No seller would send an item without being paid first. Buy now pay later with PayPal Credit.

PAD is offered by paypal when its offered you can use it and when it is not you cant.

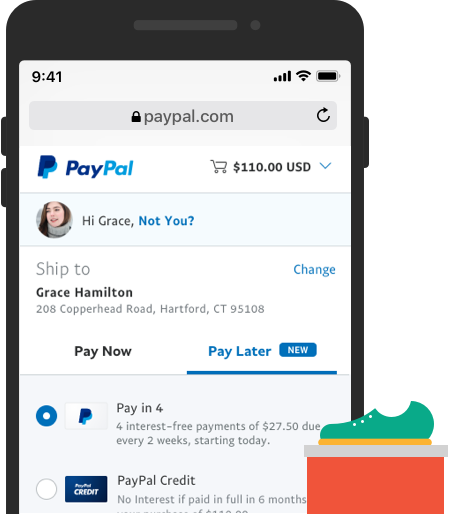

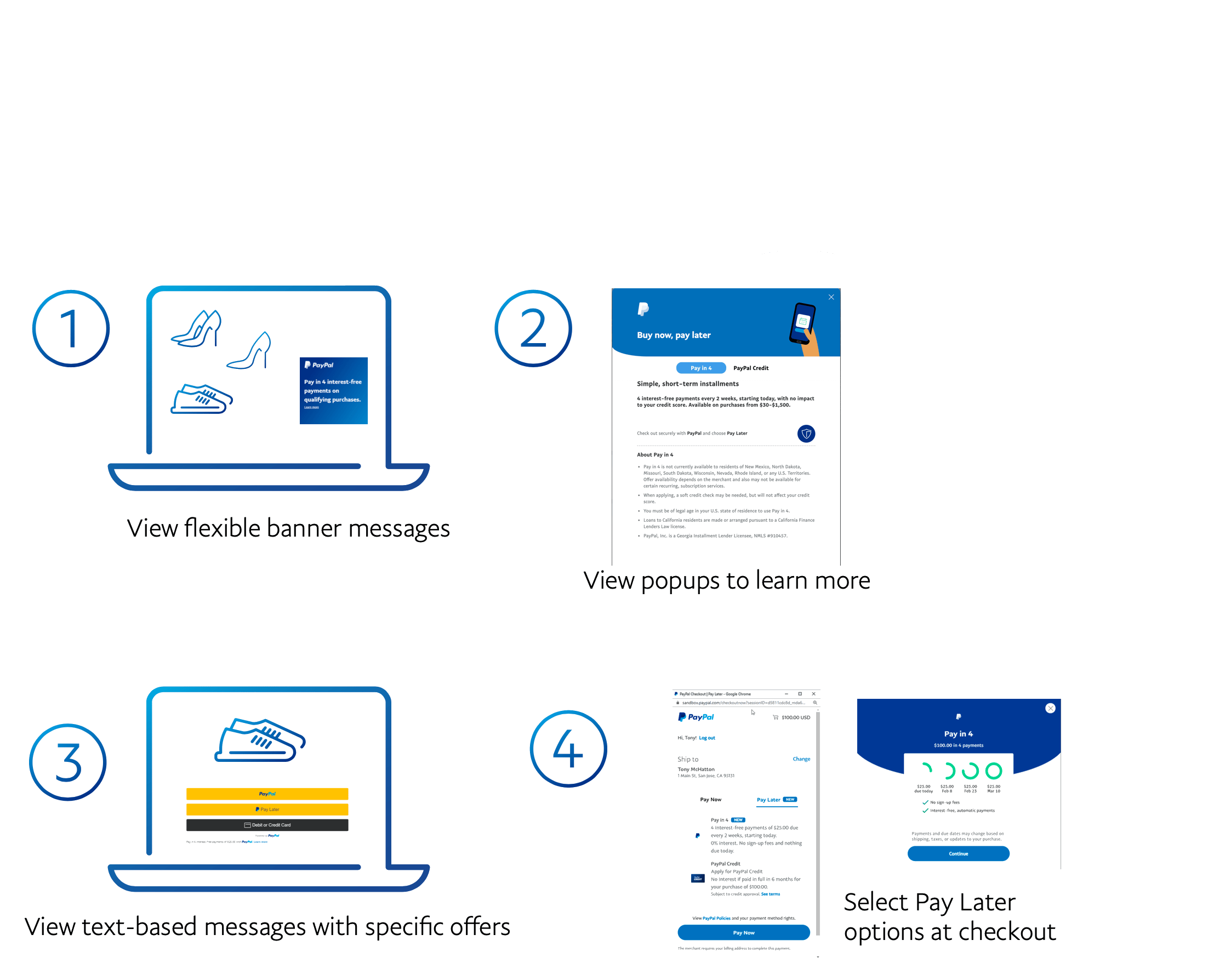

How does paypal pay later work. Pay in instalments - Monthly instalment offers at selected merchants so you can spread the cost over longer periods. Payment methods supported by PayPal. Using PayPals buy now pay later service is pretty straightforward.

That person can then immediately. Nothing to do with the seller as they get credited the funds instantly all it means is that paypal wait a bit longer before debiting your bank account. PayPal Credit is like a credit card without the plastic.

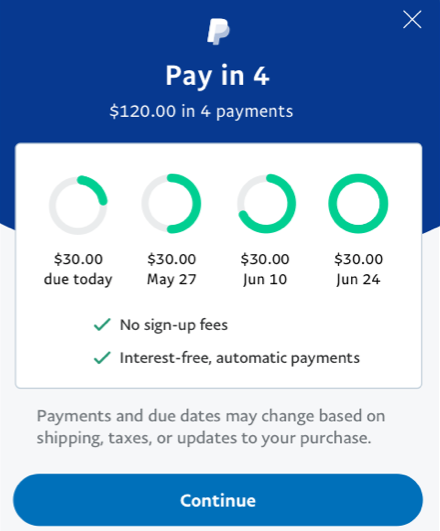

Customers to pay for a purchase over time without fees or interest. The statement provides you with information about how much you spent what your interest rate is and when your payment is due. This video shows how you can use the PayPal Pay Later Pay in 4 option at checkout to split your payments in 4 - one every two weeksFull setup.

Its Pay in 3 scheme will launch in late October and will be available to use at Crew Clothing French Connection Robert Dyas and Ryman. Buy now pay later apps allow you to make purchases online and pay them off over time in weekly bi-weekly or monthly installments. PayPal has announced a new buy now pay later BNPL scheme ahead of the Black Friday and Christmas shopping season.

The extension for WooCommerce is free. When you select Paypal Credit at checkout Paypal pays the merchant for your purchase. When your customers shop online PayPal offers short-term interest-free payments and other special financing options that they can use to buy now and pay later while you get paid up front.

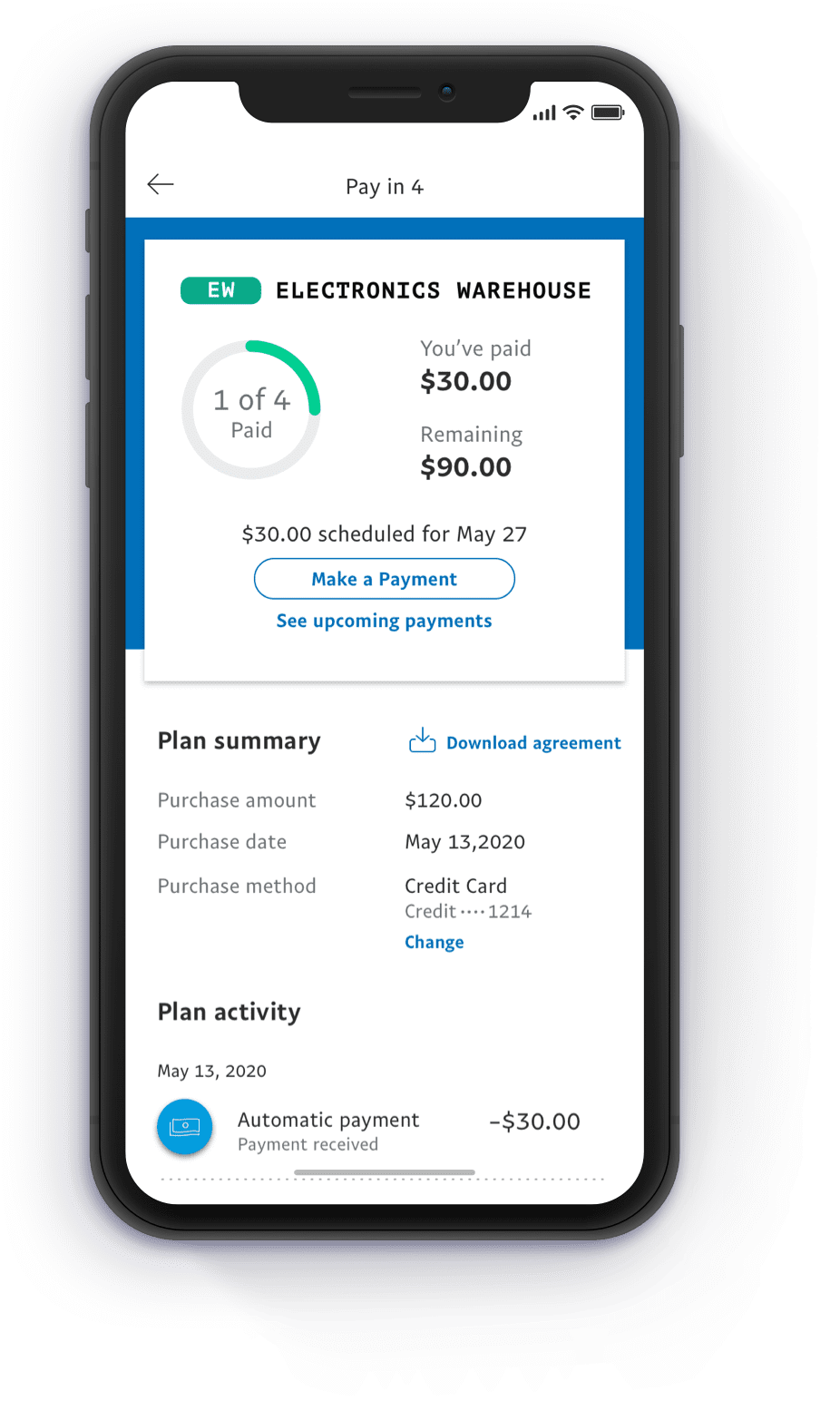

At that point you receive a statement in the mail from Paypal Credit about 10 to 15 days after your purchase. Youll make the next three payment. Sending money this way means the money is immediately credited to the recipients account.

Watch the video to see how PayPal Credit works. After their initial payment the remaining three payments are. Link your credit card andor bank account to PayPal and then add to or withdraw from a secure money pool shop at retailers who accept PayPal or send money to other users.

For customers the short-term payment option allows US. You have several ways to fund the money you send to another party through PayPal. Bill your customers for physical or digital goods on a regular basis with recurring billing options.

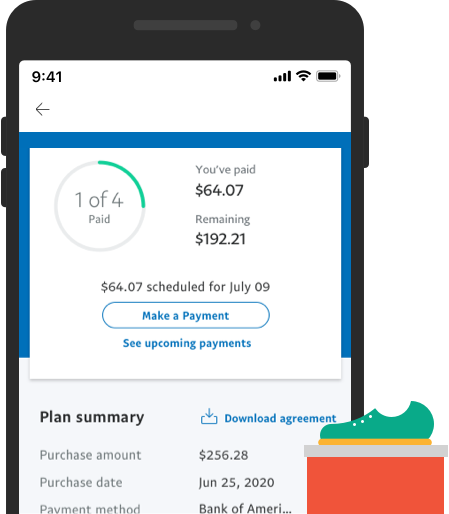

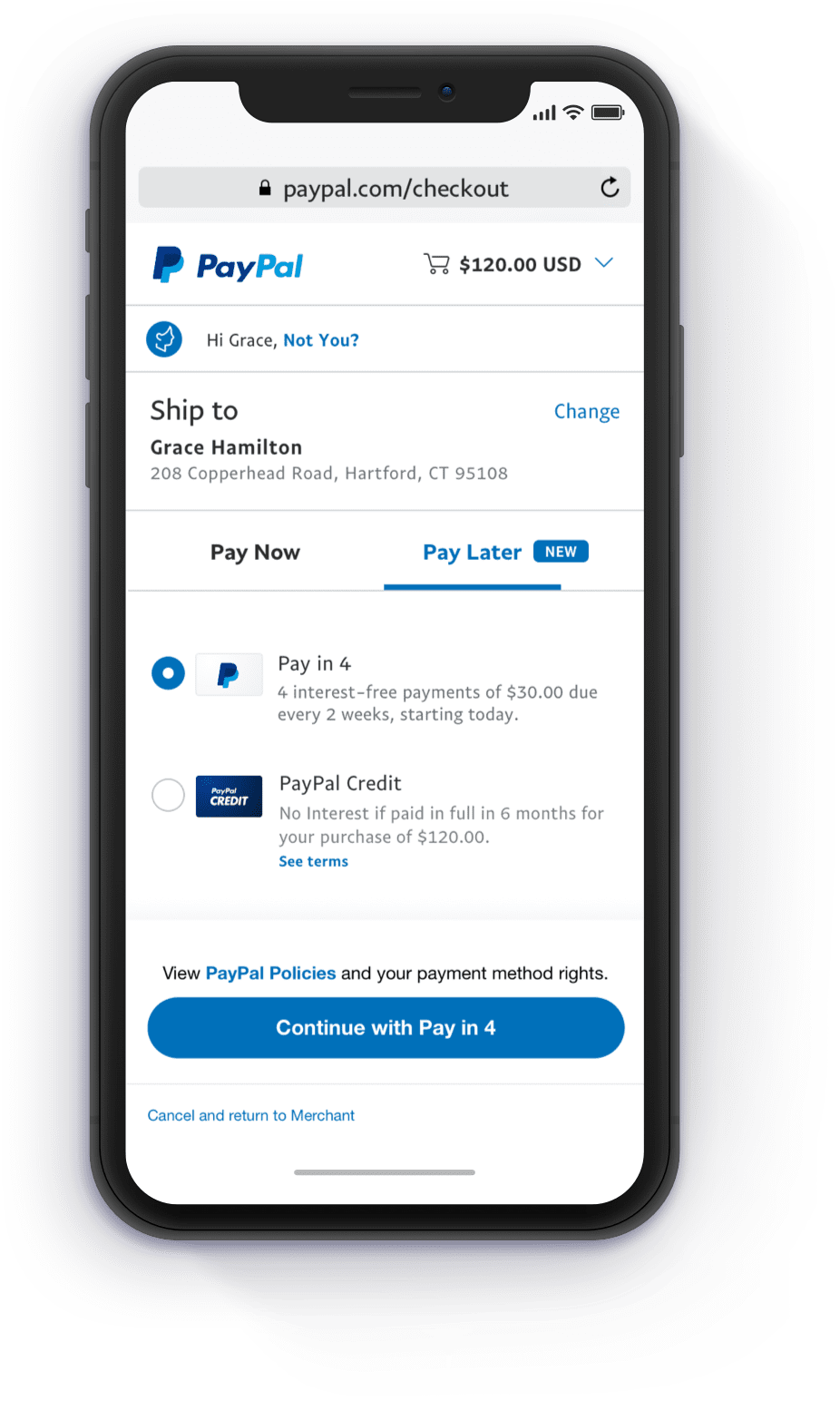

PayPal is perfect for subscriptions and all sorts of regular payments. These apps sometimes charge interest much like. When you reach checkout select Pay in 4 as your payment method.

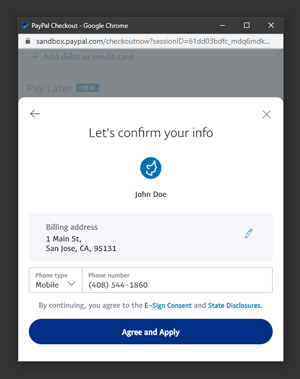

Youll be notified if you are approved instantly. Like most buy now pay later platforms PayPal Pay in 4 wont charge you a fee unless you miss a payment. PayPals website is fully-encrypted allowing your customers to make online purchases in a secure way.

You can apply for it if you dont already have the PayPal Plus Credit Card eBay MasterCard or PayPal Buyer Credit. How Does Paypal Work for You as a Seller. Once youre approved for PayPal Pay Later it becomes a funding source in your PayPal account.

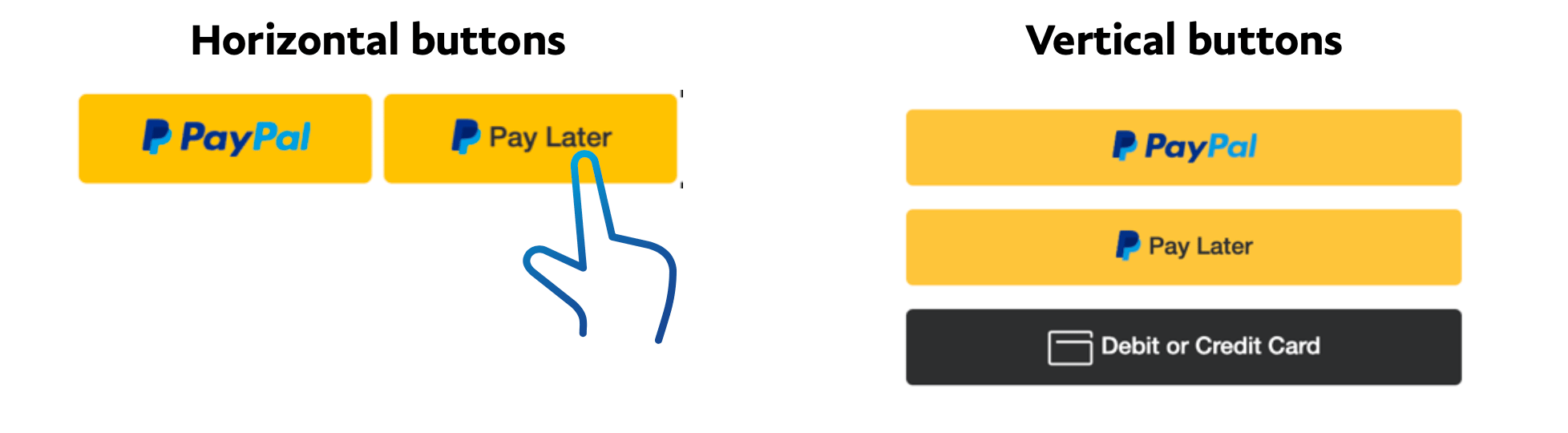

Pay in 4 is included in PayPal Checkout so you may already be offering a Buy Now Pay Later option without having to do anything else. On your side - PayPal will send you payment reminders so you never miss a payment. Introducing PayPal Credit a new way to pay at PSC.

290 030 USD per transaction. In safe hands - Your details are never shared and PayPal. PayPal keeps your customers data safe.

See our FAQs Already have PayPal Credit. And with 0 interest for 4 months on all purchases of 99 or more its the perfect way to spread the cost of larger online purchases Apply Now. PayPal Pay Later is an extension of credit for the amount of your purchase.

Our dynamic Pay Later messaging shows customers the right offer for what theyre buying and Pay Later offers are included in PayPal Checkout at no additional costs. Joe breaks down all of the advantages of using PayPal Credit as well as how to select the payment option. For purchases under 125 there is a 10 late payment fee charged one time only per plan and therefore capped at 10.

Make your first payment to complete the checkout process. How does PayPal work. PayPal is a financial tool that lets you conduct transactions online without entering your financial details into every website you deal with.

For purchases over 125 there is a 10 late payment fee per missed payment with a cap of 30 3 x 10.

Pay In 4 Buy Now Pay Later Paypal Us

Pay In 4 Buy Now Pay Later Paypal Us

Supercharge Your Woocommerce Store With Paypal

Supercharge Your Woocommerce Store With Paypal

Pay In 4 Buy Now Pay Later Paypal Us

Pay In 4 Buy Now Pay Later Paypal Us

Pay In 4 Buy Now Pay Later Paypal Us

Pay In 4 Buy Now Pay Later Paypal Us

Buy Now Pay Later Offer Customer Financing Paypal Us

Buy Now Pay Later Offer Customer Financing Paypal Us

Introducing Pay In 4 From Paypal Here S What Devs Need To Know By Harrison Ownbey Technology At Paypal Medium

Introducing Pay In 4 From Paypal Here S What Devs Need To Know By Harrison Ownbey Technology At Paypal Medium

Paypal Checkout Woocommerce Docs

Introducing Pay In 4 From Paypal Here S What Devs Need To Know By Harrison Ownbey Technology At Paypal Medium

Introducing Pay In 4 From Paypal Here S What Devs Need To Know By Harrison Ownbey Technology At Paypal Medium

Paypal Joins The Buy Now Pay Later Race With New Pay In 4 Installment Program Techcrunch

Paypal Joins The Buy Now Pay Later Race With New Pay In 4 Installment Program Techcrunch

Buy Now Pay Later Offer Customer Financing Paypal Us

Buy Now Pay Later Offer Customer Financing Paypal Us

Paypal Pay Later Pay In 4 Checkout Demo How Does Paypal Pay Later Pay In 4 Work Youtube

Paypal Pay Later Pay In 4 Checkout Demo How Does Paypal Pay Later Pay In 4 Work Youtube

Paypal S Pay In 4 Feature Tips And Tricks Hq

Paypal S Pay In 4 Feature Tips And Tricks Hq

Buy Now Pay Later Offer Customer Financing Paypal Us

Buy Now Pay Later Offer Customer Financing Paypal Us

Comments

Post a Comment