If youre driving your personnel vehicle on your own time the insurance company wont care. But if anything ever happens just log off and you were driving to pick up your own food.

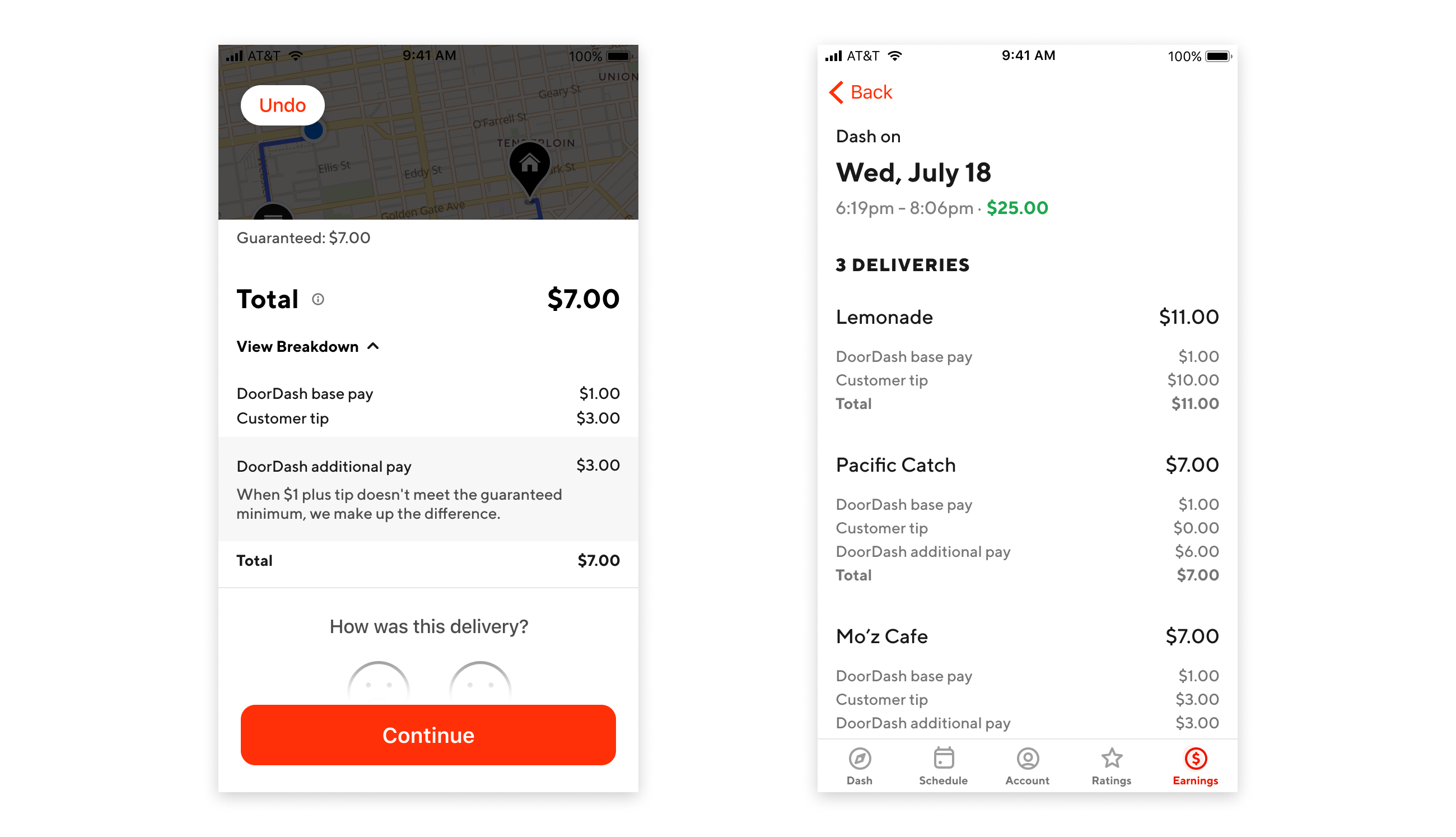

Doordash Driver Review How Much Money Can You Make Clark Howard

Doordash Driver Review How Much Money Can You Make Clark Howard

If youre driving your personnel vehicle as part of your job at doordash you should have informed your insurance company that you were going to be doing this.

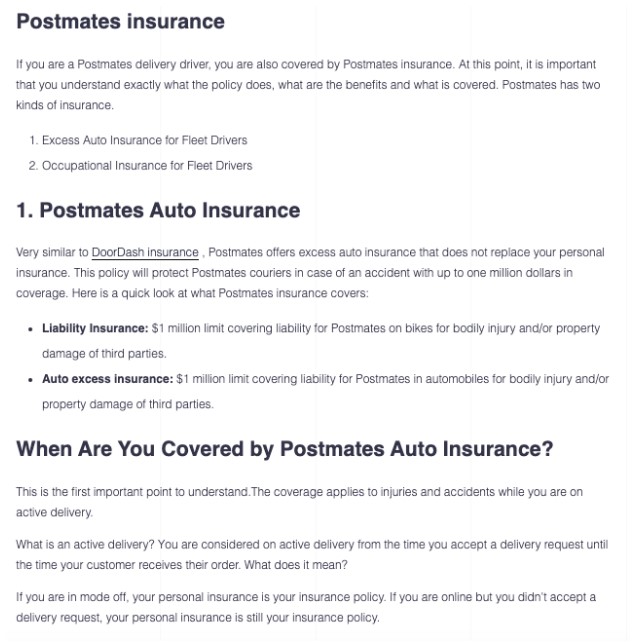

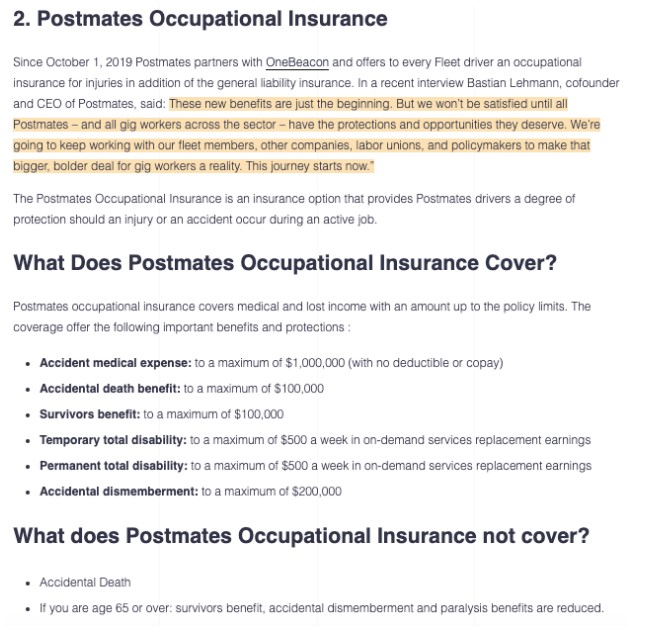

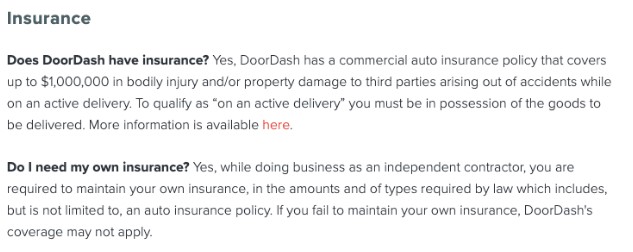

Does driving for doordash raise insurance. For example if you drive for DoorDash the company has a free and automatic commercial auto insurance policy for up to 1 million in bodily injury and property damage. Damages sustained to your vehicle in an auto accident are your responsibility and should be addressed by your auto insurance carrier directly. If you are uninsured Doordash may not step in.

If you were to ever get into an accident just do not tell the other driver or your insurance that you were working for DoorDash. How much it costs depends on your provider and your needs. If you didnt they may deny an insurance claim.

Its an escape clause for Doordash and their insurance. DoorDash has a commercial auto insurance policy that covers drivers for up to 1 million in bodily injury and property damage if you cause an accident while on. Meet with an accident while on a delivery including either when you are driving to a pickup location after accepting an order or in possession of goods to be delivered.

The only exception is when Dashers dash exclusively using bicycles or in some areas by foot. Damages you cause to other parties. This includes third party property damage andor bodily injury.

However DoorDash accepting your proof of insurance doesnt mean that your personal auto insurance permits delivery driving. However doordash has insurance that covers you up to 1 million as long as you have the food in the car at the time. It does not allow you to use your personal insurance when driving for commercial delivery businesses such as Amazon UberEats or DoorDash.

For a few extra dollars per month you can remain completely covered when driving for. Just have a valid drivers license insurance and a clean driving record But this may not be the full story. Your personal auto insurance policy will not protect you when delivering for DoorDash.

Rideshare coverage protects you and your vehicle if you drive for a ridesharing service such as Uber and Lyft. The terms of the insurance contract seem to refer only to ride-sharing apps such as Lyft or Uber and do not refer to any food delivery apps such as DoorDash. Because the contract terms are unclear and do not specifically exclude coverage while driving for such an app the insurance company should cover those drivers who work for DoorDash.

As a DoorDash driver you need special auto insurance. Third party property damage andor bodily injury and only to accidents while on an active delivery when you are in possession of goods. Important LinksSign Up to Drive for DoorDash herebitlyJoindoordash T3D Money Tracker Track Income Track Expenses Find Avg Per OrderWatch the Video.

While ridesharing companies may provide some insurance that applies to drivers operating on their platforms their coverage may be limited while youre waiting to match with a rider or when you have a passenger in your vehicle. When driving for these companies youll want to understand their requirements and what if anything they offer as supplemental insurance. Nobody who dashes has special insurance.

DoorDash requires that all Dashers maintain an up-to-date auto insurance policy. Drivers may need to add additional delivery-specific coverage. Talk to your insurance company about adding business-use coverage food delivery coverage or rideshare insurance to your existing policy.

Do I need my own auto insurance. Since DoorDashs insurance coverage is pretty bare-bones its probably a good idea for drivers to review their personal policies or rideshare policies if applicable and make sure theyre fully covered while delivering for DoorDash. One of the Doordash insurance requirements is you have to have your own coverage.

According to GrubHub drivers must be age 19 with 2 years of driving experience a valid drivers license and auto insurance No specific wording on the type of auto insurance is mentioned DoorDash requirements for drivers are equally vague stating You can use any car to deliver. DoorDash does provide excess auto insurance for Dashers but this policy applies only ifwhen. Damages sustained to your vehicle in an auto accident are your responsibility and should be addressed by your auto insurance carrier directly.

Fortunately most insurance companies allow you to easily add business-use coverage or commercial coverage to your policy. DoorDash does provide excess auto insurance for Dashers but this policy applies only to damages you cause to other parties ie.

Improving The Dasher Experience Tony Xu Co Founder And Ceo By Doordash Doordash

Improving The Dasher Experience Tony Xu Co Founder And Ceo By Doordash Doordash

Question Does Doordash Raise Your Insurance Ceramics

Question Does Doordash Raise Your Insurance Ceramics

Does Doordash Cover Car Accidents Houston Car Accident Lawyer

Does Doordash Cover Car Accidents Houston Car Accident Lawyer

Doordash Driver Requirements How To Become A Doordash Driver Ridesharing Driver

Doordash Driver Requirements How To Become A Doordash Driver Ridesharing Driver

Question Does Doordash Raise Your Insurance Ceramics

Question Does Doordash Raise Your Insurance Ceramics

Doordash Insurance Requirements Avoid This One Money Disaster

Doordash Insurance Requirements Avoid This One Money Disaster

Here S How Delivery Insurance Works For Uber Eats And Doordash Drivers

Here S How Delivery Insurance Works For Uber Eats And Doordash Drivers

The Merits Of Tipping Your Doordash Delivery Worker In Cash Quartz

The Merits Of Tipping Your Doordash Delivery Worker In Cash Quartz

Here S How Delivery Insurance Works For Uber Eats And Doordash Drivers

Here S How Delivery Insurance Works For Uber Eats And Doordash Drivers

Here S How Delivery Insurance Works For Uber Eats And Doordash Drivers

Here S How Delivery Insurance Works For Uber Eats And Doordash Drivers

How To Become A Doordash Driver Doordash Driver Requirements Hyrecar

How To Become A Doordash Driver Doordash Driver Requirements Hyrecar

Doordash Insurance Requirements Avoid This One Money Disaster

Doordash Insurance Requirements Avoid This One Money Disaster

Doordash Insurance Requirements Avoid This One Money Disaster

Doordash Insurance Requirements Avoid This One Money Disaster

Comments

Post a Comment