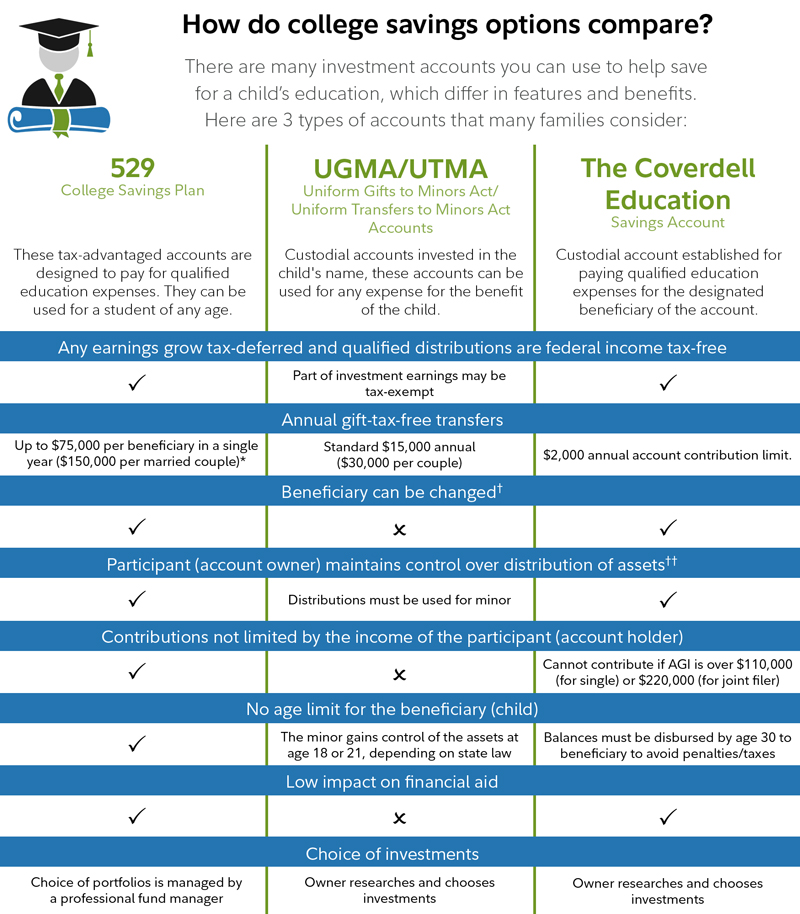

Custodial 529 Account Select this account type if you are transferring assets currently held in a Uniform GiftsTransfers to Minors custodial account to a custodial 529 account with Fidelity. In addition to the 529 college savings plan offered by your home state we will display information about a plan managed by Fidelity Investments which may also be of interest to you.

Unique College Investing Plan Fidelity

Unique College Investing Plan Fidelity

1 Fidelity cut fees on 15 of 22 529 plan portfolios both actively managed and passive index-based portfolios.

Does fidelity offer 529 plans. We upgraded the rating for. The UNIQUE College Investing Plan UFund College Investing Plan Delaware College Investment Plan the Fidelity Arizona College Savings Plan and the Connecticut Higher Education Trust CHET 529 College Savings Plan - Direct Plan are offered by the state of New Hampshire MEFA the state of Delaware and the state of Arizona with the Arizona State Treasurers Office as the Plan. Your or the beneficiarys home state 529 plan may offer additional state tax advantages or other state benefits such as financial aid scholarship funds and protection from creditors.

Three 529 college savings plans merit Gold ratings. In addition to its direct-sold 529 plans Fidelity offers the Fidelity Advisor 529 Plan through brokers utilizing Fidelity Series funds in its age-based and static portfolio options and Fidelity Advisor funds in its individual fund portfolio options. Plan Advantages Control and Flexibility Accelerated Gifting When you invest your money for college in a 529 plan.

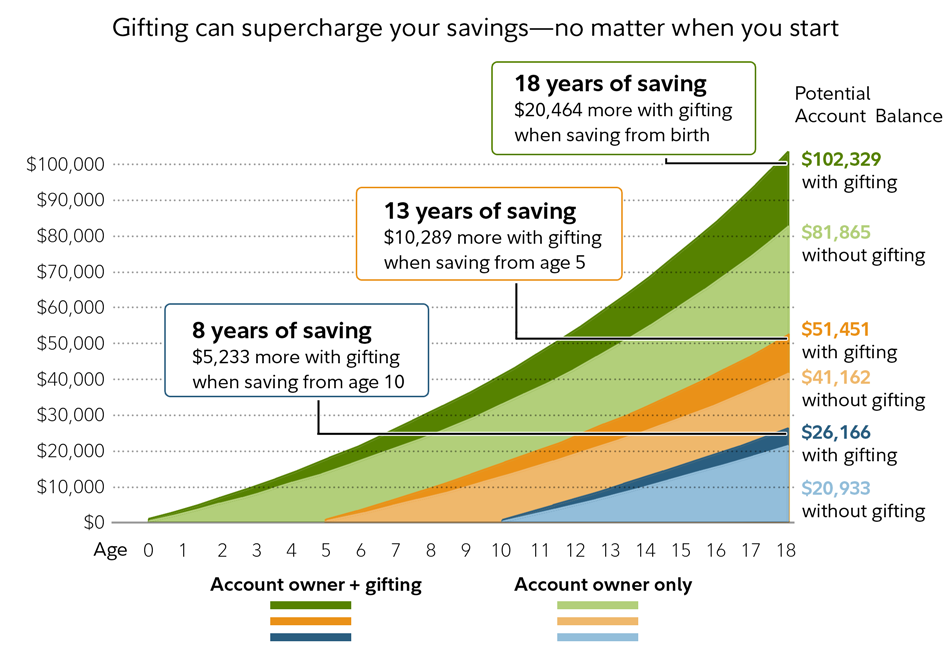

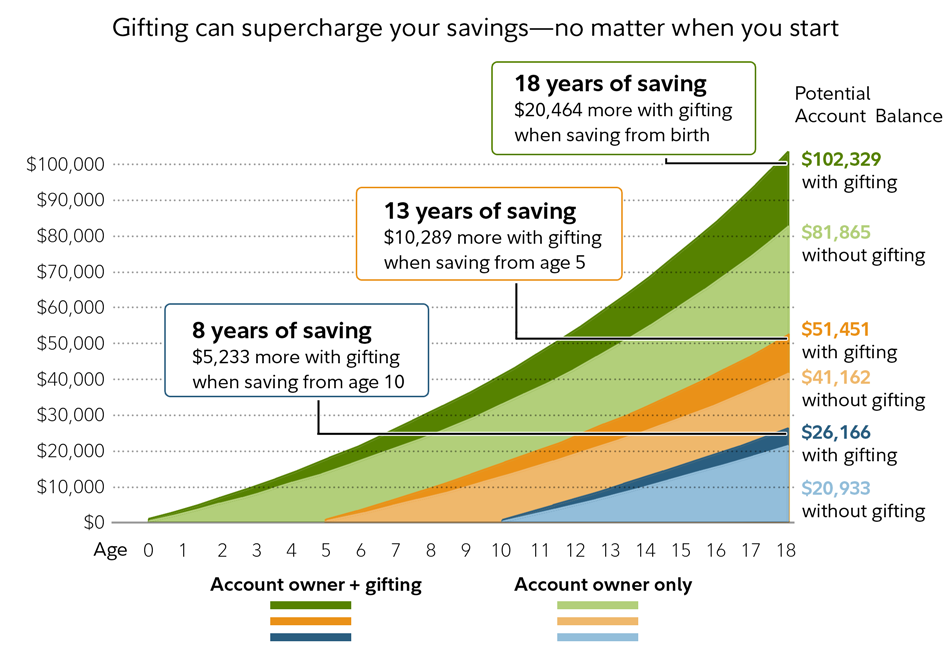

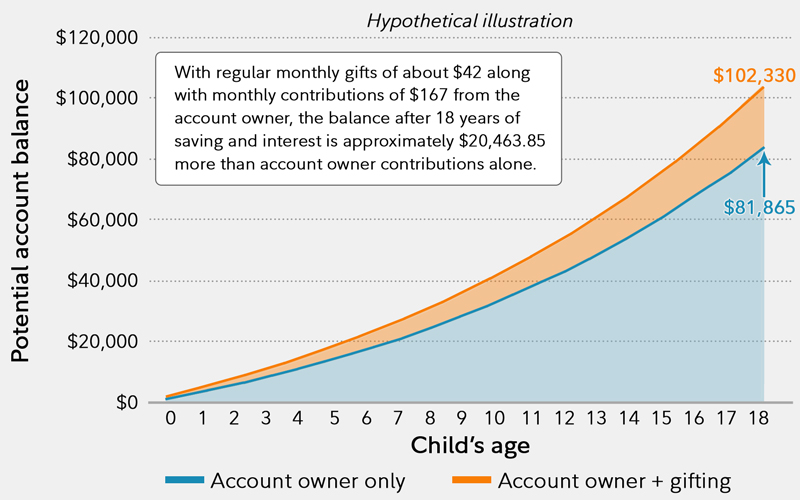

Ongoing funding including extra contributions from family and friends can. The Fidelity-managed 529 plan contribution caps are currently 350000 for the DE plan 400000 for the MA plan 500000 for the NH plan and 453000 for the AZ plan. The fees charged are incorporated into the total expense ratio.

Opening a Fidelity Advisor 529 Plan sponsored by the state of New Hampshire NH can be a great first step for your clients and their children and grandchildren. 529 offering at Fidelity gives investors access to Fidelitys deep lineup of experienced portfolio managers with 27 professionally managed portfolios including eight Age-Based Portfolios two Static Portfolios 16 Individual Fund. Most of the cuts were for 1 to 2 basis points but one portfolio the.

The tool allows you to compare up to four plans at a time. These plans offer several benefits that can help make the most of the money you invest for college. These plans set the industry standard with their low costs strong stewardship and exceptional investment options.

The Fidelity Advisor 529 Plan is offered by the state of New Hampshire and managed by Fidelity Investments. 529 Plans are tax-advantaged accounts designed specifically to help maximize your college savings. Fidelity Advisor 529 Advantage.

There is no annual account fee or minimum required to open any of the Fidelity-managed 529 plan accounts. Deposits into this type of account are considered to be irrevocable gifts to the minor. To find a financial advisor in your area use the Directory of.

If your state doesnt offer a tax deduction or credit for contributions my favorite plans are with Utahs My529 Nevadas Vanguard 529 and Californias ScholarShare 529. To be eligible for enhanced non-discretionary financial planning and support PWM Program Services Fidelity Private Wealth Management clients are subject to a qualification and acceptance process and must typically invest at least 2 million in the aggregate in Fidelity Wealth Services andor Fidelity Strategic Disciplines accounts and have investable assets of at least 10 million. Fidelity Advisor 529 Plan National Plan Our nationally distributed 529 plan offers an array of benefits including a broad range of investment options and a high contribution limit to help families save for qualified education costs.

They are sponsored by individual states and many are managed by financial services companies like Fidelity. That includes the program management fee which covers the cost of trust administration services such as recordkeeping statements and customer service. A Fidelity Advisor 529 Plan A 529 plan can be a smart strategy for covering the cost of collegeand for good reason.

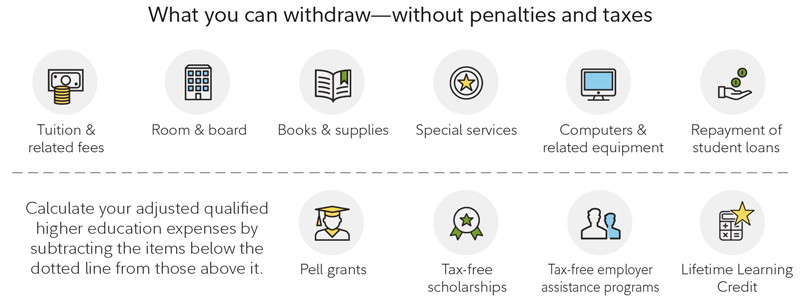

Fidelity Institutional SM offers college savings plans that enable financial intermediaries to help their clients reach their higher education savings goals. 63 rijen College Foundation of North Carolina NC 529 Plan. College-related expenses refer to qualified higher education expenses as defined in section 529 of the Internal Revenue Code.

Even though the plans are sponsored by a specific state you dont need to be a resident of that state to invest in its 529 Plan. If Fidelity does not manage a plan for your state you may want to consider our national plan the UNIQUE College Investing Plan.

Arizona 529 College Savings Plan Fidelity Investments

Arizona 529 College Savings Plan Fidelity Investments

Qualified 529 Expenses Withdrawals From Savings Plan Fidelity

Qualified 529 Expenses Withdrawals From Savings Plan Fidelity

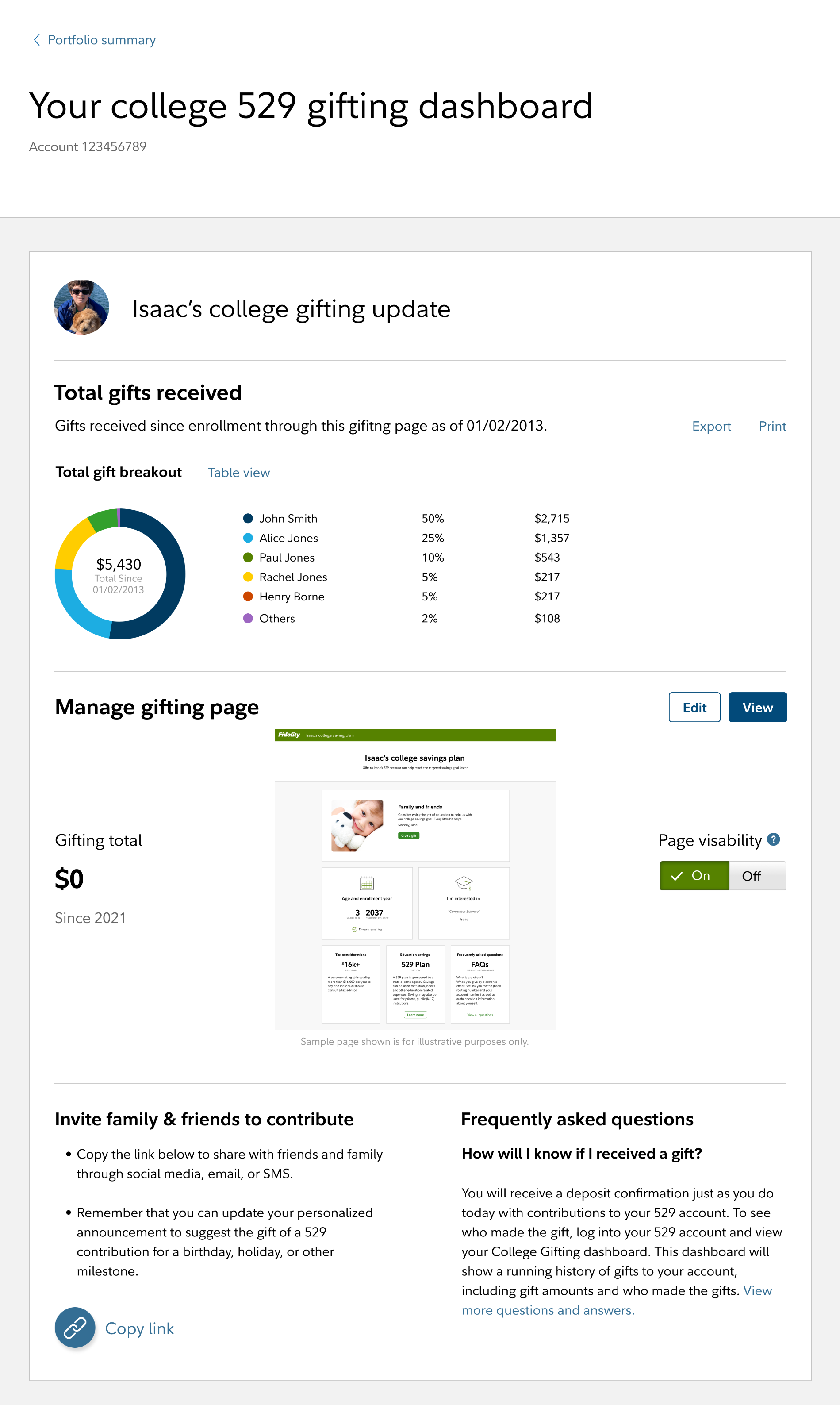

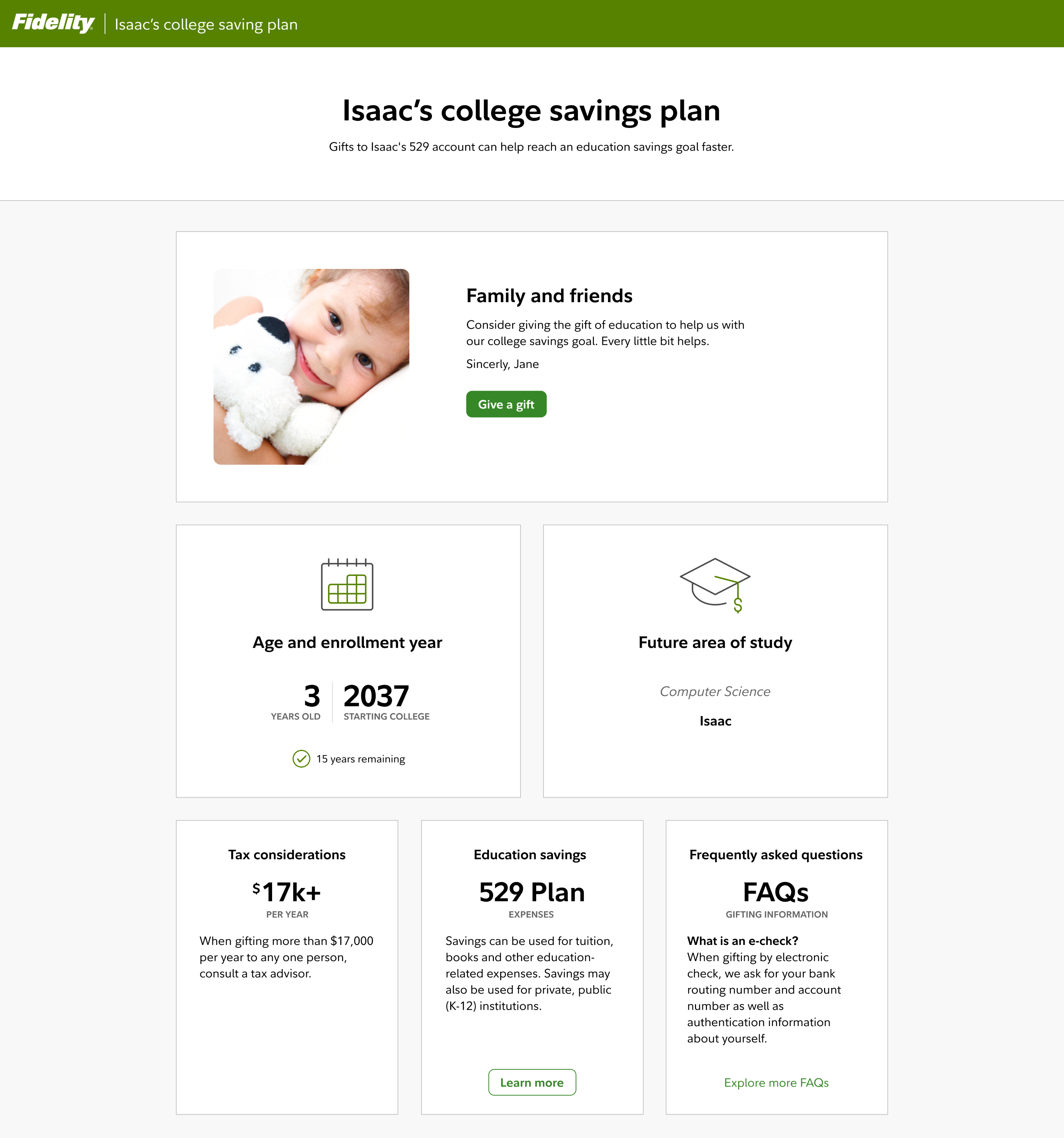

College Gifting Program 529 Savings Plan Fidelity

College Gifting Program 529 Savings Plan Fidelity

The Fidelity Advisor 529 Plan Start Investing Today

The Fidelity Advisor 529 Plan Start Investing Today

The Top 529 College Savings Plans Of 2020 Morningstar

The Top 529 College Savings Plans Of 2020 Morningstar

College Gifting Program 529 Savings Plan Fidelity

College Gifting Program 529 Savings Plan Fidelity

529 Contribution The Gift Of Education Fidelity

529 Contribution The Gift Of Education Fidelity

529 College Savings Plan Fundamentals Invest Your Child S Future

529 College Savings Plan Fundamentals Invest Your Child S Future

College Gifting Program 529 Savings Plan Fidelity

College Gifting Program 529 Savings Plan Fidelity

Fidelity 529 College Savings Plan Index Portfolios Fee Reducton My Money Blog

Fidelity 529 College Savings Plan Index Portfolios Fee Reducton My Money Blog

Fidelity Advisor 529 Plan New Hampshire 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Fidelity Advisor 529 Plan New Hampshire 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Https Www Hanover Ma Gov Finance Department Payroll Benefits Office Files Fidelity Advisor 529 College Plan Advantages

Comments

Post a Comment