They do not perform credit checks. Here are some other features to consider before you take out a Sezzle loan.

Guide To Sezzle Creditcards Com

Guide To Sezzle Creditcards Com

Sezzle is not a credit card but works in a similar fashion.

Does sezzle build credit. Tips for maximizing Sezzle. See a list of stores who support Sezzle How does Sezzle work. Sezzle is the ideal financing partner for Millennials and Gen Zs.

Sezzle performs a soft credit check which means applying for financing through Sezzle wont affect your credit score. Upon signing up the approvals team will let you know what rate applies to your store - the rate is determined by the type of. The company does still look at your credit score as part of their risk check but it does not have an impact on your credit score like a hard check would - it is known as a soft check This information is used to help approve you for Sezzle.

If you decide to take advantage of Sezzles interest-free installment plan keep the following tips in mind. However Sezzle do still look at your credit score as part of a risk check. There are absolutely no sign-up or set-up costs.

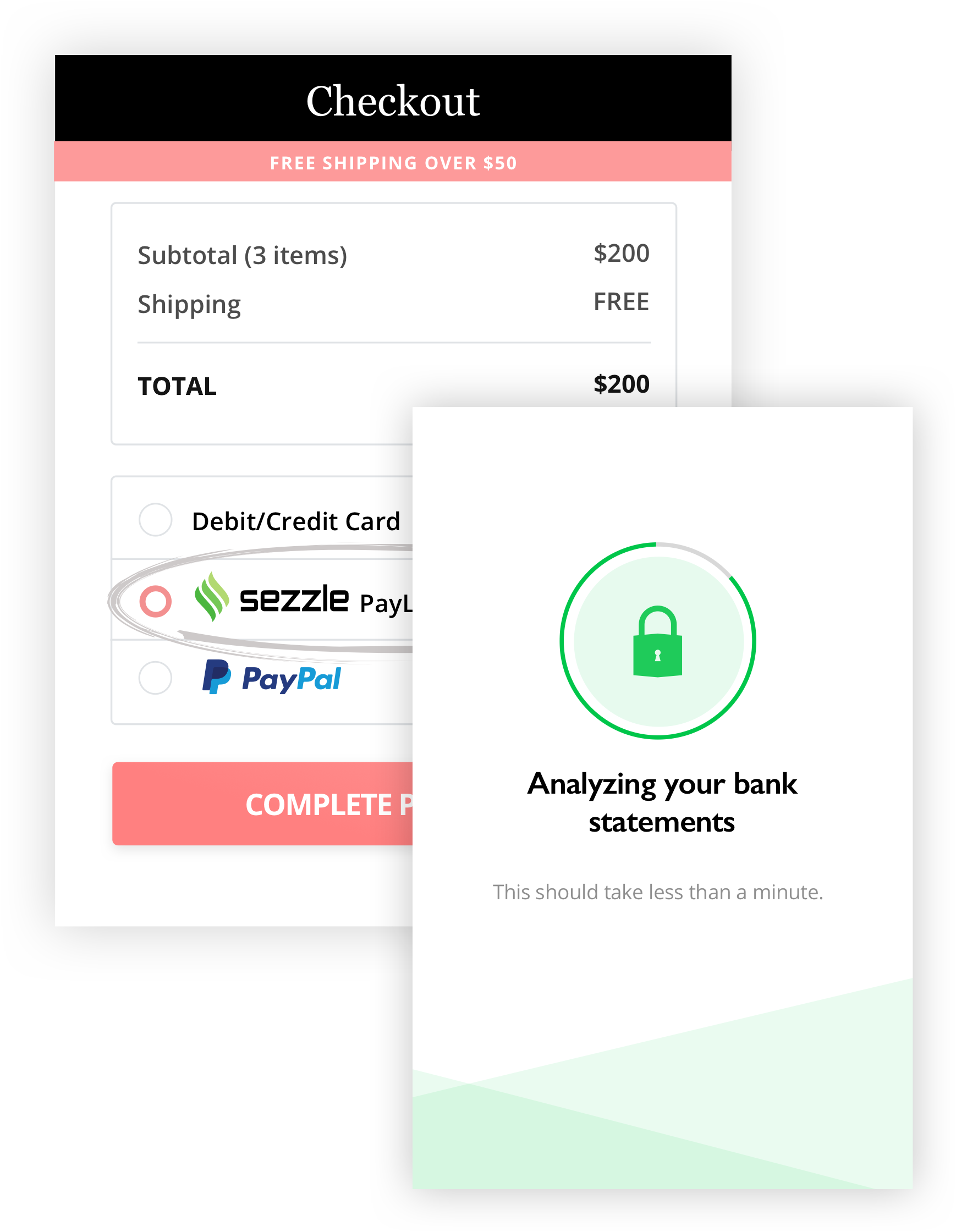

Sezzle doesnt qualify as a credit product per United States regulations Reg Z so there is no hard credit check processed. The company operates in the US. Consumers pay us 25 at the time of purchase and we set up an automatic repayment plan that has them pay us.

Details Pricing and Features Sezzles 1-shopper-rated Buy Now Pay Later product enables millions of shoppers across the United States and Canada to take control of their spending be more responsible and gain access to fi. Is Sezzle a Credit Card. Through Sezzle Up Sezzle reports your payments and balance to the three national credit bureaus monthly.

Be sure to make your credit card payments on time and that your credit. Sezzle enables consumers to pay for their purchases in four equal installments spread over six weeks while paying the merchant in full upfront. Sezzle does offer an upgraded account called Sezzle Up with a feature to build your credit access to your limit and a boost as well as exclusive in-app merchants.

You wont pay interest and Sezzle doesnt affect your credit score. Does Sezzle report to credit bureaus. Sezzle does offer an upgraded account called Sezzle Up with a feature to build your credit access to your limit and a boost as well as exclusive in-app merchants.

Unless you join Sezzle Up using the service wont help you build credit. Our platform operates by charging the merchant a set percentage of each order and a small processing fee. But youll need to make a down payment 25 of the total cost and pay off the rest within six weeks.

Use the right payment method. This does not have an impact on your credit - this is often referred to as a soft check They use this information to help approve you for Sezzle verify your identity and help minimize fraud risk. Sezzle offers interest-free loans with the ability to opt in to a credit-building feature.

We should note that even if a financing service doesnt report to credit bureaus paying your installments with a credit card can help you build credit in some cases. They dont believe traditional credit scores are an accurate predictor of your ability to repay them and they want to avoid negatively impacting your credit score. If you find yourself in a position where you cannot build a credit score Sezzle offers an alternative solution.

No pun intended If you want the freedom of a credit card but none of the debt sign up for Sezzle and start paying at your pace. Sezzle Reviews 2021. How much does Sezzle cost.

At this time Sezzle does not report activity to any credit bureaus for users not enrolled in Sezzle Up. November 05 2020 2248. At this time Sezzle does not report activity to any credit bureaus for users not enrolled in Sezzle Up.

Can Sezzle help my credit. No Sezzle doesnt report to any major credit bureaus so paying off your balance wont boost your credit. For Sezzles standard service there is no credit reporting involved.

You get access to financing without the need to prove any payment history with banks or creditors. In the end the time and energy you spend keeping your balance low monitoring your credit score and improving your debt-to-credit ratio will pay off. Once it can establish the applicant isnt a fraudster it is more or less always able to approve them for a small amount usually around.

But if you want to use the program to build your credit history you can sign up for Sezzle Ups revolving line of credit. Sezzle can accept 88 percent of the consumers who apply.

Reducing Cart Abandonment And Building Credit With Sezzle By Paul Paradis Sezzle

Reducing Cart Abandonment And Building Credit With Sezzle By Paul Paradis Sezzle

Guide To Sezzle Creditcards Com

Guide To Sezzle Creditcards Com

Reducing Cart Abandonment And Building Credit With Sezzle By Paul Paradis Sezzle

Reducing Cart Abandonment And Building Credit With Sezzle By Paul Paradis Sezzle

Sezzle Buy Now Pay Later Reviews Pricing

Sezzle Buy Now Pay Later Reviews Pricing

Reducing Cart Abandonment And Building Credit With Sezzle By Paul Paradis Sezzle

Reducing Cart Abandonment And Building Credit With Sezzle By Paul Paradis Sezzle

How Does Sezzle Stack Up Against Competing Finance Services

How Does Sezzle Stack Up Against Competing Finance Services

Guide To Sezzle Creditcards Com

Guide To Sezzle Creditcards Com

Reducing Cart Abandonment And Building Credit With Sezzle By Paul Paradis Sezzle

Reducing Cart Abandonment And Building Credit With Sezzle By Paul Paradis Sezzle

How Does Sezzle Impact My Credit Score Sezzle

How To Build Credit Without A Credit Card Sezzle

How To Build Credit Without A Credit Card Sezzle

Sezzle Helps Millennials With Poor Fico Scores Pymnts Com

Sezzle Helps Millennials With Poor Fico Scores Pymnts Com

Guide To Sezzle Creditcards Com

Guide To Sezzle Creditcards Com

Buy Now Build Your Future Fintech Pioneer Sezzle Unveils Bold New Branding Focused On Engaging The Next Generation

Buy Now Build Your Future Fintech Pioneer Sezzle Unveils Bold New Branding Focused On Engaging The Next Generation

Here Are Some Things To Consider To Get Your Order Approved Do You Have Sufficient Funds Available Typically We Check To Make Sure You Have At Least 25 Of The Total Order

Comments

Post a Comment