depth knowledge and experience needed to navigate todays complicated commercial insurance industry.

Commercial Mortgage Loans A Historically Attractive Asset Class For Insurance Investors Aam Company

Commercial Mortgage Loans A Historically Attractive Asset Class For Insurance Investors Aam Company

Theyre a step up from commercial loans which arent secured against property or assets.

Commercial mortgage insurance. Canada Mortgage and Housing Corporation CMHC is Canadas provider of mortgage loan insurance for the construction purchase and refinancing of multi-unit commercial real estate properties including rental buildings licensed care facilities and retirement homes. Term life insurance can be taken out anywhere between 5-30 years to cover the mortgage. Theyre specifically for business owners and designed to help you buy a property for your business.

Business loans up to 25000 are unsecured but for larger amounts lenders need security in order to reduce the risk to themselves. The commercial property you own and whether its in an area prone to flooding or if its a listed building that would be harder to repair. Commercial mortgage whole loans currently provide insurance investors with an attractive yield advantage to investment grade bond alternatives.

Its a good idea to compare a few different quotes for commercial. Those that do are usually affiliated with a life insurer. Commercial mortgages generally take over where business loans finish.

Similar to private mortgage insurance in the residential mortgage finance market commercial lenders need a means to pass on some of this risk rather than holding it all in their own portfolios. A borrower can lock in a loan for 20 to 30 years keeping repayments consistent and avoiding changes in interest rates. Commercial Mortgage Insurance Insurance for a commercial property is more complicated than with a residential propertyFor instance CMHC wont insure a pure commercial property.

The number of properties you want to insure. With a commercial mortgage your property acts as security. Yea I agree with Bill there is no sub-prime commercial mortgage insurance policy out there.

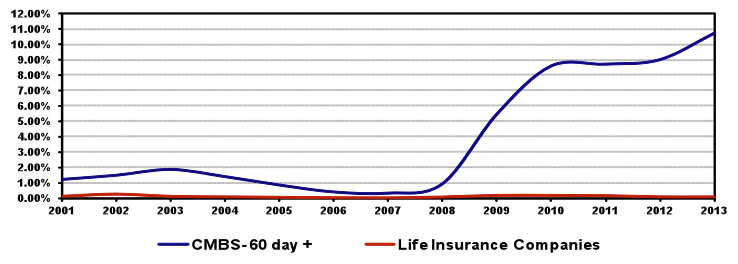

Bill mentions some of the factoring metrics. Commercial mortgage loans are a unique private asset class that can provide compelling benefits and worthwhile relative value to institutional investors. Recent modern innovations in investment-grade insurance products can provide banks with both the structure and liquidity required and most importantly risk coverage for all projects and.

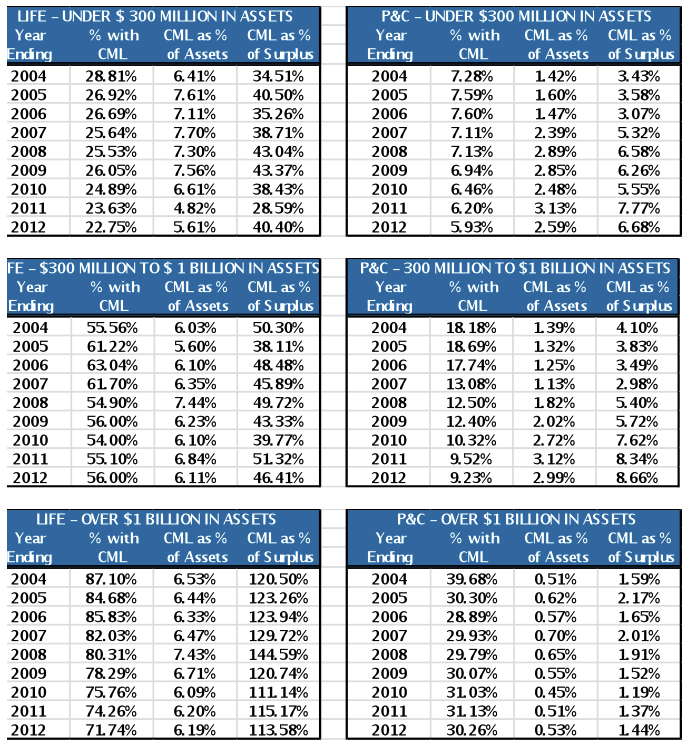

Some of the features of the asset class for insurers include favorable risk based capital treatment enhanced risk adjusted returns versus fixed income alternatives and low correlation to other asset. If youve claimed on your commercial property insurance before. However they may insure a mixed residential - commercial property with a down payment as low as 15With a personal residential property the lender can be assured that the borrower will make mortgage payments a priority.

Once the mortgage is paid off the need for insurance is no longer needed and the policy can then end. Few P. When are commercial mortgages used.

Term life insurance for commercial mortgages As you are looking to cover a commercial mortgage term life insurance is probably a better option. Mortgage insurance protects a mortgage lender or title holder if a borrower defaults on payments dies or otherwise cant pay the mortgage. NONGENERIC INSURANCE REQUIRE-MENTS Beyond the generic insurance re-quirements in the model language offered here loan documents for a substantial commercial loan will often require other insurance based on characteristics of a specific building such as particular occupancies construction tech-niques zoning issues nearby risks special haz-.

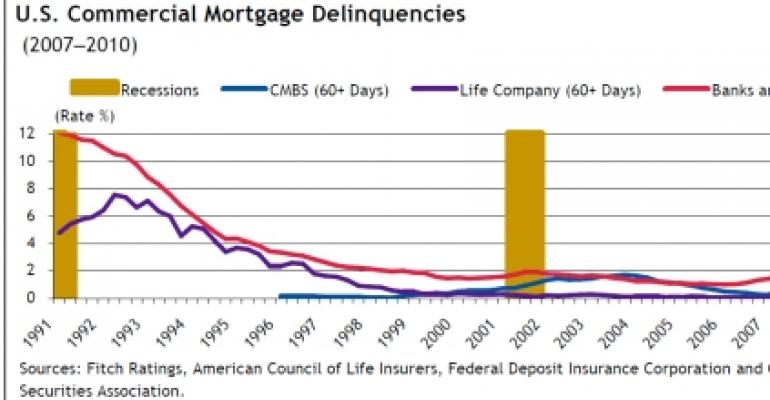

A commercial mortgage is a type of mortgage or loan thats secured on a property that isnt your place of residence. The premiums are also substantial but it is helpful in that it enables companies to secure financing for large projects that may otherwise not be granted. Commercial mortgage investments held by life insurance companies posted a positive 122 percent total return in the fourth quarter of 2020 a slight decrease from the positive 171.

Commercial mortgage insurance covers the loss of the lender for big projects such as condominiums shopping malls or complexes. Nor does any MI policy really affect your world per se. A business mortgage usually lasts from three to 25 years and you can usually find a 70-75 mortgage.

Key Benefits of a Commercial Mortgage from a Life Insurance Company For borrowers and properties that qualify for a commercial mortgage from a life insurance company the biggest advantages are the long-term fixed-rate options. Many insurance companies consider commercial mortgage loans to be a core component of their investment strategy and are currently a highly favored investment class by many companies. Mortgage insurance is not insurance for the Mortgagee for the entire balance only a portion.

Commercial mortgage loan CML market is a.

Fed S Medicine Gradually Pricking The Commercial Real Estate Bubble Wolf Street

Fed S Medicine Gradually Pricking The Commercial Real Estate Bubble Wolf Street

Https Www Nbc Insurance Ca Content Dam Bnc Entreprise Pdf Cli Summary Cml Ctl Pdf

Commercial Mortgages Held By Life Insurance Companies Weather The Storm National Real Estate Investor

Commercial Mortgages Held By Life Insurance Companies Weather The Storm National Real Estate Investor

Lending For Commercial Property Falls As Investors Pull Back Wsj

Lending For Commercial Property Falls As Investors Pull Back Wsj

Life Insurance For A Commercial Mortgage Business Cover Expert

Life Insurance For A Commercial Mortgage Business Cover Expert

How To Invest In Cmbs Commercial Mortgage Backed Securities Financeninsurance

How To Invest In Cmbs Commercial Mortgage Backed Securities Financeninsurance

Commercial Mortgage Loans A Historically Attractive Asset Class For Insurance Investors Aam Company

Commercial Mortgage Loans A Historically Attractive Asset Class For Insurance Investors Aam Company

Find A Better Safety Net Scotsman Guide

Find A Better Safety Net Scotsman Guide

Commercial Mortgages Mid Atlantic Technology Loans

Commercial Mortgages Mid Atlantic Technology Loans

Why You Should Have A Mortgage Insurance

Why You Should Have A Mortgage Insurance

Commercial Mortgage Ever North Buy To Let Mortgage Mortgage Protection Insurance Private Medical Insurance

Commercial Mortgage Ever North Buy To Let Mortgage Mortgage Protection Insurance Private Medical Insurance

U S Commercial Real Estate Lenders Expect A Strong 2019 Urban Land Magazine

U S Commercial Real Estate Lenders Expect A Strong 2019 Urban Land Magazine

Comments

Post a Comment