Close to 25 of this Schwab fund is concentrated in the financial sector followed by industrials and consumer goods. May 21 2021 700 am.

The Best Etfs For Global Dividend Stocks How To Invest In Global Dividend Stocks Justetf

The Best Etfs For Global Dividend Stocks How To Invest In Global Dividend Stocks Justetf

Higher prices usually dont benefit anyone.

Etf and dividends. Theres an ETF for just about anything we can think ofstocks bonds commodities growth value sectors industries and of course high yield. The total amount of non-qualified. Für deutsche Anleger bieten sich ETFs auf den DivDax an dem DividendenDax.

Dividend Achievers Select Index formerly known as the Dividend Achievers Select Index which covers about 182 dividend stocks. What to Look for in Dividend ETFs. Non-qualified dividends are taxed at the investors ordinary income tax rate.

If you choose this approach finding the best dividend ETFs that meet your investing goals is key to your success. Two Types of Dividends an ETF Can Pay Out Qualified dividends qualify for long-term capital gains and the underlying stock must be held for longer than 60 days. Dividend ETFs let you take advantage of the dividend investing strategy without having to devote significant time to research and rebalancing.

ETFs die speziell in dividendenstarke Aktien investieren. Exchange listed securities of companies that pay above-average dividends. The Timing of ETF Dividend Payments.

A dividend ETF focused on annual dividend growth. This ETF tracks the Nasdaq US. Investors looking to hold a basket of stocks of companies that have a record of growing their dividends can consider buying an ETF like Vanguards Dividend Appreciation fund.

ETFs sind für Investoren die nicht allzu viel Zeit in die Börse investieren können oder möchten ideale Anlageinstrumente. Die Kombination aus beidem. To keep it simple there are two popular types of dividend ETFs which I think you should be aware of.

25 Zeilen A dividend ETF typically includes dozens if not hundreds of dividend stocks. The Vanguard Dividend Appreciation ETF VIG is the most popular dividend ETF. Like any other investment youll want to do a bit of research before diving into any ETF whether.

Und Aktien mit hohen Dividenden sind für Anleger vor allem mit mittel- und langfristigem Zeithorizont immens attraktiv. VYM Vanguard High Dividend Yield ETF. The largest High Dividend Yield ETF is the Vanguard High Dividend Yield ETF VYM with 3768B in assets.

How Do ETF Dividends Work. Dividenden-ETF sind Indexfonds die in Aktien mit überdurchschnittlicher Dividendenrendite investieren. This ETF tracks the Value Line Dividend Index which is a modified equal-dollar weighted index comprised of US.

Given the growing popularity of exchange-traded funds ETFs and the proven benefits of dividend investing strategies it becomes imperative to explore ETFs focused on dividends. Fairvalue hat 13 der beliebtesten Dividenden-ETF für fünf verschiedene Regionen Welt Emerging Markets USA Europa Eurozone getestet. Many analysts are talking about the perils of inflation.

According to the funds prospectus the SPDR. This specific class of ETFs primarily hold a. Dividends are our beat here at.

The fund has a 006 expense ratio and just over 100 holdings. This ETF Has An 84 Dividend Yield. Such a dividend paying ETF usually tracks a so-called dividend index.

The SPDR SP 500 ETF pays out dividends in cash. The metric calculations are based on US-listed Dividend ETFs and every Dividend ETF has one issuer. The Vanguard High Dividend Yield ETF is another dividend ETF from Vanguard.

A dividend ETF is an Exchange Traded Fund which is designed to return dividends on a regular basis to its investors. Dividends Paid in Cash. Seit September 2000 haben alle Fonds eine höhere Rendite erzielt als der jeweilige Marktindex.

Similar to an individual companys stock an ETF sets an ex-dividend date a record. Schwab US Dividend Equity ETF has a 16 dividend yield. SDY SPDR SP Dividend.

Es erscheint daher sinnvoll in einen ETF zu investieren der sich auf dividendenstarke Aktien spezialisiert hat. In the last trailing year the best-performing High Dividend Yield ETF was SMHB at 26646. The 11 Best Dividend ETFs VIG Vanguard Dividend Appreciation ETF.

ETF issuers who have ETFs with exposure to Dividend are ranked on certain investment-related metrics including estimated revenue 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields.

7 Monthly Dividend Etfs For Your Investment Portfolio Dividendinvestor Com

7 Monthly Dividend Etfs For Your Investment Portfolio Dividendinvestor Com

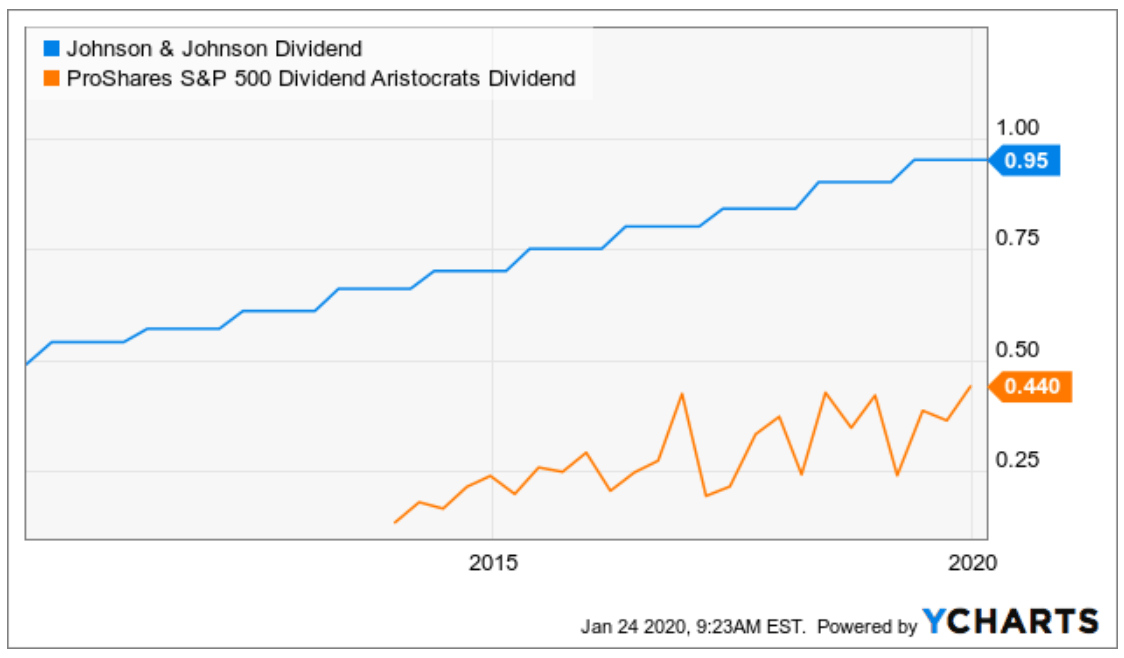

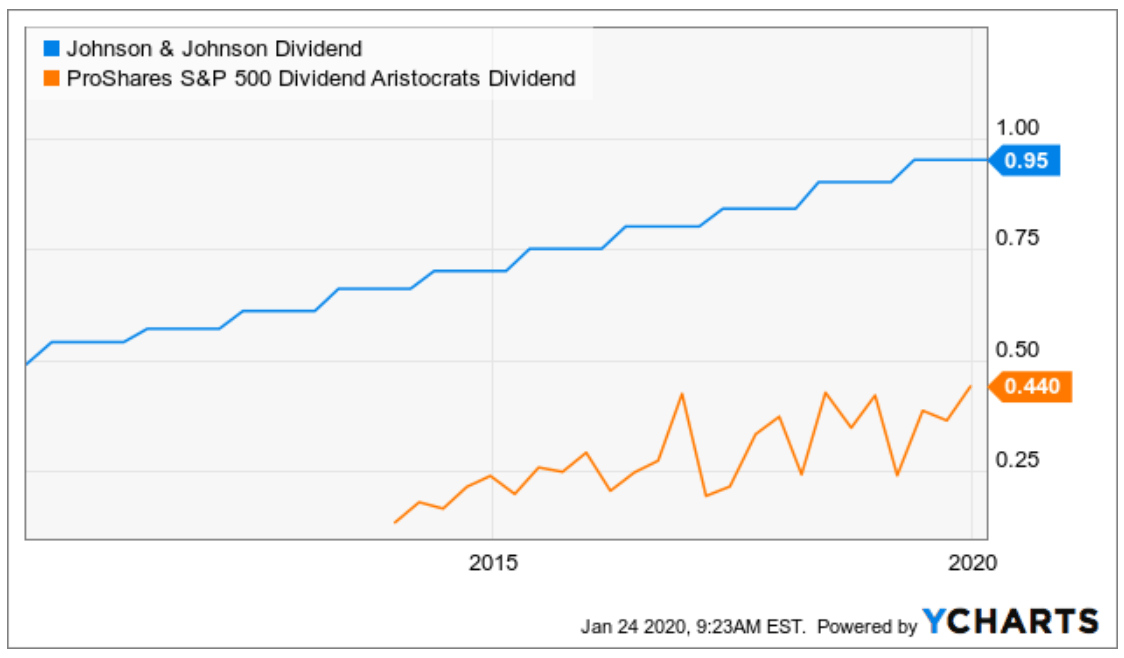

How To Find And Compare Dividend Etfs Ycharts

How To Find And Compare Dividend Etfs Ycharts

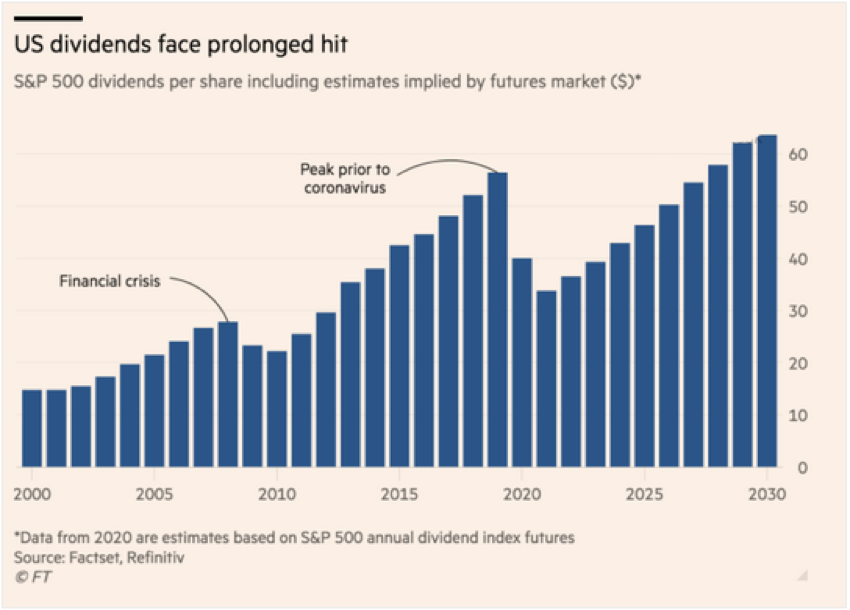

A Caution From 2007 Beware Of The Dividend In Your High Dividend Etfs Funds Etf Trends

A Caution From 2007 Beware Of The Dividend In Your High Dividend Etfs Funds Etf Trends

Which Vanguard Dividend Etf Is Winning The Race In 2018 The Motley Fool

Which Vanguard Dividend Etf Is Winning The Race In 2018 The Motley Fool

The Best Dividend Etf In The Accumulation Phase Dividend Growth Investor

The Best Dividend Etf In The Accumulation Phase Dividend Growth Investor

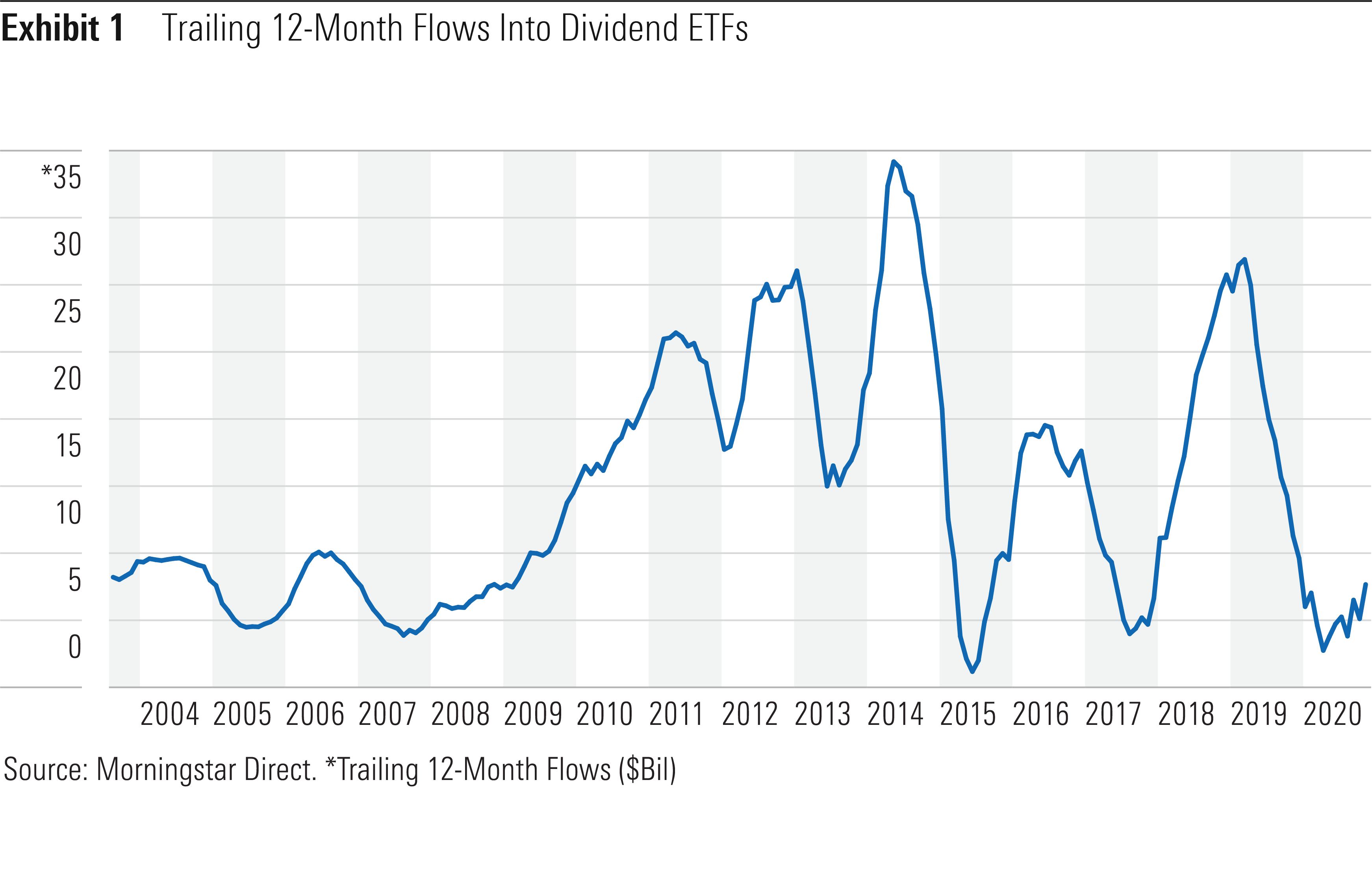

What To Look For In A Dividend Etf Morningstar

What To Look For In A Dividend Etf Morningstar

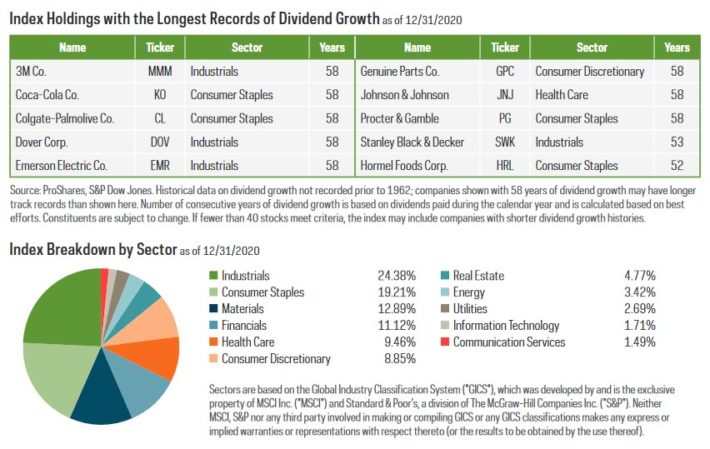

The Dividend Aristocrats Etf Own The 53 Best Dividend Growers Cabot Wealth Network

The Dividend Aristocrats Etf Own The 53 Best Dividend Growers Cabot Wealth Network

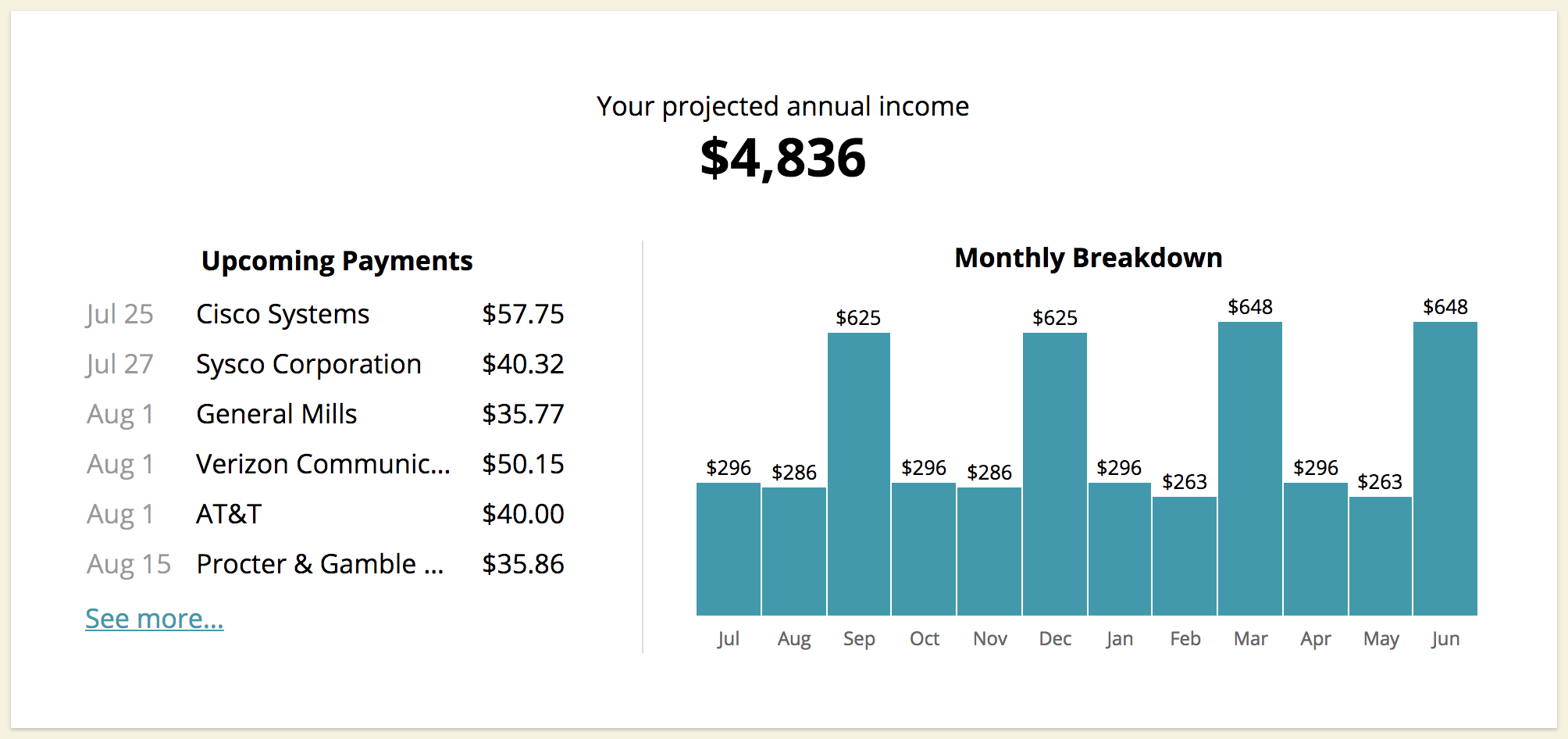

Dividend Etfs Vs Individual Stocks Intelligent Income By Simply Safe Dividends

Dividend Etfs Vs Individual Stocks Intelligent Income By Simply Safe Dividends

Voordeel Halen Uit Etf Dividend Aandelenkopen Nl

Voordeel Halen Uit Etf Dividend Aandelenkopen Nl

How Vanguard S Dividend Etfs Have Done In 2017 The Motley Fool

How Vanguard S Dividend Etfs Have Done In 2017 The Motley Fool

The 2021 List Of Dividend Exchange Traded Funds

The 2021 List Of Dividend Exchange Traded Funds

Dividend Focused Etfs That Outperformed During The Bull Market Financial Planning

Dividend Focused Etfs That Outperformed During The Bull Market Financial Planning

No Dividend Strategy Etfs Are Dividend Champions But There Is One Contender Seeking Alpha

No Dividend Strategy Etfs Are Dividend Champions But There Is One Contender Seeking Alpha

:max_bytes(150000):strip_icc()/dividends-5bfc2e7f46e0fb00511a3b38.jpg)

Comments

Post a Comment