During the accumulation phase you are making payments and your annuity is accumulating interest on a tax-deferred basis. First to the extent the annuity is deferred taxation on the growth in the.

Variable Annuities Your Retirement Insurance Raymond James

Variable Annuities Your Retirement Insurance Raymond James

However it may be non-taxable if you use the funds for education.

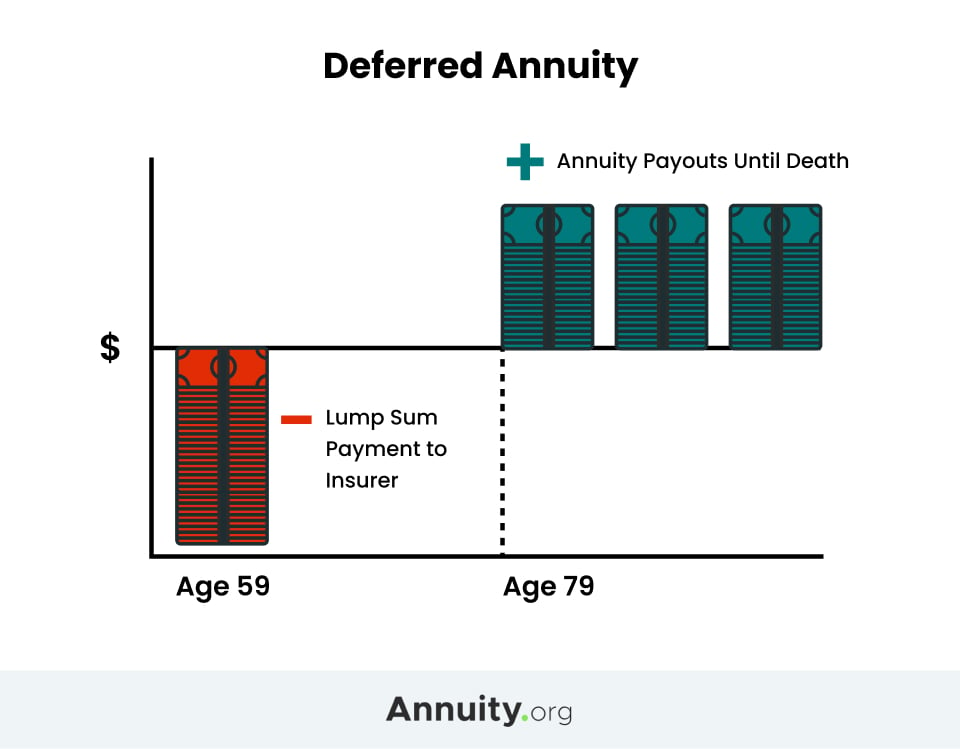

Tax deferred variable annuity. They do not receive the benefit of being taxed as capital gains. The contributions made to a non-qualified annuity arent taxable but any growth or earnings on your initial investment are tax deferred. A deferred annuity is an insurance contract that promises to pay the buyer a regular income or a lump sum of money at some date in the future.

It is sold by insurance companies and it offers fixed or variable rates of return. Variable annuities are insurance contracts that provide tax-deferred growth of assets that can later generate a guaranteed income stream thus. Withdrawals and lump sum distributions from an annuity are taxed as ordinary income.

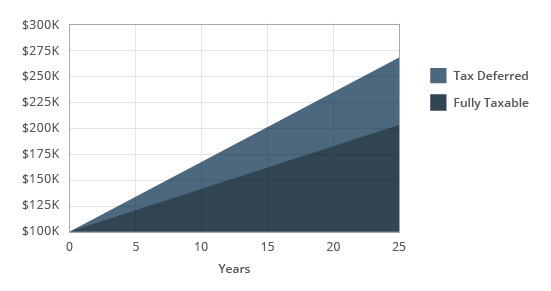

You invest with after-tax money and you pay no taxes on any interest dividends or capital gains until you begin taking withdrawals. You invest a lump sum like 100000 in a fund of stocks or bonds. Trusts And Tax Deferral Of Annuities The standard tax treatment for deferred annuity is that they are tax-deferred note.

It keeps the tax deferral going and getting a retirement income stream is after all the main reason middle-aged people buy. Variable annuity contracts are sold as investment vehicles that can offer significant tax savings by deferring income taxes on any gains. With tax-deferred investments you can watch your money grow without worrying about the bite of taxes.

Immediate annuities by contrast start paying right. And the annuity deferral period is taxed differently than the payout period. While you wont receive a tax deduction for the money you contribute your account grows without.

The taxes on any investment gains are deferred until you make a withdrawal. How this accumulation occurs varies depending on the annuity type. A tax-deferred annuity is an investment vehicle used by an individual planning his retirement income.

The accumulation phase and the payout phase. If the beneficiary is the spouse of the annuitant the spouse can change the contract into his or her own name. But there is no 10 early withdrawal penalty to worry about and you dont have to deal with RMDs either.

Nonqualified variable annuities are tax-deferred investment vehicles with a unique tax structure. Fidelity Personal Retirement Annuity. Any gain you withdraw before age 59 ½ will be subject to a 10 penalty tax in addition to ordinary income taxes.

But that doesnt mean theyre a way to avoid taxes completely. In other words you have to pay ordinary income tax on the earnings part of your distributions. Rolling over a variable annuity into a fixed one does make sense.

The involved interest is tax-deferred for both of these bonds until you cash it in. Let the account build for a long while perhaps 15. Annuities are tax deferred.

The Series I also includes a variable rate. Most of these variable annuities are deferred. Fixed Deferred and Variable Annuities.

What this means is taxes are not due until you receive income payments from your annuity. Inherited annuities are taxable as income. Recognized as a Top Traditional Annuity by Barrons 1 our Fidelity Personal Retirement Annuity 2 FPRA is a low-cost deferred variable annuity that allows you to increase your tax-deferred retirement savings beyond the contribution limits of an IRA or 401 k.

The reason theyre called deferred annuities is not because theyre tax-deferred but because they date of annuitization is deferred to. There are two phases to a deferred annuity. There are two basic income tax rules.

The beneficiary of a tax-deferred annuity may choose from several payout options which will determine how the income benefit will be taxed. As a result you can hold off paying taxes on. Variable annuities share certain features with IRAs and 401 k plans including tax-deferred growth.

Variable annuities grow tax-deferred so you dont have to pay taxes on any investment gains until you begin receiving income or make a withdrawal. With a deferred annuity you deposit your funds with an insurance company in a fixed variable equity-indexed or longevity annuity contract.

Annuities For Retirement Maria Gutierrez Insurance

Annuities For Retirement Maria Gutierrez Insurance

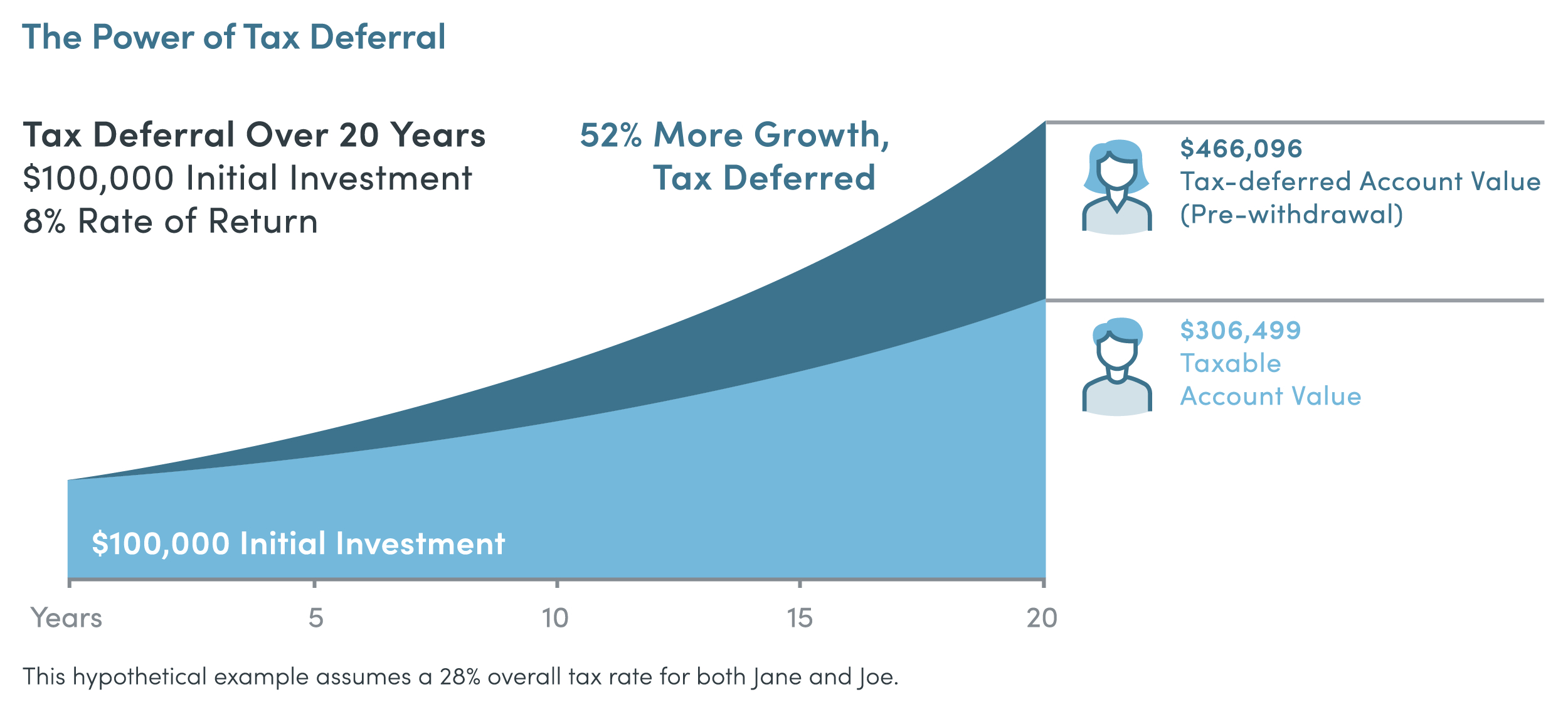

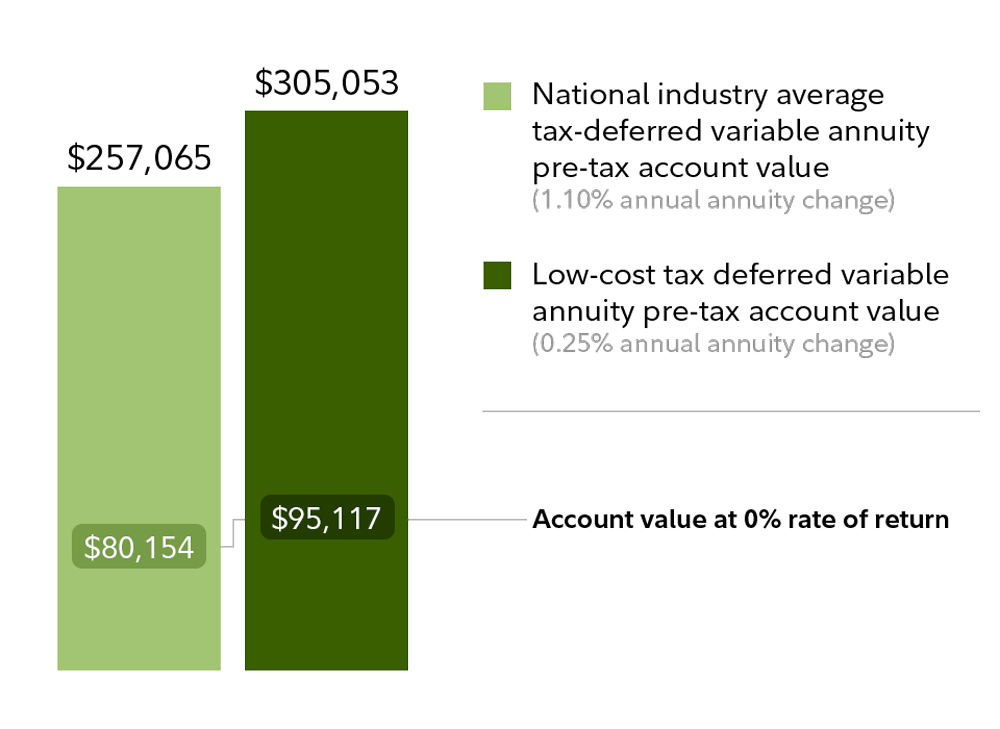

Capitalizing On The Tax Deferral Advantage Of A Variable Annuity J P Morgan Asset Management

Capitalizing On The Tax Deferral Advantage Of A Variable Annuity J P Morgan Asset Management

Capitalizing On The Tax Deferral Advantage Of A Variable Annuity J P Morgan Asset Management

Capitalizing On The Tax Deferral Advantage Of A Variable Annuity J P Morgan Asset Management

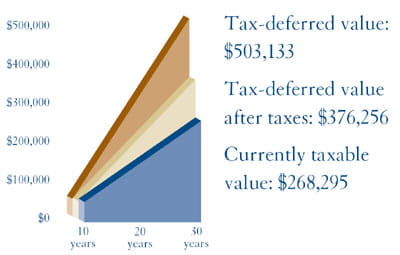

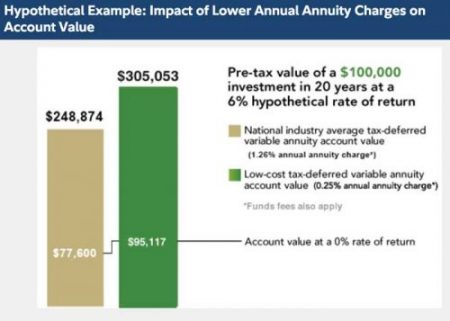

How Tax Deferral Works Securitybenefit Com

How Tax Deferral Works Securitybenefit Com

Understanding Deferred Variable Annuities Two Phases Thinkadvisor

Understanding Deferred Variable Annuities Two Phases Thinkadvisor

Variable Annuity Elitedesigns Solutions Security Benefit

Variable Annuity Elitedesigns Solutions Security Benefit

Taxation Of Annuities Explained Annuity 123

Variable Annuities How Do They Work

Variable Annuities How Do They Work

Best Annuities Of 2021 Costs Reviews Retirement Living

Best Annuities Of 2021 Costs Reviews Retirement Living

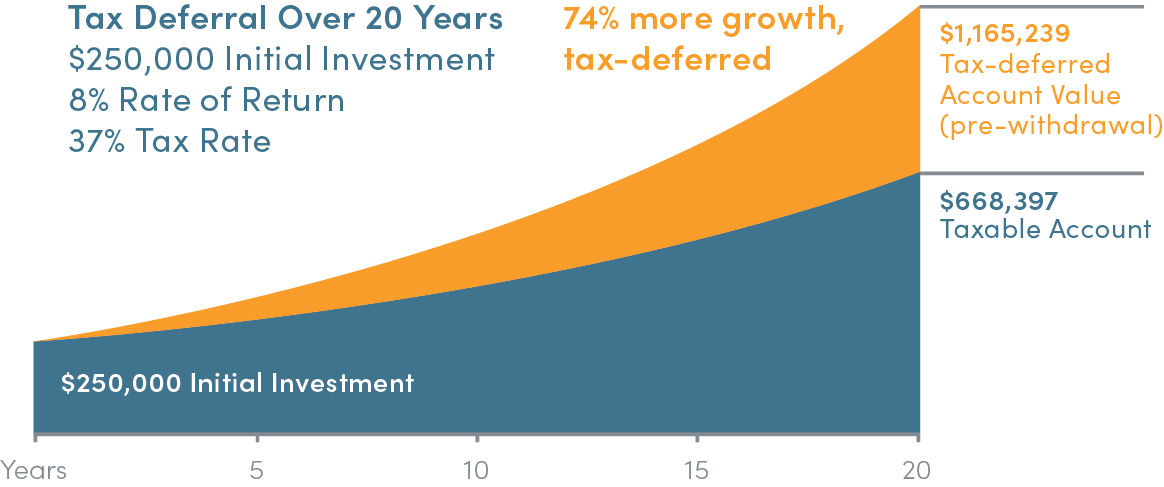

How To Optimize Fixed Annuity Tax Deferral

How To Optimize Fixed Annuity Tax Deferral

Deferred Annuities Accumulation Payout Options Pros Cons

Deferred Annuities Accumulation Payout Options Pros Cons

Annuity Exchange Tax Free With Fidelity Personal Retirement Annuity Fidelity

Annuity Exchange Tax Free With Fidelity Personal Retirement Annuity Fidelity

Deferred Annuities Annuityadvantage

Deferred Annuities Annuityadvantage

Equitable Adds Protection Features To Its Tax Deferred Variable Annuity Business Wire

Equitable Adds Protection Features To Its Tax Deferred Variable Annuity Business Wire

Comments

Post a Comment