As a rule bond prices and interest rates move inversely to each other with bond. You can also post a question or comment on FixedIncomeRisk forums on a variety of fixed income topics journal articles and the top fifty books in the fixed income area.

Fixed Income Securities Valuation Risk And Risk Management Wiley

Fixed Income Securities Valuation Risk And Risk Management Wiley

Wir bereiten Ihr Unternehmen gegen aktuelle und zukünftige Bedrohungen optimal vor.

Fixed income risk management. Our models are unbiased by PIMCOs market views and where. What is Managing Market Risk in a Fixed-Income Portfolio. You can download software for managing interest rate risk and for valuing fixed income securities and their derivatives.

Risks of fixed income investing Interest rate risk. One of the critical metrics an investor should ascertain is the amount of plus their manager uses. Attribute portfolio performance to the risk factors.

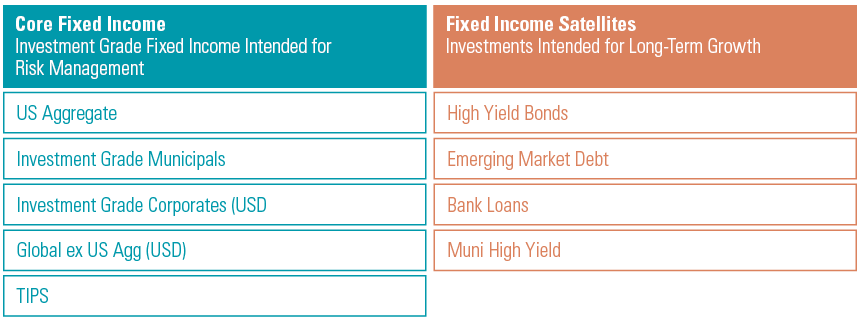

In the arena of fixed income investing we believe risk management is portfolio management and vice versa. Domestics foreigns treasuries high yield very emerging markets debt local EM USD EM swaps swaptions cross-currency structured notes local EM CDS futures CDX indices ABS CAT bonds currency forwards and options and sometimes funky structured notes. Value and measure risks in virtually every fixed income security type including.

Anzeige Unsere Arbeitsweise - Geprägt von Professionalität Transparenz und Effizienz. Fixed income investing is a conservative strategy where returns are generated from low-risk securities that pay predictable interest. The classic risk measures of fixed income securities.

All investing involves risk including the risk of loss. Immunization and applications in assetliability management. Monitor and manage risk through ex-ante risk decomposition.

Finreon Fixed Income Risk Control USD Aggregate misst das Kreditrisiko sowie das Zinsrisiko an den USD-denominierten Anleihemärkten. Das Zinsrisiko wird innerhalb fester Bandbreiten über liquide börsengehandelte Zinsfutures gesteuert. Duration DV01 and convexity and their applications to risk management.

This course takes participants through the valuation and risk measures for fixed-income FI products and deals with the. Whats a fixed income risk manager to do. These relative value and risk models are designed to permit stress testing of all embedded assumptions in order to provide portfolio managers with the widest spectrum of outcomes from very likely to most unlikely.

Originally the plus sectors were typically high yield non-dollar denominated investments and. Bonds carry the risk of default which means that the issuer may be unable or unwilling to make further. Je nach Risikomessung investiert der Fonds in Unternehmensanleihen oder in US-Staatsanleihen.

A buy-and-hold investor purchases a 5 year 10 annual coupon payment bond at 9279 per 100 of par value and holds it until maturity. This two-day course covers the management of market risk in a fixed income portfolio. Wir bereiten Ihr Unternehmen gegen aktuelle und zukünftige Bedrohungen optimal vor.

Any discussion of risk management is intended to describe PGIM Fixed Incomes efforts to monitor and manage risk but does not imply low risk. Fixed Income securities are subject to certain risks including credit interest rate issuer market and inflation risk. Construct Smart Beta strategies and tilt portfolios.

Anzeige Unsere Arbeitsweise - Geprägt von Professionalität Transparenz und Effizienz. Calculating the total return on a bond that is held until maturity. Riding the yield curve and rate level trading.

Calculate the total return on the bond. Sector Risk Fixed Income managers may allocate their holdings across a rather broad spectrum of securities including Treasuries agencies corporates municipals mortgage backed securities MBS commercial mortgage backed securities CMBS and other. Create tracking baskets to replicate broad fixed income indices.

The biggest risks buyers of fixed-income investments face are interest rate risk credit risk and inflation risk. Investors dont have to buy bonds directly from the issuer and hold them until maturity. Since the risk is lower the interest coupon payments are also.

January 23 2003 Department ofAccounting and Finance University Southern Denmark Campusvej 55 DK-5230. We own or have bought over the years. Securities Pricing and Risk Management Claus Munk This version.

Fixed Income Securities Valuation Risk Management Pdf

Fixed Income Securities Valuation Risk Management Pdf

Risk Management Approaches For Fixed Income Markets By Bennett W Golub

Risk Management Approaches For Fixed Income Markets By Bennett W Golub

New Approaches For Risk Management In Fixed Income And Stock Markets Rania Jammazi Livres Specialises Africa Vivre

New Approaches For Risk Management In Fixed Income And Stock Markets Rania Jammazi Livres Specialises Africa Vivre

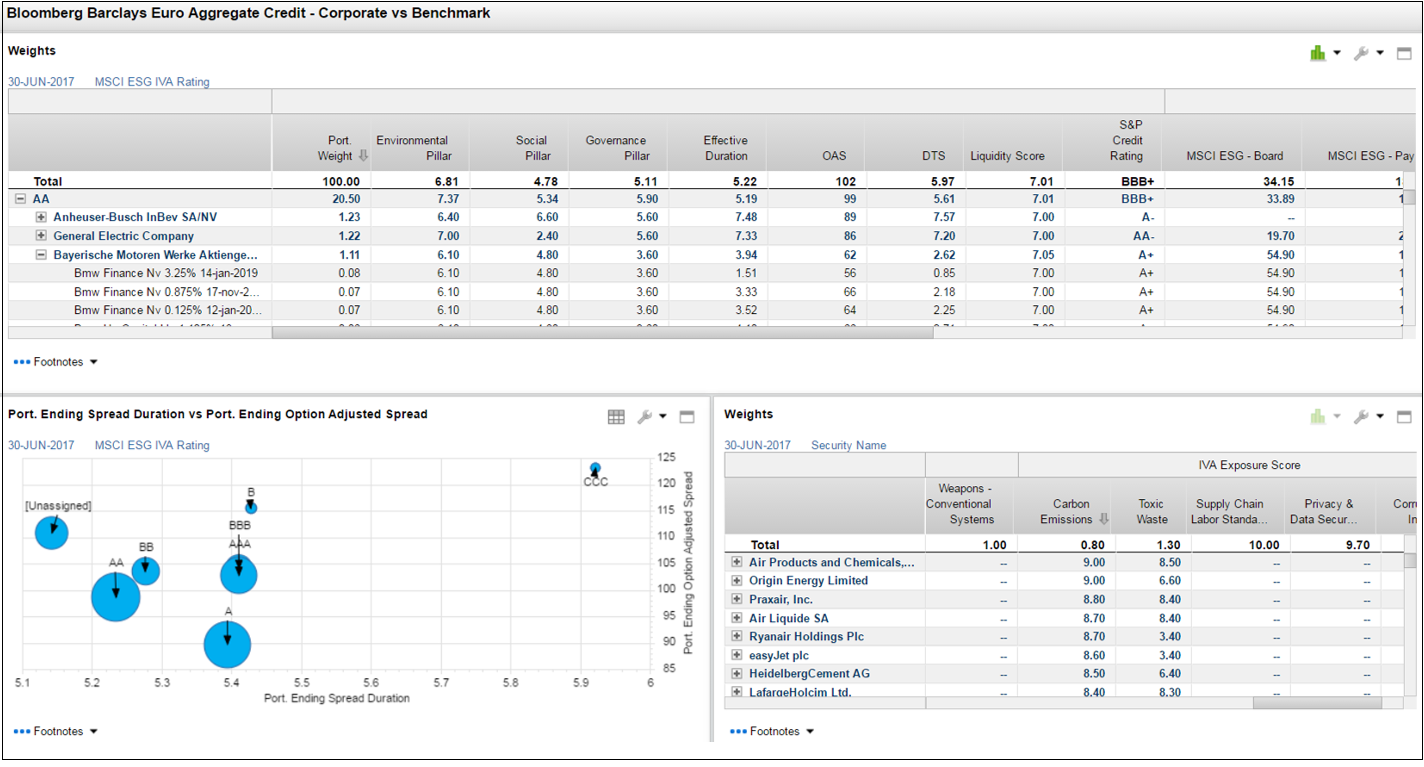

Esg In Fixed Income Enhancing Risk Management

Esg In Fixed Income Enhancing Risk Management

Fixed Income Trading And Risk Management The Complete Guide Wiley

Fixed Income Trading And Risk Management The Complete Guide Wiley

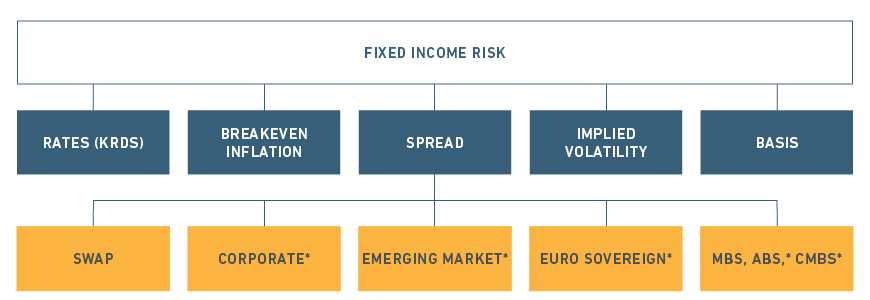

Managing Fixed Income Risk In Turbulent Times Msci

Managing Fixed Income Risk In Turbulent Times Msci

Systematic Fixed Income Institutional Blackrock

Systematic Fixed Income Institutional Blackrock

Die 10 Besten Bucher Fur Fixed Income

Die 10 Besten Bucher Fur Fixed Income

Amazon Com Fixed Income Trading And Risk Management The Complete Guide Wiley Finance Ebook During Alexander Kindle Store

Amazon Com Fixed Income Trading And Risk Management The Complete Guide Wiley Finance Ebook During Alexander Kindle Store

The Role Of Core Fixed Income This Time Is Not Different

The Role Of Core Fixed Income This Time Is Not Different

Integrated Fixed Income Risk And Performance Analysis Msci

Risk Management Approaches For Fixed Income Markets Wiley

Risk Management Approaches For Fixed Income Markets Wiley

Fixed Income Securities Valuation Risk Management And Portfolio Strategies Wiley

Fixed Income Securities Valuation Risk Management And Portfolio Strategies Wiley

Comments

Post a Comment